- China

- /

- Auto Components

- /

- SHSE:605333

August 2024's Chinese Exchange Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In August 2024, Chinese stocks have seen mixed performance, with the Shanghai Composite Index falling by 1.48% and the blue-chip CSI 300 dropping by 1.56%, despite a stronger-than-expected increase in consumer prices. Amid these market fluctuations and concerns about deflationary pressures, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities. A good stock in this context is one that demonstrates strong fundamentals and resilience amidst economic uncertainties, offering potential for appreciation as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥171.02 | CN¥326.01 | 47.5% |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥39.91 | CN¥76.16 | 47.6% |

| Shenzhen Hopewind Electric (SHSE:603063) | CN¥13.92 | CN¥26.91 | 48.3% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥18.90 | CN¥37.47 | 49.6% |

| Guangzhou Tinci Materials Technology (SZSE:002709) | CN¥14.72 | CN¥28.93 | 49.1% |

| Skyworth Digital (SZSE:000810) | CN¥7.74 | CN¥14.99 | 48.4% |

| Gambol Pet Group (SZSE:301498) | CN¥43.08 | CN¥80.73 | 46.6% |

| Qingdao NovelBeam TechnologyLtd (SHSE:688677) | CN¥31.66 | CN¥62.66 | 49.5% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥8.03 | CN¥15.61 | 48.6% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥25.45 | CN¥50.05 | 49.2% |

Here's a peek at a few of the choices from the screener.

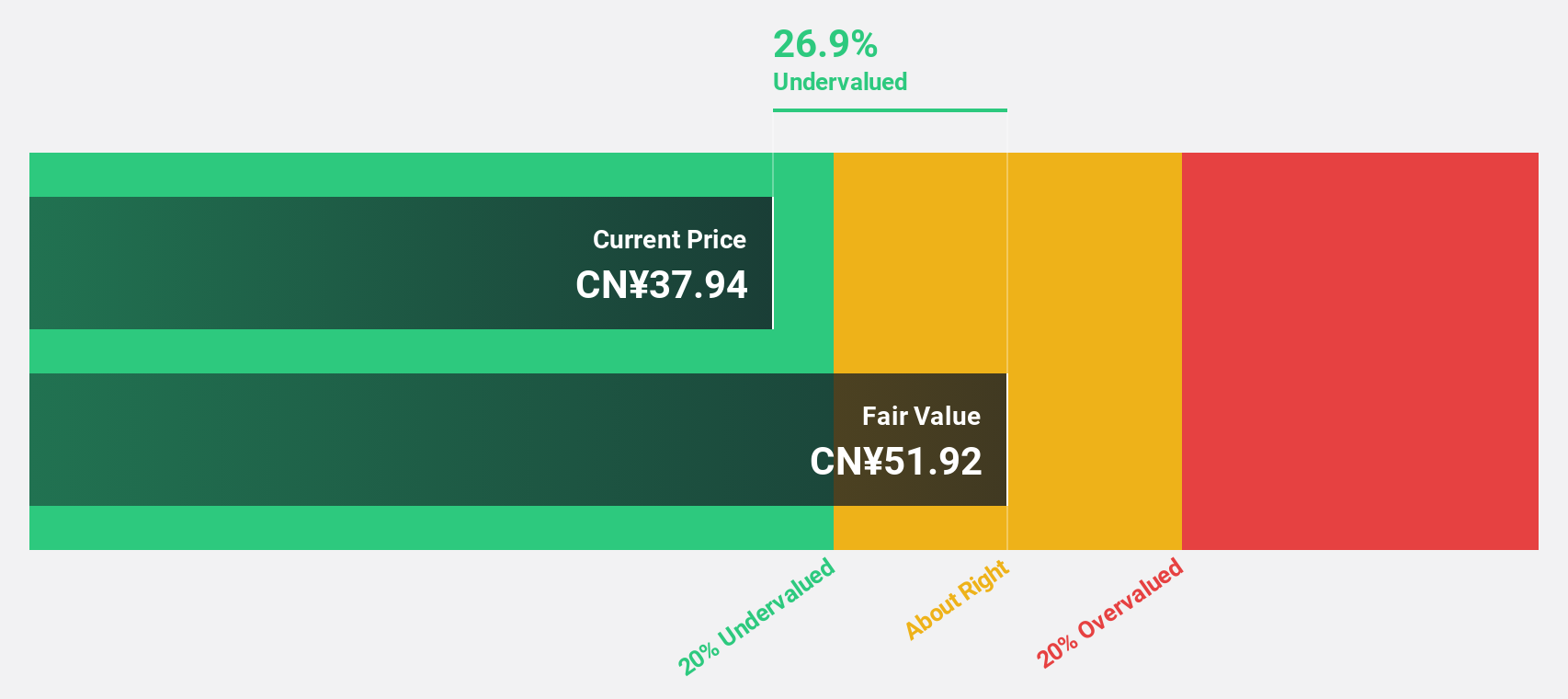

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. produces and sells paints, coatings, and building materials under the 3trees brand in China, with a market cap of CN¥16.64 billion.

Operations: SKSHU Paint Co., Ltd. generates revenue from producing and selling paints, coatings, and building materials under the 3trees brand in China.

Estimated Discount To Fair Value: 40.3%

SKSHU Paint Ltd. is trading at CN¥31.57, significantly below its estimated fair value of CN¥52.92, indicating undervaluation based on discounted cash flow analysis. Despite a high level of debt and volatile share price over the past three months, earnings are forecast to grow 56.4% annually, outpacing the market average of 22%. Recent earnings showed a decline in net income to CN¥210 million from CN¥310.56 million year-on-year, reflecting lower profit margins but stable revenue growth.

- Our comprehensive growth report raises the possibility that SKSHU PaintLtd is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of SKSHU PaintLtd stock in this financial health report.

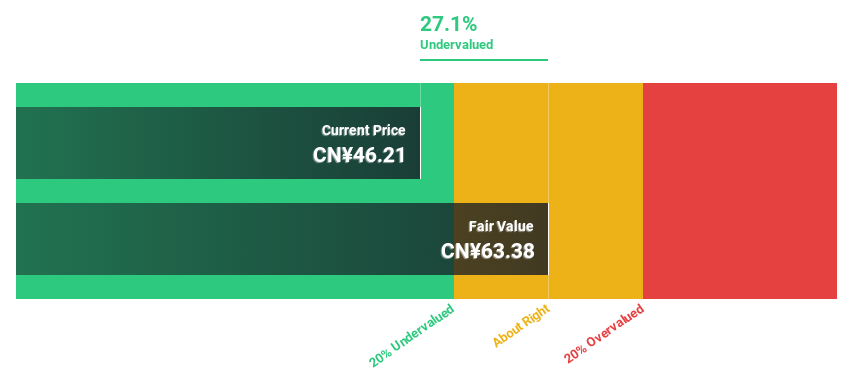

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. engages in the R&D, production, and sales of automotive high and low voltage wiring harness assembly products in China and internationally, with a market cap of CN¥10.16 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue from the development, manufacturing, and sale of automotive high and low voltage wiring harness assembly products both domestically and internationally.

Estimated Discount To Fair Value: 41%

Kunshan Huguang Auto Harness Ltd. is trading at CN¥23.26, well below its estimated fair value of CN¥39.44, highlighting significant undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow 44.25% annually over the next three years, outpacing the Chinese market average of 22%. Despite high past earnings growth and a projected revenue increase of 28.9% per year, debt coverage by operating cash flow remains a concern for investors.

- Insights from our recent growth report point to a promising forecast for Kunshan Huguang Auto HarnessLtd's business outlook.

- Click here to discover the nuances of Kunshan Huguang Auto HarnessLtd with our detailed financial health report.

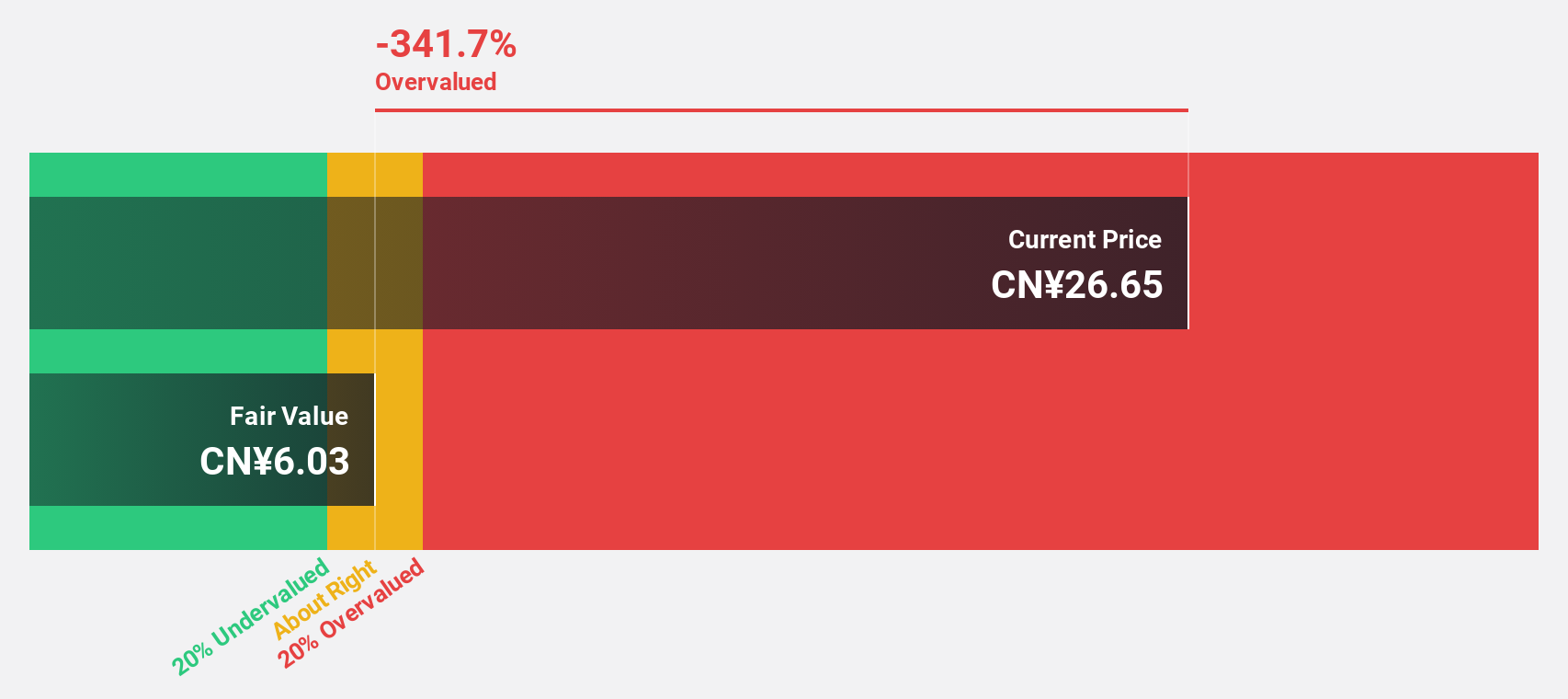

Shenzhen Bluetrum Technology (SHSE:688332)

Overview: Shenzhen Bluetrum Technology Co., Ltd. focuses on the research, development, design, and sale of wireless audio SOC chips and has a market cap of CN¥6.36 billion.

Operations: The company generates revenue primarily from the research, development, design, and sale of wireless audio SOC chips.

Estimated Discount To Fair Value: 15.1%

Shenzhen Bluetrum Technology is trading at CN¥52.89, below its estimated fair value of CN¥62.32, indicating it is undervalued based on cash flows. The company's earnings are expected to grow significantly at 23.5% per year over the next three years, outpacing the Chinese market average of 22%. However, its dividend yield of 1.57% is not well covered by free cash flows, and its return on equity forecast remains low at 9.6%.

- Our expertly prepared growth report on Shenzhen Bluetrum Technology implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Shenzhen Bluetrum Technology with our comprehensive financial health report here.

Taking Advantage

- Explore the 104 names from our Undervalued Chinese Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Huguang Auto HarnessLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605333

Kunshan Huguang Auto HarnessLtd

Engages in the research and development, production, and sales of automotive high and low voltage wiring harness assembly products in China and internationally.

Exceptional growth potential with solid track record.