As global markets react to the Federal Reserve's cautious outlook and political uncertainties, investors are navigating a landscape marked by volatility and mixed economic signals. Despite these challenges, certain investment opportunities continue to attract attention, particularly in the realm of penny stocks. While the term "penny stocks" might seem outdated, it remains relevant for those seeking growth potential in smaller or newer companies with strong financial foundations. This article highlights several standout penny stocks that combine robust balance sheets with promising long-term prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,841 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces and sells solar glass products across the People’s Republic of China, other parts of Asia, North America, Europe, and internationally with a market cap of HK$28.69 billion.

Operations: The company's revenue is primarily derived from the sales of solar glass, amounting to HK$24.04 billion, and its solar farm business, including EPC services, contributing HK$3.03 billion.

Market Cap: HK$28.69B

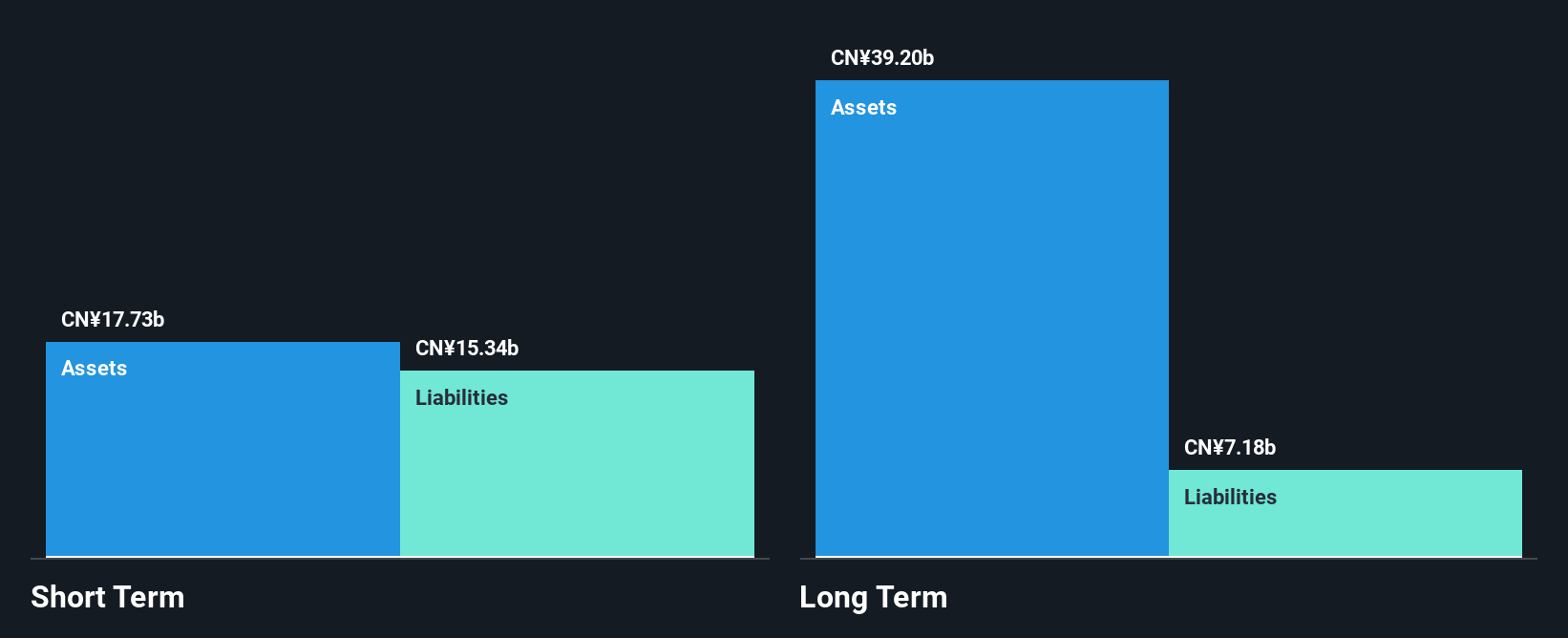

Xinyi Solar Holdings has demonstrated strong financial performance with earnings growth of 43.9% over the past year, significantly outpacing the semiconductor industry. Its net profit margins have improved to 17.5%, and it maintains high-quality earnings. The company has effectively managed its debt, reducing its debt-to-equity ratio from 44.7% to a satisfactory 23.9%. Despite this progress, its dividend yield of 7.91% is not well covered by free cash flows, indicating potential sustainability concerns. Xinyi's short-term assets comfortably cover both long-term and short-term liabilities, suggesting robust liquidity management in an evolving market landscape.

- Click to explore a detailed breakdown of our findings in Xinyi Solar Holdings' financial health report.

- Explore Xinyi Solar Holdings' analyst forecasts in our growth report.

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yiwu Huading Nylon Co., Ltd. focuses on the research, development, manufacture, and sale of nylon filaments primarily in China, with a market cap of CN¥4.71 billion.

Operations: No specific revenue segments are reported for Yiwu Huading Nylon Co., Ltd.

Market Cap: CN¥4.71B

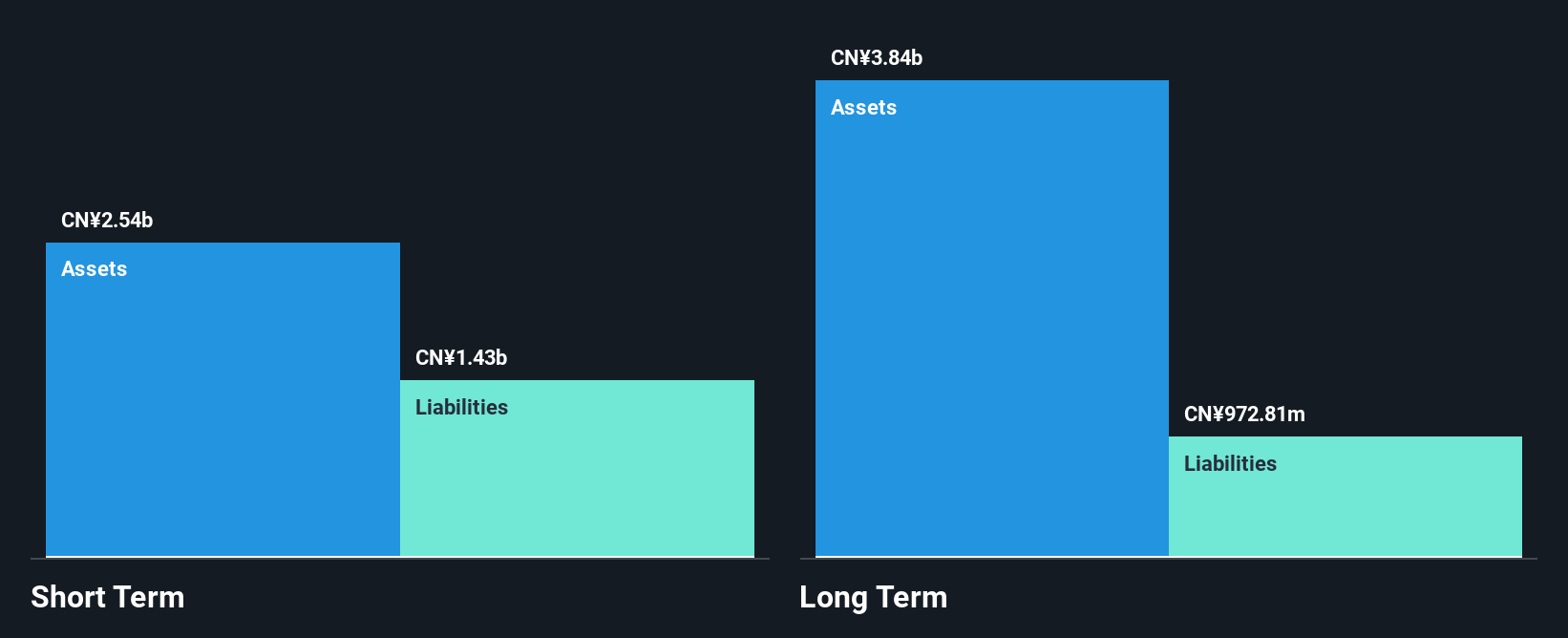

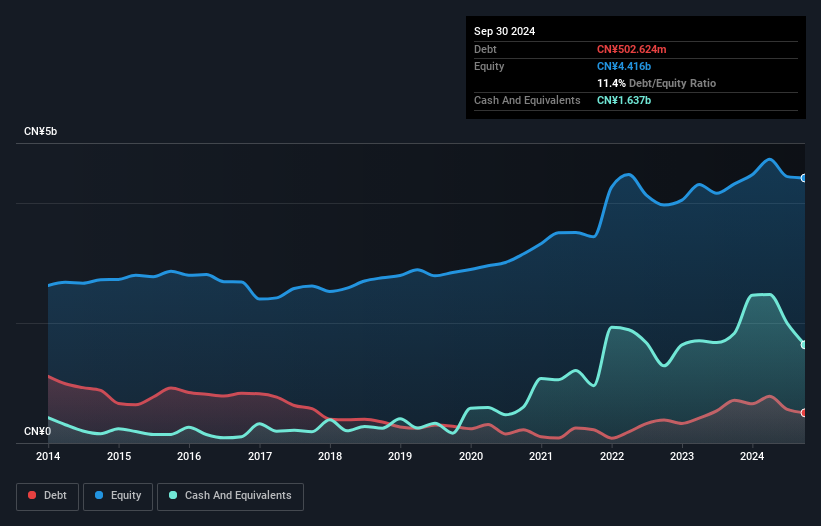

Yiwu Huading Nylon Co., Ltd. has shown commendable financial resilience, with earnings growth of 40% over the past year, surpassing the broader chemicals industry trend. The company maintains high-quality earnings and improved net profit margins from 2.8% to 3.8%. Its short-term assets of CN¥2.4 billion comfortably cover both short-term and long-term liabilities, highlighting strong liquidity management. Yiwu Huading's debt-to-equity ratio has decreased significantly over five years, indicating prudent debt management, while its return on equity remains low at 8.4%. A recent private placement agreement aims to raise CN¥707.50 million for further strategic initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Yiwu Huading NylonLtd.

- Examine Yiwu Huading NylonLtd's past performance report to understand how it has performed in prior years.

Baoxiniao Holding (SZSE:002154)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. operates in the research and development, production, and sale of branded clothing products in China with a market capitalization of CN¥7.05 billion.

Operations: The company generates its revenue primarily from the Textile and Apparel segment, which accounts for CN¥4.98 billion.

Market Cap: CN¥7.05B

Baoxiniao Holding Co., Ltd. has experienced a decline in earnings, with net income decreasing to CN¥415.27 million from CN¥555.12 million year-over-year, reflecting challenges in its core Textile and Apparel segment. Despite this, the company maintains a solid financial position with short-term assets of CN¥4 billion exceeding both short and long-term liabilities, ensuring liquidity strength. The management team is seasoned with an average tenure of eight years, contributing to stability amidst market fluctuations. Baoxiniao's recent private placement aims to raise approximately CN¥800 million for strategic growth initiatives while maintaining shareholder value without significant dilution over the past year.

- Take a closer look at Baoxiniao Holding's potential here in our financial health report.

- Evaluate Baoxiniao Holding's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Reveal the 5,841 hidden gems among our Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yiwu Huading NylonLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601113

Yiwu Huading NylonLtd

Engages in the research, development, manufacture, and sale of nylon filaments primarily in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives