The recent announcement of higher-than-expected tariffs has sparked significant concerns about global trade, leading to sharp declines in stock markets worldwide. Despite these challenges, penny stocks—typically representing smaller or newer companies—remain an intriguing investment area due to their affordability and potential for growth. In this article, we will explore several Asian penny stocks that exhibit strong financial foundations and could offer promising opportunities for investors seeking value in a turbulent market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.28 | THB1.78B | ✅ 4 ⚠️ 5 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.32 | THB2.68B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.365 | SGD147.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.193 | SGD38.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.57B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.11 | HK$1.28B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.01 | HK$45.93B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.16 | CN¥3.66B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,111 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in China, with a market capitalization of approximately HK$30.45 billion.

Operations: The company generates revenue from its segments, with CN¥17.44 billion from Chemical Products, CN¥62.07 billion from Petroleum Products, and CN¥6.91 billion from Petrochemical Products Trade.

Market Cap: HK$30.45B

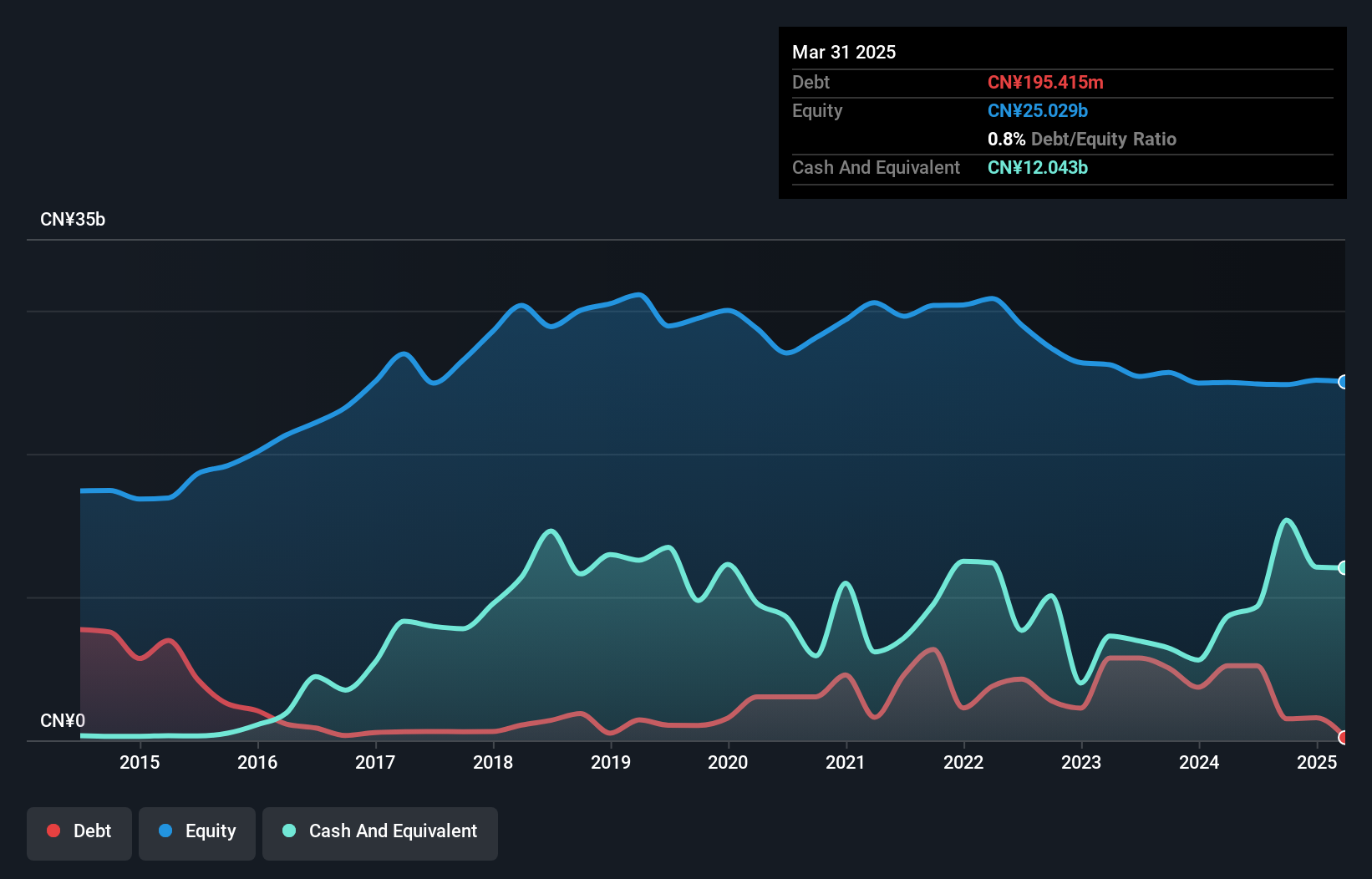

Sinopec Shanghai Petrochemical has shown a financial turnaround, reporting a net income of CN¥316.5 million for 2024 compared to a loss the previous year. The company has strong liquidity, with short-term assets exceeding both short and long-term liabilities significantly. Despite low return on equity at 1.3%, it maintains high-quality earnings and interest coverage is not an issue due to more cash than total debt. Recent strategic moves include a proposed dividend and technology R&D collaboration with Sinopec Corp., while leadership transitions do not disrupt operations, as evidenced by stable management tenure and board experience.

- Click to explore a detailed breakdown of our findings in Sinopec Shanghai Petrochemical's financial health report.

- Gain insights into Sinopec Shanghai Petrochemical's future direction by reviewing our growth report.

Shaanxi Beiyuan Chemical Industry Group (SHSE:601568)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shaanxi Beiyuan Chemical Industry Group Co., Ltd. operates in the chemical industry, focusing on the production and sale of chemical products, with a market cap of approximately CN¥16.09 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥16.09B

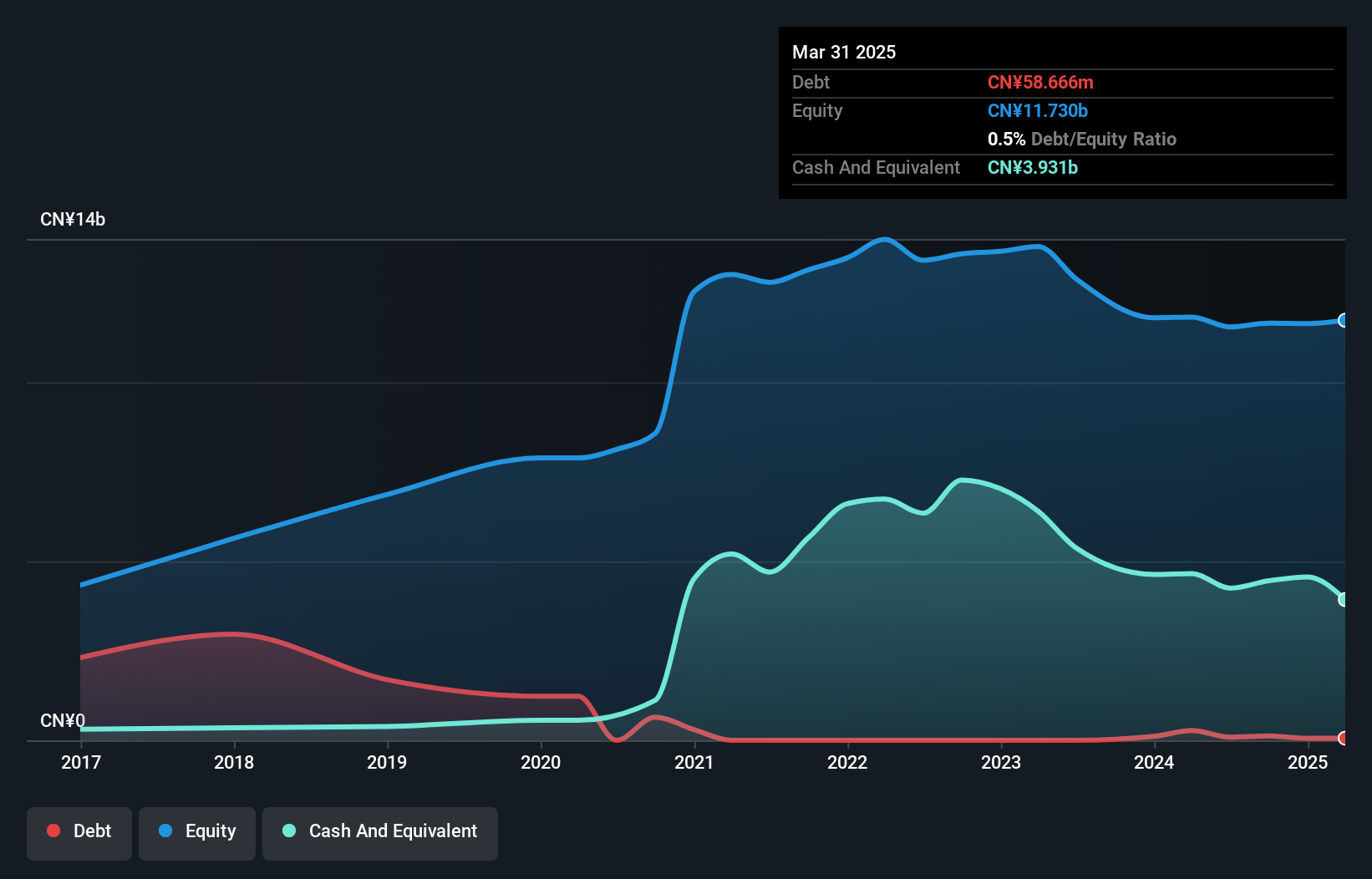

Shaanxi Beiyuan Chemical Industry Group, with a market cap of CN¥16.09 billion, has shown financial stability despite recent challenges. The company's short-term assets of CN¥5.7 billion comfortably cover both short and long-term liabilities, and its interest payments are well covered by EBIT at 6.4 times coverage. However, earnings have declined significantly over the past year with net income dropping to CN¥235.56 million from CN¥372.57 million the previous year, reflecting a negative growth trend in profits and profit margins narrowing to 2.3%. Management remains stable with seasoned leadership averaging 5.7 years tenure.

- Navigate through the intricacies of Shaanxi Beiyuan Chemical Industry Group with our comprehensive balance sheet health report here.

- Evaluate Shaanxi Beiyuan Chemical Industry Group's historical performance by accessing our past performance report.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd, along with its subsidiaries, manufactures and markets rutile titanium dioxide products both domestically in China and internationally, with a market cap of CN¥16.19 billion.

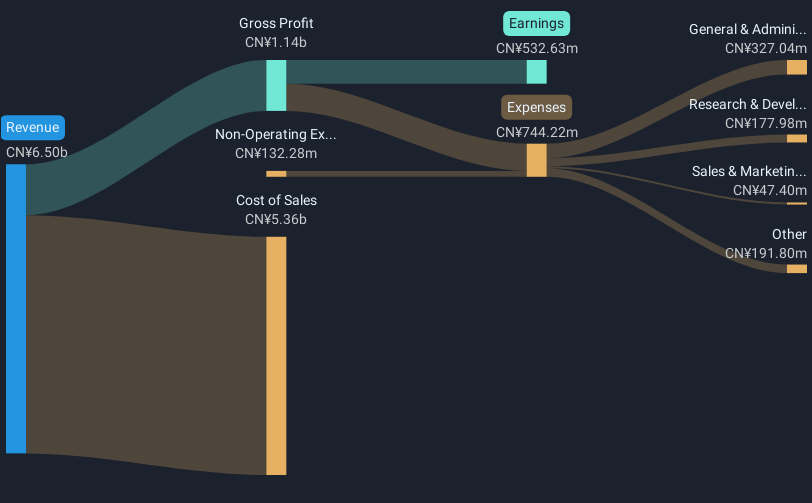

Operations: The company's revenue segments include New Energy Class generating CN¥4.12 billion, Fine Chemical Type contributing CN¥5.84 billion, Logistics Services with CN¥347.73 million, and Phosphorus Chemical Industry adding CN¥597.04 million.

Market Cap: CN¥16.19B

CNNC Hua Yuan Titanium Dioxide Co., Ltd, with a market cap of CN¥16.19 billion, has seen robust earnings growth over the past year at 34.8%, surpassing the industry average. Despite this, its debt coverage by operating cash flow remains weak at 8%. The company’s short-term assets of CN¥10.3 billion cover both short and long-term liabilities comfortably, and interest payments are not a concern due to sufficient earnings coverage. Recent announcements include a share buyback program worth up to CN¥500 million aimed at employee incentives, reflecting strategic financial management amidst fluctuating profit margins and new leadership challenges.

- Take a closer look at CNNC Hua Yuan Titanium Dioxide's potential here in our financial health report.

- Review our historical performance report to gain insights into CNNC Hua Yuan Titanium Dioxide's track record.

Make It Happen

- Dive into all 1,111 of the Asian Penny Stocks we have identified here.

- Ready For A Different Approach? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives