Discovering Undiscovered Gems in Global Stocks This October 2025

Reviewed by Simply Wall St

In October 2025, global markets are navigating a complex landscape marked by the U.S. government shutdown and mixed economic signals, yet small-cap stocks have shown resilience with the Russell 2000 Index outperforming larger indices amid expectations of potential rate cuts. As investors seek opportunities in this dynamic environment, identifying undiscovered gems requires focusing on companies that can thrive under shifting monetary policies and demonstrate strong fundamentals despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| TCM Biotech International | 2.84% | 2.11% | 5.25% | ★★★★★★ |

| Green World Fintech Service | 5.27% | 9.27% | 14.30% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Pacific Construction | 22.17% | -12.87% | 37.11% | ★★★★★☆ |

| First Copper Technology | 19.69% | 3.43% | -2.37% | ★★★★★☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Guodian Nanjing Automation (SHSE:600268)

Simply Wall St Value Rating: ★★★★★★

Overview: Guodian Nanjing Automation Co., Ltd. is involved in the manufacture and sale of industrial power automation equipment both in China and internationally, with a market cap of CN¥10.76 billion.

Operations: Guodian Nanjing Automation generates revenue primarily from its industrial power automation equipment segment, totaling CN¥9.89 billion.

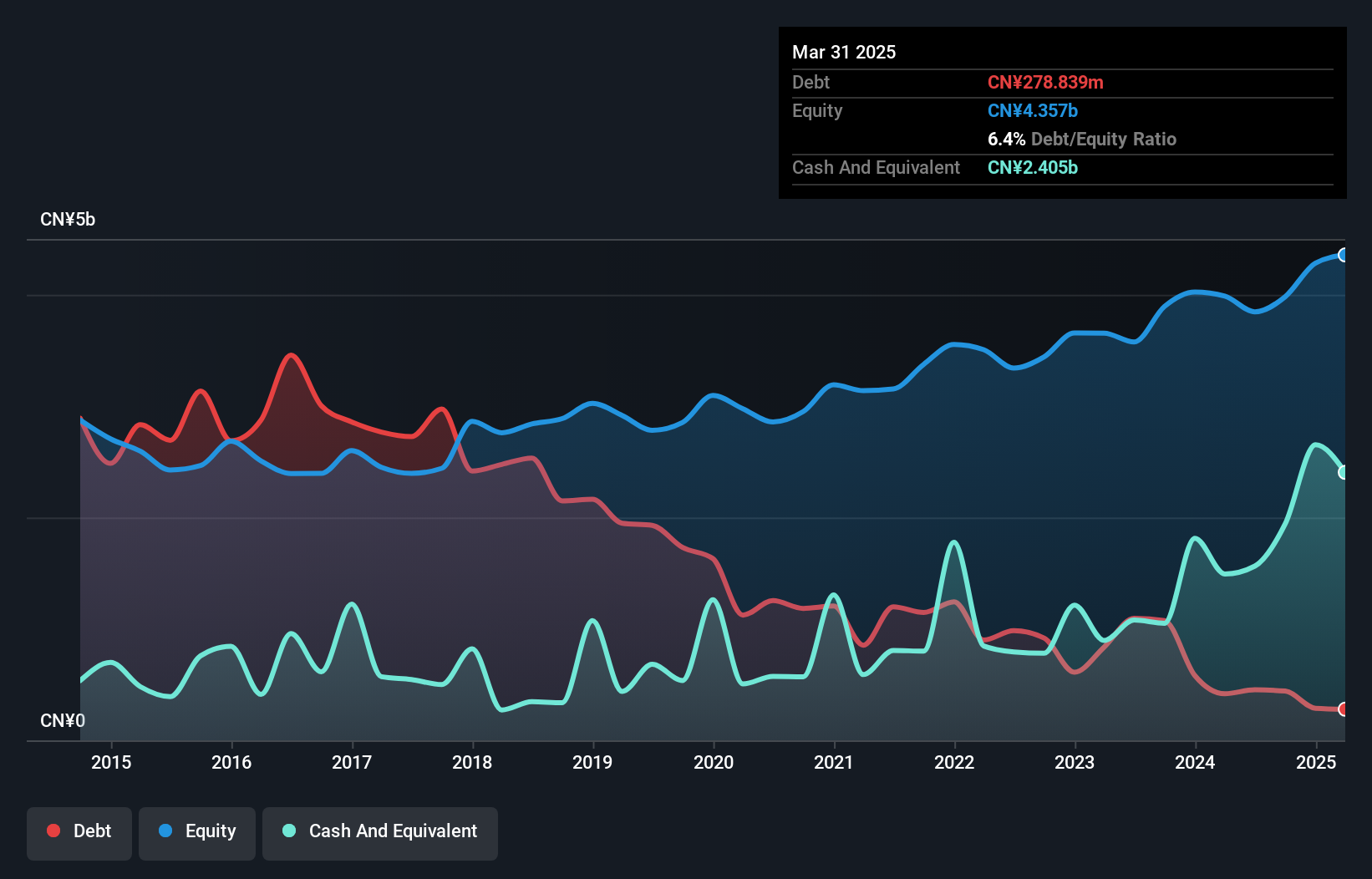

Guodian Nanjing Automation stands out with a notable earnings growth of 83.7% over the past year, surpassing the Electrical industry's -0.2%, highlighting its robust performance in a challenging market. The company reported half-year sales of CNY 4.27 billion and net income of CNY 158.86 million, both significantly up from last year's figures. With a price-to-earnings ratio of 26.5x, it presents good value compared to the broader CN market at 45.7x. Additionally, their debt-to-equity ratio has improved to 6.9% from 43.9% over five years, indicating prudent financial management amidst high volatility in share prices recently observed.

Hubei Zhenhua ChemicalLtd (SHSE:603067)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hubei Zhenhua Chemical Co., Ltd. focuses on the research, development, manufacture, and sale of chromium salt and related products mainly in China, with a market capitalization of CN¥13.40 billion.

Operations: Hubei Zhenhua Chemical Co., Ltd. generates revenue primarily from the sale of chromium salt products in China. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin, which reflects the efficiency of its operations.

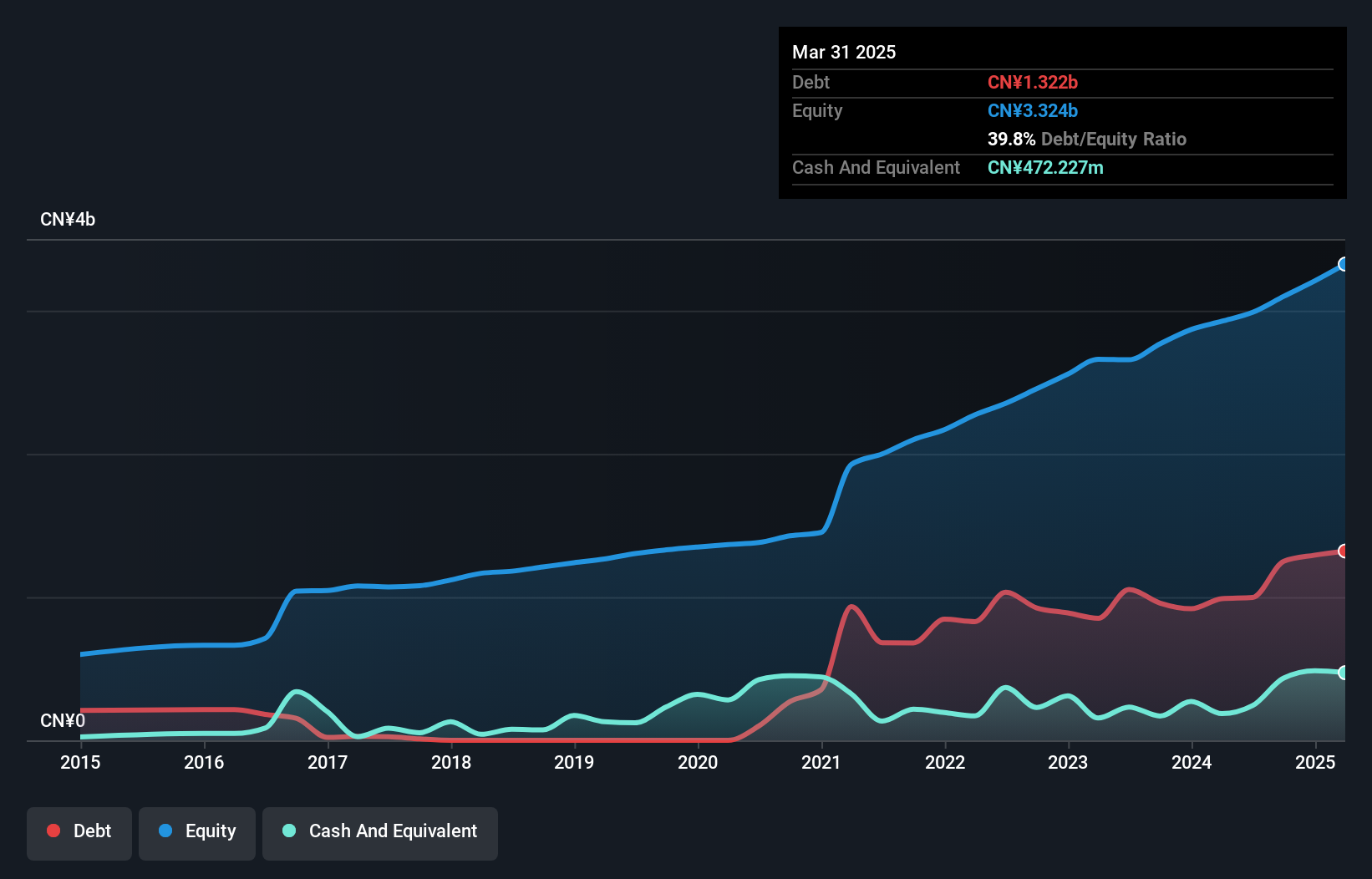

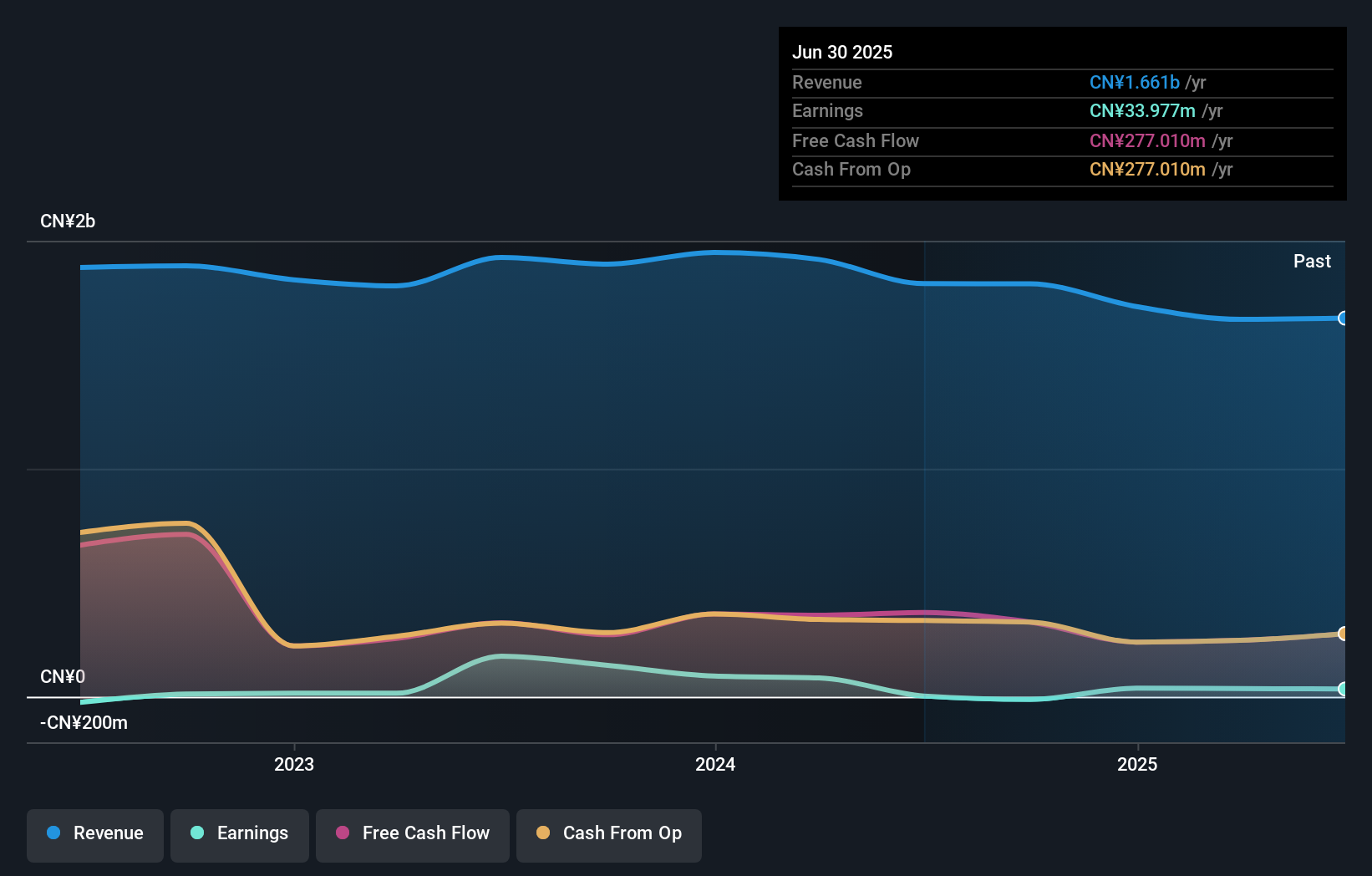

Hubei Zhenhua Chemical appears to be an intriguing player in the chemicals industry, showcasing solid growth with earnings rising by 26.7% over the past year, outpacing the industry's 1.6%. The company reported half-year sales of CNY 2.18 billion and net income of CNY 297.93 million, reflecting a healthy increase from last year's figures. Despite a debt-to-equity ratio climbing from 7.2% to 37.6% over five years, its interest payments are well covered by EBIT at a strong coverage of 20.5 times, indicating financial stability and potential for future growth within its sector context.

- Click here to discover the nuances of Hubei Zhenhua ChemicalLtd with our detailed analytical health report.

Learn about Hubei Zhenhua ChemicalLtd's historical performance.

Shenzhen SEGLtd (SZSE:000058)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen SEG Co., Ltd operates in China, focusing on electronic professional markets, leasing, real estate development, and property management, with a market cap of CN¥10.12 billion.

Operations: The company generates revenue primarily from property management (CN¥851.26 million) and electronic market circulation (CN¥538.62 million), with additional contributions from new energy, real estate development, and inspection services.

Shenzhen SEG Ltd., a relatively small player in the market, has demonstrated impressive earnings growth of 1022% over the past year, outpacing its industry peers. Despite a one-off loss of CN¥27.9M impacting recent results, the company remains profitable with a solid debt-to-equity ratio improvement from 69.7% to 26.6% over five years. Interest payments are comfortably covered by EBIT at seven times coverage, indicating financial stability. Recent shareholder meetings have focused on governance and audit matters, suggesting active management engagement in strategic decisions for future growth and operational efficiency improvements within the company’s framework.

- Click to explore a detailed breakdown of our findings in Shenzhen SEGLtd's health report.

Gain insights into Shenzhen SEGLtd's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 2922 companies within our Global Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Zhenhua ChemicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603067

Hubei Zhenhua ChemicalLtd

Engages in the research, development, manufacture, and sale of chromium salt and other related products primarily in China.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives