- Japan

- /

- Wireless Telecom

- /

- TSE:9434

3 Global Stocks Estimated To Be Undervalued In October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of a U.S. government shutdown and shifting economic indicators, investors are closely watching for signs of potential Federal Reserve rate cuts amid mixed labor market data. In this environment, identifying undervalued stocks can be particularly appealing as they may offer opportunities for growth when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.58 | CN¥76.69 | 49.7% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Profoto Holding (OM:PRFO) | SEK17.80 | SEK35.08 | 49.3% |

| Mobvista (SEHK:1860) | HK$19.19 | HK$37.84 | 49.3% |

| Kadokawa (TSE:9468) | ¥3609.00 | ¥7215.86 | 50% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.30 | HK$34.41 | 49.7% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95790.40 | 49.7% |

| Cosmax (KOSE:A192820) | ₩212000.00 | ₩422997.50 | 49.9% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥48.60 | CN¥95.68 | 49.2% |

| Allegro.eu (WSE:ALE) | PLN33.495 | PLN66.20 | 49.4% |

Let's uncover some gems from our specialized screener.

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Overview: Chifeng Jilong Gold Mining Co., Ltd. is involved in the mining, metallurgical processing, and sales of gold on a global scale, with a market capitalization of CN¥56.90 billion.

Operations: Chifeng Jilong Gold Mining Co., Ltd. generates revenue primarily through its global activities in gold mining, metallurgical processing, and sales.

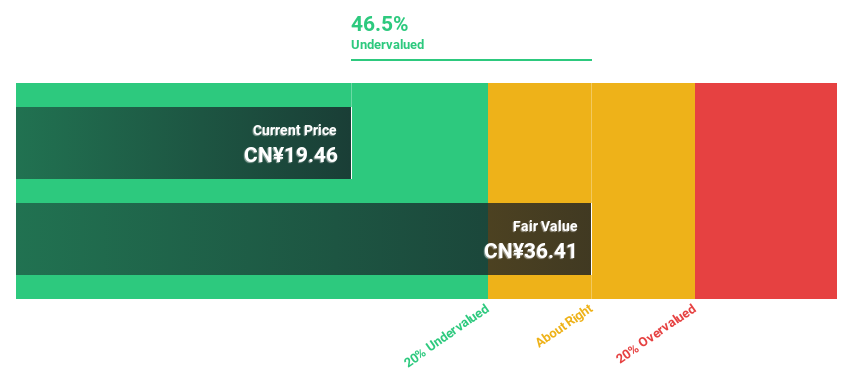

Estimated Discount To Fair Value: 47.3%

Chifeng Jilong Gold Mining Ltd. appears undervalued based on cash flow analysis, trading at CN¥32.1, significantly below its estimated fair value of CN¥60.91. Despite earnings growth trailing the broader market, forecasts indicate substantial annual profit increases of 23.65% over three years. Recent additions to major indices and a promising new gold-copper discovery in Laos enhance its prospects, while strong interim results show sales and net income growth year-over-year, affirming operational strength amidst expansion efforts.

- Our earnings growth report unveils the potential for significant increases in Chifeng Jilong Gold MiningLtd's future results.

- Get an in-depth perspective on Chifeng Jilong Gold MiningLtd's balance sheet by reading our health report here.

Shandong Boyuan Pharmaceutical & Chemical (SZSE:301617)

Overview: Shandong Boyuan Pharmaceutical & Chemical Co., Ltd. operates in the pharmaceutical and chemical industries, focusing on the development and production of specialty chemicals, with a market cap of CN¥9.47 billion.

Operations: The company's revenue from its pharmaceuticals segment amounts to CN¥1.38 billion.

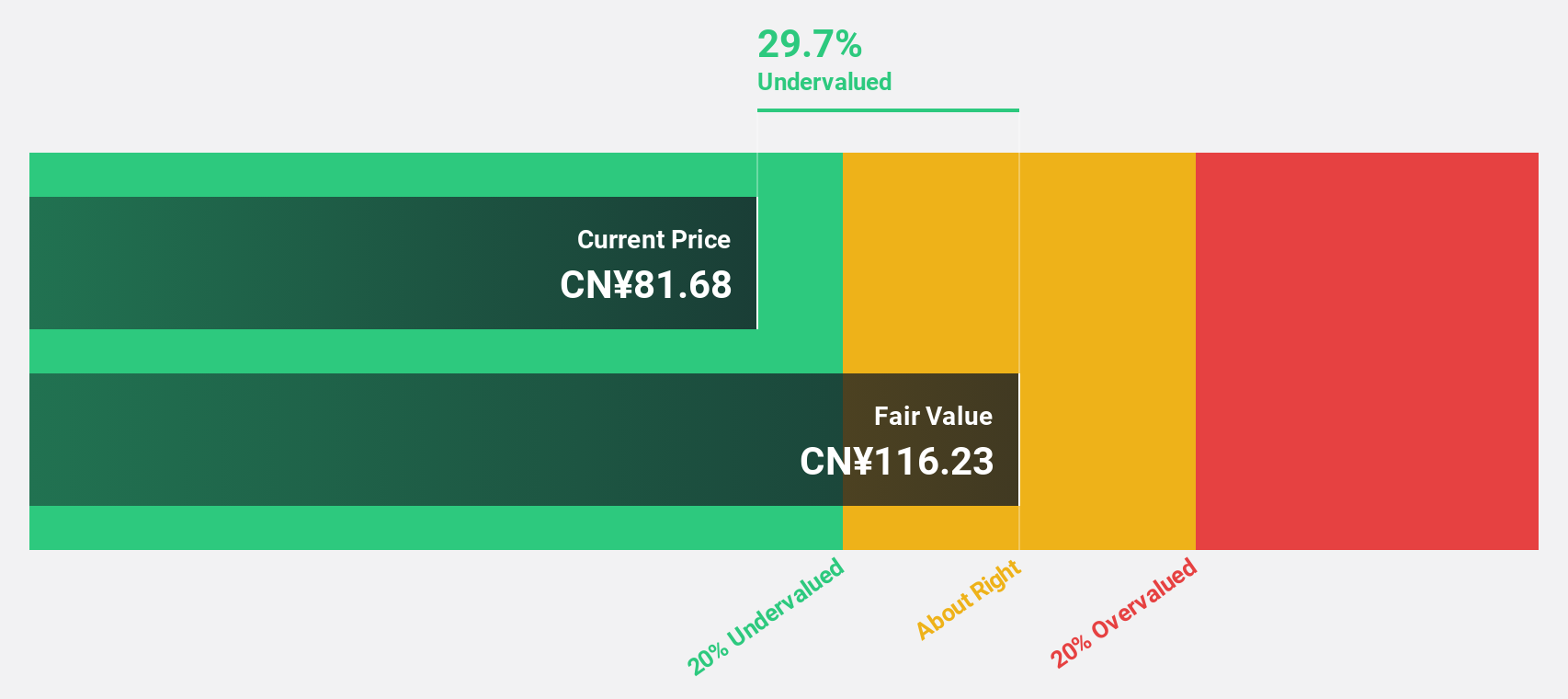

Estimated Discount To Fair Value: 26.7%

Shandong Boyuan Pharmaceutical & Chemical is trading at CN¥85.06, well below its estimated fair value of CN¥116.1, indicating potential undervaluation based on cash flows. Despite a volatile share price recently and a decline in net income to CNY 99.04 million for the first half of 2025, revenue growth forecasts are robust at 22.4% annually, outpacing the market average. However, its dividend yield of 0.47% lacks coverage by free cash flows, raising sustainability concerns.

- According our earnings growth report, there's an indication that Shandong Boyuan Pharmaceutical & Chemical might be ready to expand.

- Dive into the specifics of Shandong Boyuan Pharmaceutical & Chemical here with our thorough financial health report.

SoftBank (TSE:9434)

Overview: SoftBank Corp., along with its subsidiaries, offers mobile communications, fixed-line telecommunications, and ISP services in Japan, with a market cap of ¥10.25 trillion.

Operations: The company's revenue is primarily derived from its Consumer segment at ¥2.99 trillion, followed by Media & EC at ¥1.69 trillion, Enterprise at ¥940.64 billion, Distribution at ¥916.48 billion, and Financial services at ¥294.44 billion.

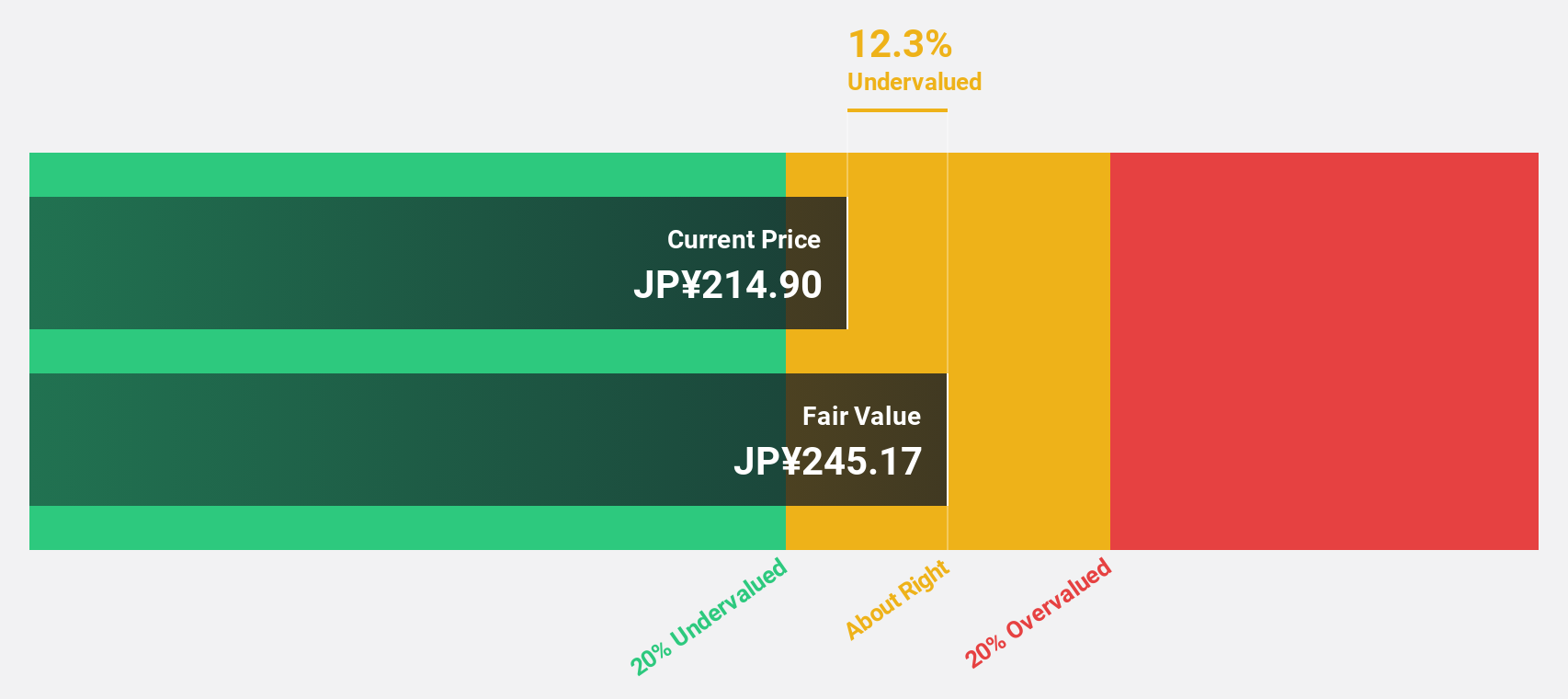

Estimated Discount To Fair Value: 12.2%

SoftBank is trading at ¥215.6, slightly below its estimated fair value of ¥245.66, suggesting it may be undervalued based on cash flows. Despite carrying a high level of debt, SoftBank's revenue and earnings are forecast to grow faster than the Japanese market at 6.3% and 8.3% annually, respectively. Recent strategic alliances like the Candle Submarine Cable System project could enhance growth prospects by expanding communication infrastructure in Asia amidst rising data demand.

- Our expertly prepared growth report on SoftBank implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of SoftBank with our detailed financial health report.

Taking Advantage

- Delve into our full catalog of 513 Undervalued Global Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives