Suzhou Shihua New Material Technology Co., Ltd.'s (SHSE:688093) Shares Bounce 31% But Its Business Still Trails The Market

Those holding Suzhou Shihua New Material Technology Co., Ltd. (SHSE:688093) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

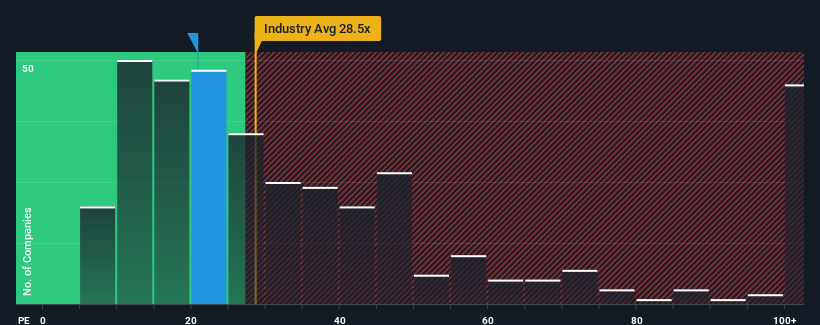

Even after such a large jump in price, Suzhou Shihua New Material Technology may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.8x, since almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 56x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Suzhou Shihua New Material Technology's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Suzhou Shihua New Material Technology

Is There Any Growth For Suzhou Shihua New Material Technology?

The only time you'd be truly comfortable seeing a P/E as low as Suzhou Shihua New Material Technology's is when the company's growth is on track to lag the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Regardless, EPS has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 42% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Suzhou Shihua New Material Technology is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Suzhou Shihua New Material Technology's P/E

Suzhou Shihua New Material Technology's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Suzhou Shihua New Material Technology revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Suzhou Shihua New Material Technology that you should be aware of.

You might be able to find a better investment than Suzhou Shihua New Material Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688093

Suzhou Shihua New Material Technology

Suzhou Shihua New Material Technology Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives