- China

- /

- Metals and Mining

- /

- SHSE:688102

Shaanxi Sirui Advanced Materials Co., Ltd. (SHSE:688102) Stocks Shoot Up 43% But Its P/E Still Looks Reasonable

Shaanxi Sirui Advanced Materials Co., Ltd. (SHSE:688102) shares have had a really impressive month, gaining 43% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 7.8% isn't as attractive.

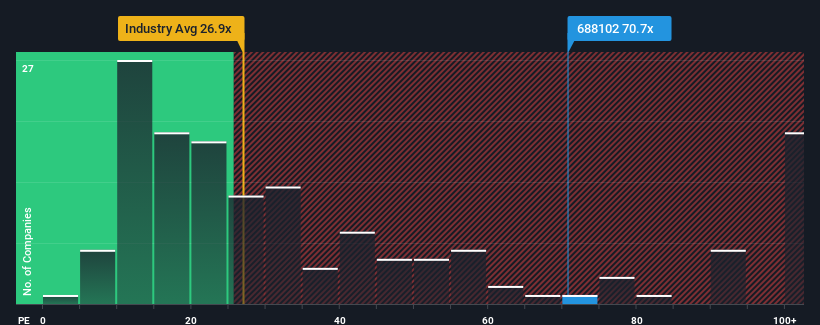

Since its price has surged higher, Shaanxi Sirui Advanced Materials' price-to-earnings (or "P/E") ratio of 70.7x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 33x and even P/E's below 20x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Shaanxi Sirui Advanced Materials certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Shaanxi Sirui Advanced Materials

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Shaanxi Sirui Advanced Materials' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 46%. Pleasingly, EPS has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Shaanxi Sirui Advanced Materials' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shaanxi Sirui Advanced Materials' P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shaanxi Sirui Advanced Materials maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Shaanxi Sirui Advanced Materials that you need to take into consideration.

If these risks are making you reconsider your opinion on Shaanxi Sirui Advanced Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688102

Shaanxi Sirui Advanced Materials

Shaanxi Sirui Advanced Materials Co., Ltd.

High growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026