- Saudi Arabia

- /

- Insurance

- /

- SASE:8313

Spotlighting Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from the ECB and SNB, alongside expectations of a Federal Reserve cut, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming compared to larger indices. In this environment of cautious optimism and mixed economic signals, identifying undiscovered gems requires focusing on companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Komori | 9.77% | 7.35% | 59.64% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

| NCD | nan | nan | nan | ☆☆☆☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in Saudi Arabia, with a market capitalization of SAR 5.61 billion.

Operations: With a market capitalization of SAR 5.61 billion, revenue is primarily driven by Tameeni - Motors at SAR 187.93 million, followed by Leasing at SAR 77.92 million and Tameeni - Health contributing SAR 40.40 million.

Rasan Information Technology, a small cap player in the tech space, has been making waves with its impressive earnings growth of 84% over the past year. This performance outpaces the broader insurance industry, which saw a -6.9% change. The company is debt-free and boasts high-quality earnings, indicating strong financial health. Rasan's free cash flow turned positive in recent years, reaching US$109 million as of June 2024. Despite its volatile share price recently, Rasan seems poised for continued expansion with revenue projected to grow by over 25% annually moving forward.

Gansu Dunhuang Seed GroupLtd (SHSE:600354)

Simply Wall St Value Rating: ★★★★★★

Overview: Gansu Dunhuang Seed Group Co., Ltd. operates in the seed, cotton, and food processing sectors both within China and internationally, with a market capitalization of approximately CN¥3.48 billion.

Operations: The company's primary revenue streams are derived from its seed, cotton, and food processing businesses. A notable trend is observed in its gross profit margin, which stands at 25%, indicating the efficiency of its core operations in generating profit relative to cost of goods sold.

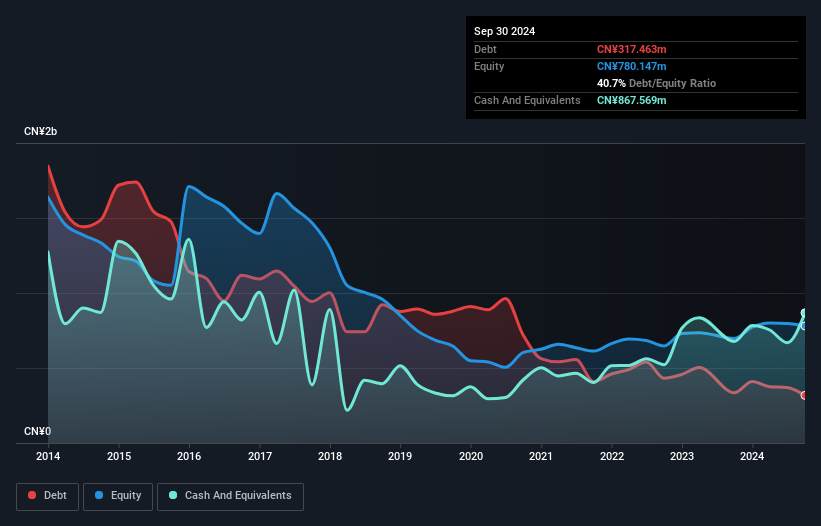

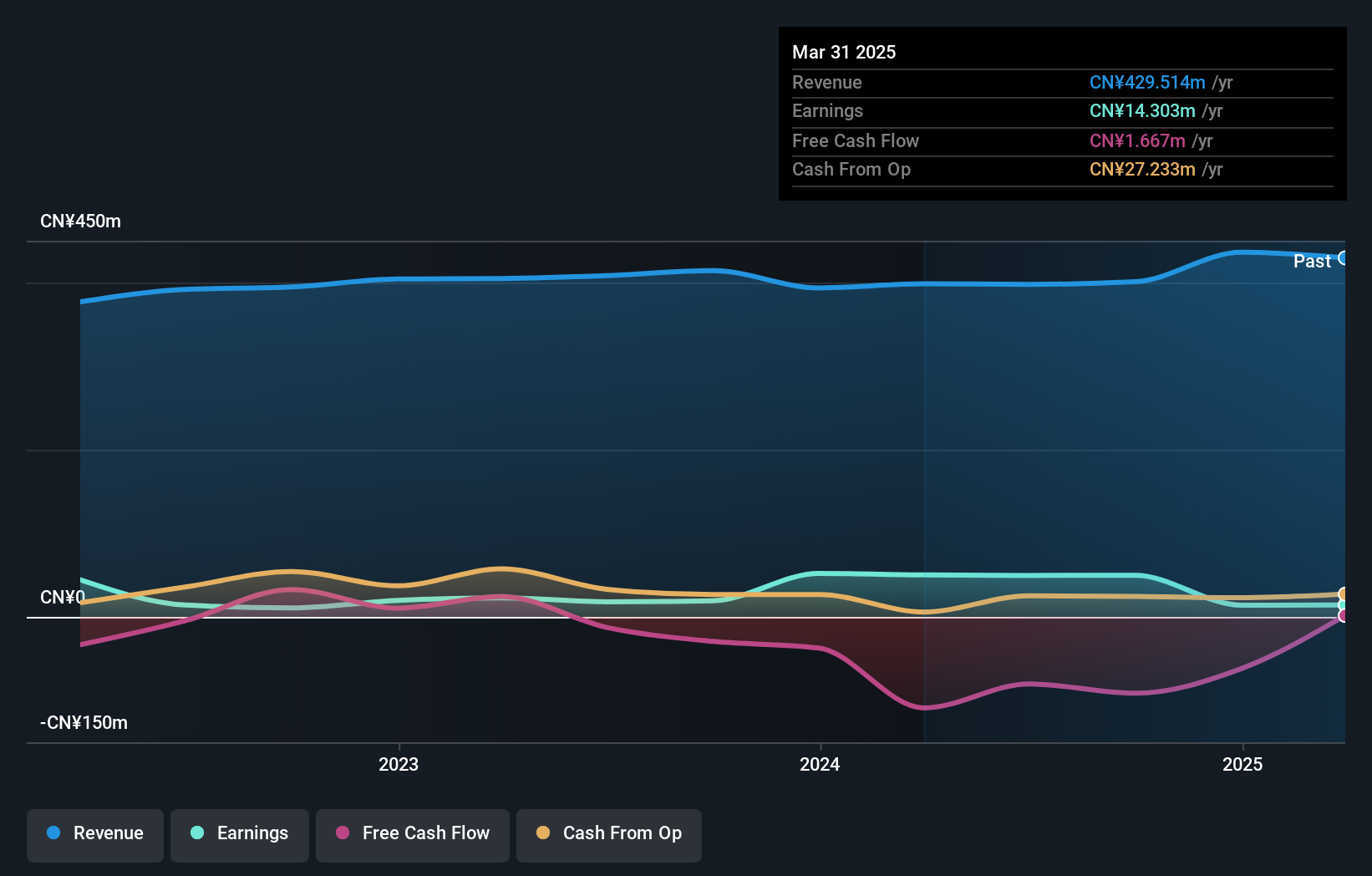

Gansu Dunhuang Seed Group has shown promising performance, with earnings surging by 75.7% over the past year, outpacing the broader food industry which saw a 5.8% drop. The company reported sales of CNY 690 million for the first nine months of 2024, up from CNY 525 million in the previous year, and turned a net income of CNY 17.98 million from a loss of CNY 13.54 million last year. Interest payments are comfortably covered at an impressive rate of 27 times by EBIT, and its debt-to-equity ratio improved significantly to 40.7% over five years, indicating prudent financial management.

- Delve into the full analysis health report here for a deeper understanding of Gansu Dunhuang Seed GroupLtd.

Gain insights into Gansu Dunhuang Seed GroupLtd's past trends and performance with our Past report.

New East New Materials (SHSE:603110)

Simply Wall St Value Rating: ★★★★★★

Overview: New East New Materials Co., Ltd specializes in manufacturing and selling raw materials for the flexible and polyurethane adhesives packaging industry in China, with a market cap of CN¥3.66 billion.

Operations: The company generates revenue primarily from the sale of raw materials used in flexible and polyurethane adhesives packaging. It has reported a net profit margin of 15.2% in its latest financial period, reflecting its profitability after accounting for all expenses.

New East New Materials, a noteworthy player in the chemicals sector, has shown impressive earnings growth of 157.6% over the past year, outpacing the industry average of -4.7%. Despite this surge, its earnings have decreased by 9.8% annually over five years. The company is debt-free today compared to a debt-to-equity ratio of 6.3% five years ago, highlighting improved financial health. However, recent reports indicate a dip in net income to CNY 12.7 million from CNY 14.94 million last year for nine months ending September 2024, with basic EPS at CNY 0.06 versus CNY 0.07 previously reported—suggesting some challenges ahead despite strong growth metrics and no debt burden.

Seize The Opportunity

- Discover the full array of 4625 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8313

Rasan Information Technology

A financial technology company, provides insurance and financial services in the Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives