- China

- /

- Paper and Forestry Products

- /

- SHSE:600966

Take Care Before Diving Into The Deep End On Shandong Bohui Paper Industry Co.,Ltd. (SHSE:600966)

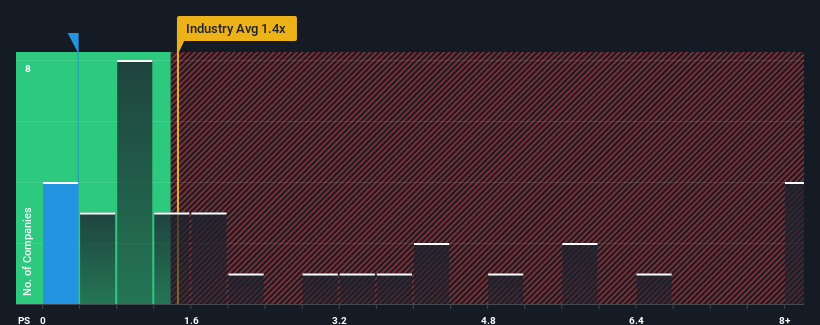

Shandong Bohui Paper Industry Co.,Ltd.'s (SHSE:600966) price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Forestry industry in China, where around half of the companies have P/S ratios above 1.4x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Shandong Bohui Paper IndustryLtd

What Does Shandong Bohui Paper IndustryLtd's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Shandong Bohui Paper IndustryLtd has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shandong Bohui Paper IndustryLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Shandong Bohui Paper IndustryLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shandong Bohui Paper IndustryLtd's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 45% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 22% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's peculiar that Shandong Bohui Paper IndustryLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Shandong Bohui Paper IndustryLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You always need to take note of risks, for example - Shandong Bohui Paper IndustryLtd has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Shandong Bohui Paper IndustryLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600966

Shandong Bohui Paper IndustryLtd

Researches, develops, produces, sells, imports, and exports paper products in China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives