Zhejiang Xinan Chemical Industrial GroupLtd's (SHSE:600596) Soft Earnings Are Actually Better Than They Appear

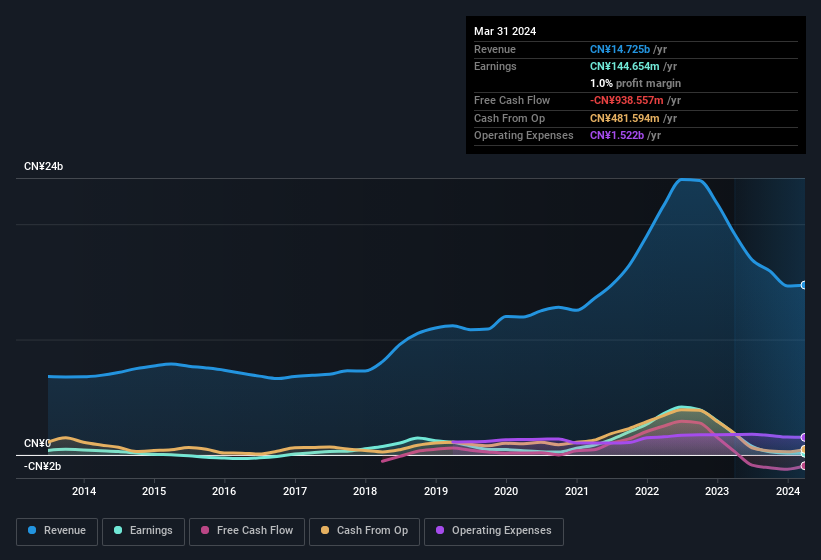

Zhejiang Xinan Chemical Industrial Group Co.,Ltd's (SHSE:600596) recent soft profit numbers didn't appear to worry shareholders, as the stock price showed strength. We think that investors might be looking at some positive factors beyond the earnings numbers.

View our latest analysis for Zhejiang Xinan Chemical Industrial GroupLtd

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Zhejiang Xinan Chemical Industrial GroupLtd increased the number of shares on issue by 18% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Zhejiang Xinan Chemical Industrial GroupLtd's historical EPS growth by clicking on this link.

A Look At The Impact Of Zhejiang Xinan Chemical Industrial GroupLtd's Dilution On Its Earnings Per Share (EPS)

Zhejiang Xinan Chemical Industrial GroupLtd's net profit dropped by 83% per year over the last three years. Even looking at the last year, profit was still down 92%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 93% in the same period. So you can see that the dilution has had a bit of an impact on shareholders.

If Zhejiang Xinan Chemical Industrial GroupLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Zhejiang Xinan Chemical Industrial GroupLtd's profit suffered from unusual items, which reduced profit by CN¥145m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. In the twelve months to March 2024, Zhejiang Xinan Chemical Industrial GroupLtd had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On Zhejiang Xinan Chemical Industrial GroupLtd's Profit Performance

To sum it all up, Zhejiang Xinan Chemical Industrial GroupLtd took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Considering all the aforementioned, we'd venture that Zhejiang Xinan Chemical Industrial GroupLtd's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Be aware that Zhejiang Xinan Chemical Industrial GroupLtd is showing 4 warning signs in our investment analysis and 1 of those is potentially serious...

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xinan Chemical Industrial GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600596

Zhejiang Xinan Chemical Industrial GroupLtd

Develops, manufactures, and sells chemical products for plant protection in China and internationally.

Adequate balance sheet with moderate growth potential.