Zhejiang Sanmei Chemical Industry Co.,Ltd. (SHSE:603379) Stock Rockets 39% As Investors Are Less Pessimistic Than Expected

Zhejiang Sanmei Chemical Industry Co.,Ltd. (SHSE:603379) shares have continued their recent momentum with a 39% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 35%.

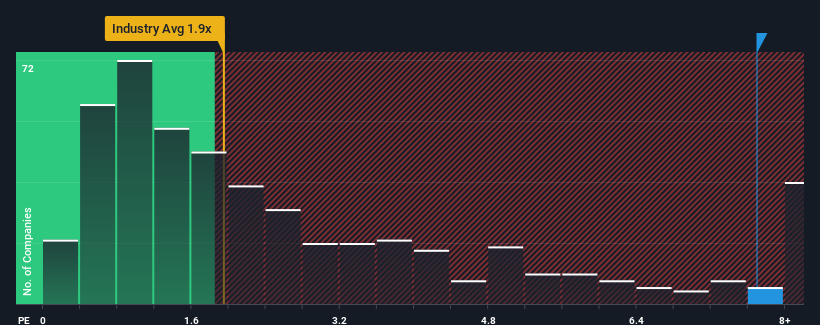

Since its price has surged higher, you could be forgiven for thinking Zhejiang Sanmei Chemical IndustryLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.7x, considering almost half the companies in China's Chemicals industry have P/S ratios below 1.9x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zhejiang Sanmei Chemical IndustryLtd

What Does Zhejiang Sanmei Chemical IndustryLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Zhejiang Sanmei Chemical IndustryLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Sanmei Chemical IndustryLtd will help you uncover what's on the horizon.How Is Zhejiang Sanmei Chemical IndustryLtd's Revenue Growth Trending?

Zhejiang Sanmei Chemical IndustryLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 25%, which is not materially different.

With this information, we find it interesting that Zhejiang Sanmei Chemical IndustryLtd is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Zhejiang Sanmei Chemical IndustryLtd's P/S

Shares in Zhejiang Sanmei Chemical IndustryLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Zhejiang Sanmei Chemical IndustryLtd's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zhejiang Sanmei Chemical IndustryLtd (1 shouldn't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Zhejiang Sanmei Chemical IndustryLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Sanmei Chemical IndustryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603379

Zhejiang Sanmei Chemical IndustryLtd

Zhejiang Sanmei Chemical Industry Co., Ltd.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives