- Hong Kong

- /

- Hospitality

- /

- SEHK:9922

NagaCorp Leads The Pack Of 3 Noteworthy Penny Stocks

Reviewed by Simply Wall St

Global markets have shown resilience with major stock indexes recovering some losses, driven by a robust labor market and positive home sales reports. As investors navigate these conditions, penny stocks—though an outdated term—remain relevant for those seeking opportunities in smaller or newer companies. By focusing on penny stocks with strong financial health, investors can potentially find value in this niche segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.19 | £836.42M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.275 | £417.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.69 | £74.76M | ★★★★☆☆ |

Click here to see the full list of 5,747 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NagaCorp (SEHK:3918)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NagaCorp Ltd. is an investment holding company that manages and operates a hotel and casino complex in Cambodia, with a market cap of HK$13.58 billion.

Operations: The company's revenue is primarily derived from Casino Operations, contributing $545.61 million, with an additional $23.22 million generated from Hotel and Entertainment Operations.

Market Cap: HK$13.58B

NagaCorp Ltd. has demonstrated financial resilience with short-term assets of $598.2M exceeding long-term liabilities of $131.7M, and its debt is well covered by operating cash flow at 60.2%. However, short-term liabilities surpass short-term assets, posing liquidity challenges. While earnings are forecast to grow 42.41% annually, recent financials were impacted by a one-off loss of $48.9M, and current profit margins (17.7%) have declined from the previous year (30%). The company benefits from experienced leadership and trades below estimated fair value but faces volatility and low return on equity at 4.6%.

- Click here and access our complete financial health analysis report to understand the dynamics of NagaCorp.

- Learn about NagaCorp's future growth trajectory here.

Jiumaojiu International Holdings (SEHK:9922)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiumaojiu International Holdings Limited operates Chinese cuisine restaurant brands across the People's Republic of China, Singapore, Canada, Malaysia, Thailand, and the United States with a market cap of HK$4.67 billion.

Operations: The company's revenue is primarily generated from its Tai Er segment at CN¥4.54 billion, followed by Jiu Mao Jiu at CN¥603.83 million, and Song Hot Pot at CN¥885.66 million.

Market Cap: HK$4.67B

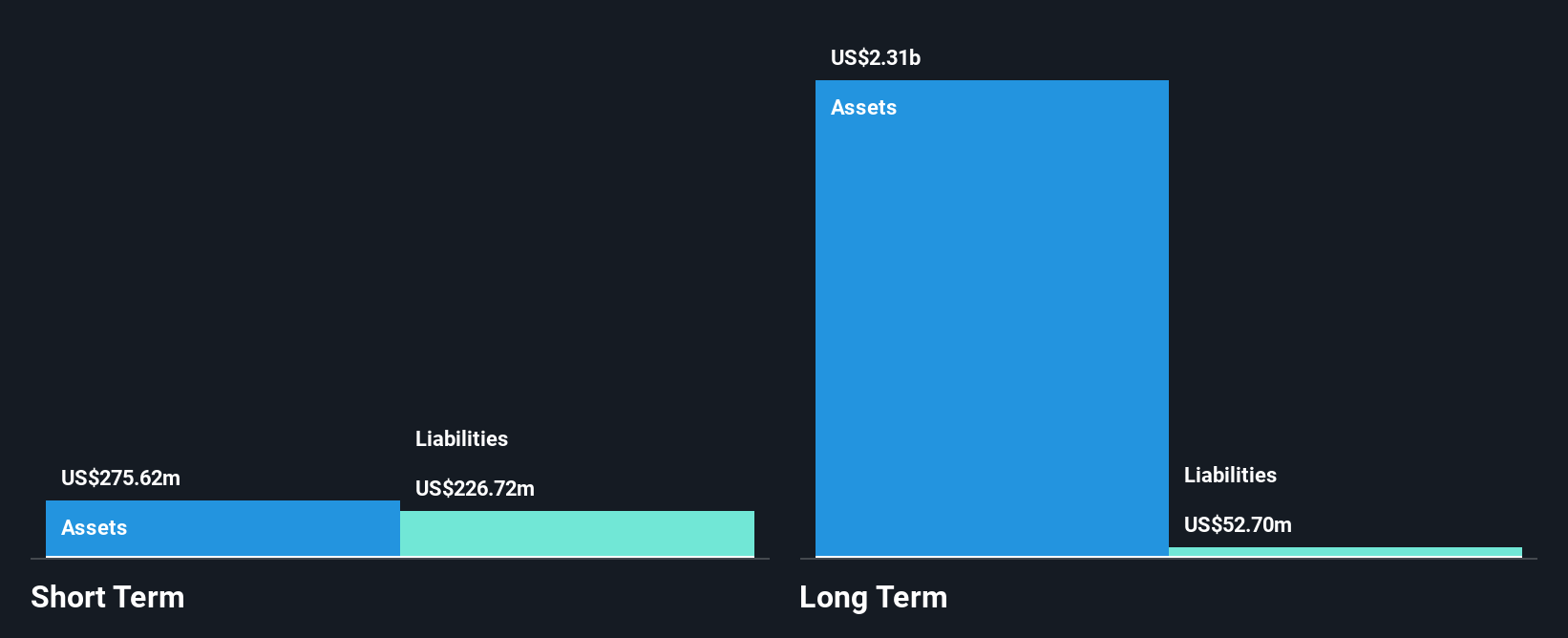

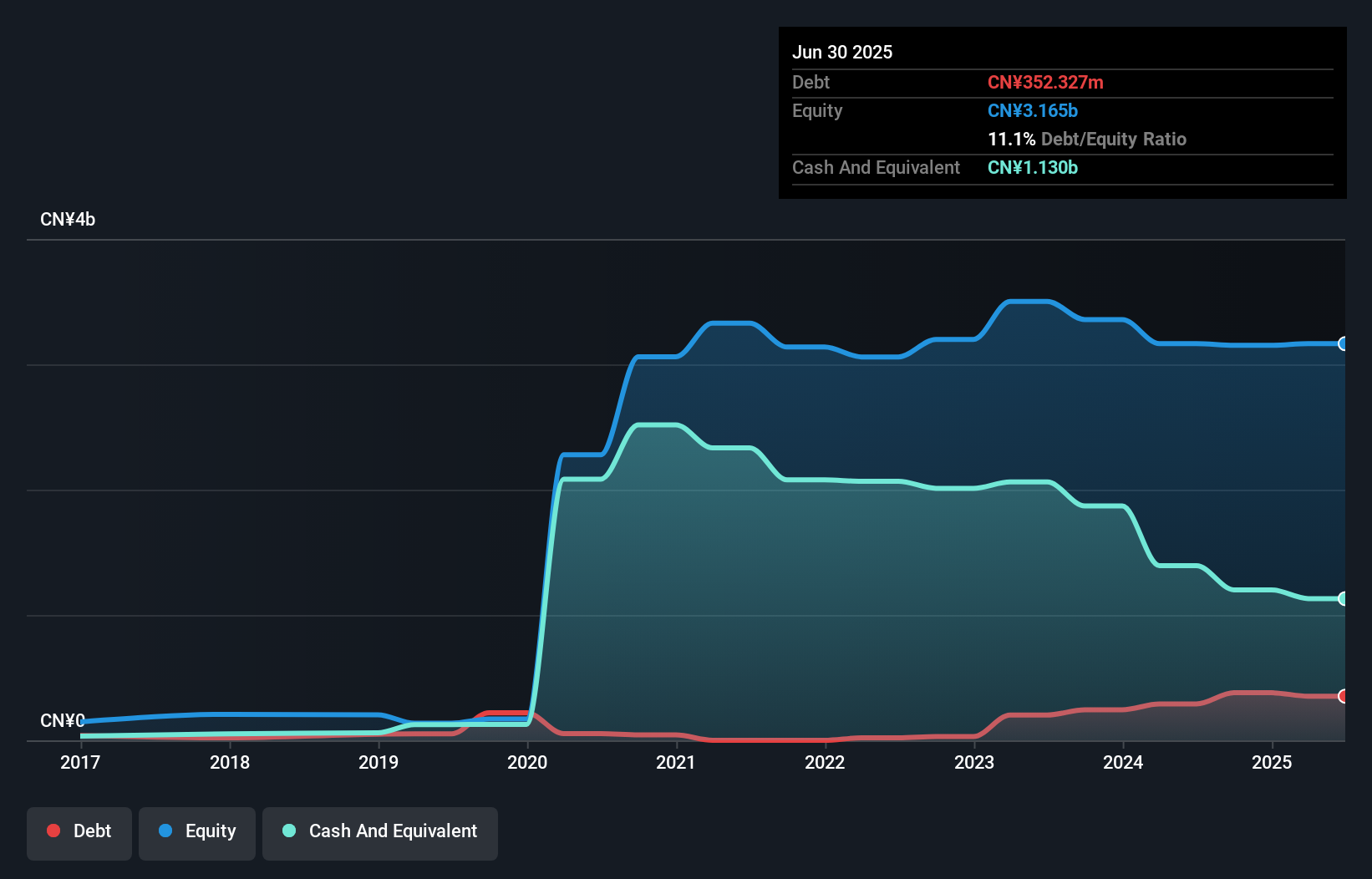

Jiumaojiu International Holdings has shown robust financial performance, with earnings growth of 42% over the past year, outpacing its five-year average of 21.2% annually. The company's short-term assets of CN¥2.5 billion comfortably cover both short-term and long-term liabilities, indicating solid liquidity management. Its debt level is well-managed, with more cash than total debt and operating cash flow covering debt by a significant margin. Despite trading at a substantial discount to estimated fair value, the stock experiences high volatility and low return on equity at 9.8%. Recent share buybacks suggest confidence in future prospects but also highlight potential concerns about market perception or valuation stability.

- Navigate through the intricacies of Jiumaojiu International Holdings with our comprehensive balance sheet health report here.

- Understand Jiumaojiu International Holdings' earnings outlook by examining our growth report.

Fangda Special Steel Technology (SHSE:600507)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangda Special Steel Technology Co., Ltd. operates in the steel manufacturing industry, focusing on producing and selling special steel products, with a market cap of CN¥9.68 billion.

Operations: No revenue segments have been reported for Fangda Special Steel Technology Co., Ltd.

Market Cap: CN¥9.68B

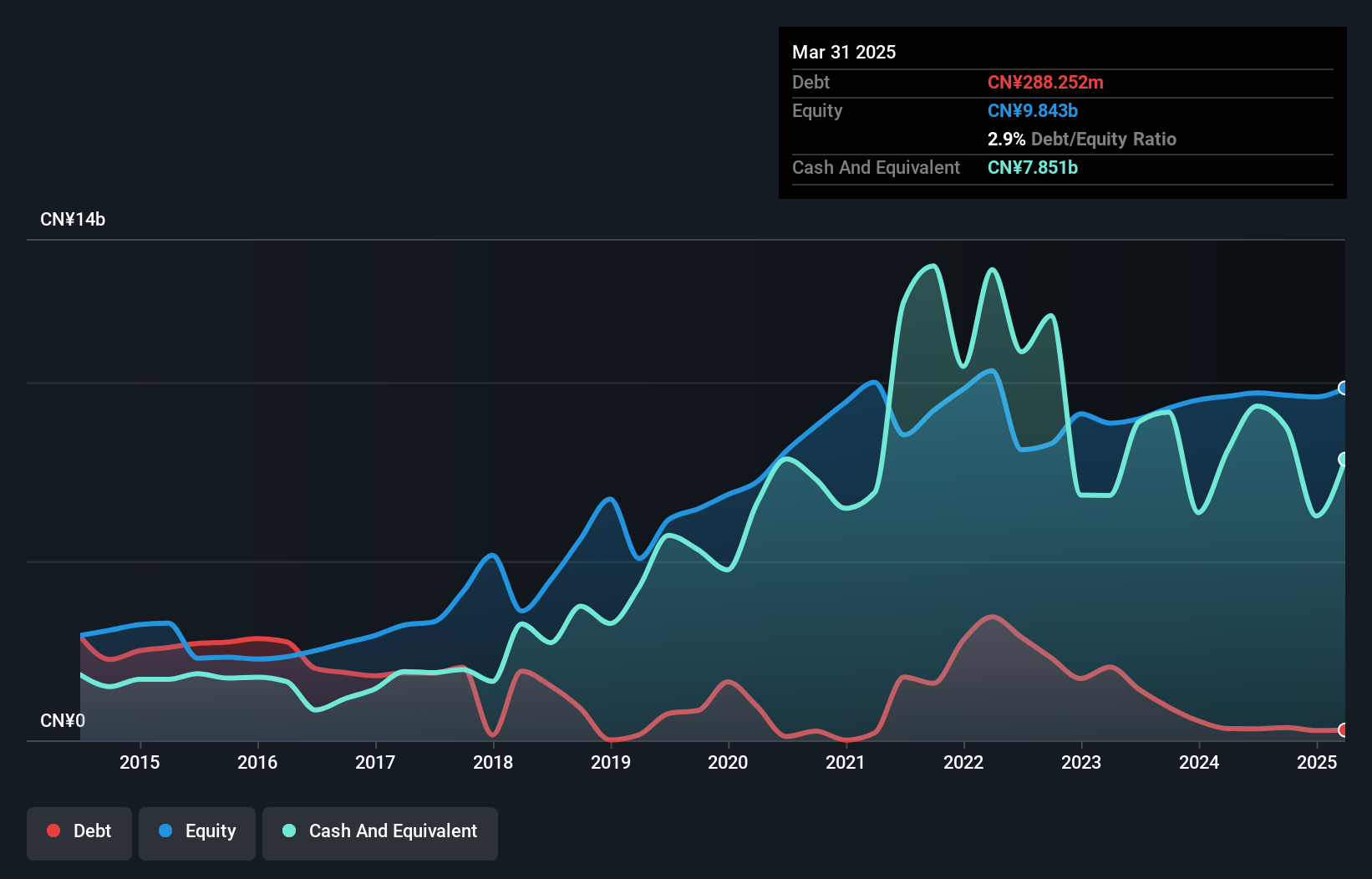

Fangda Special Steel Technology faces challenges with declining earnings, reporting a net income drop to CN¥189 million from CN¥586.75 million year-over-year for the nine months ending September 2024. Despite this, its debt management is strong, with more cash than total debt and short-term assets surpassing both short- and long-term liabilities. The company's P/E ratio of 33.3x suggests it is slightly undervalued relative to the broader Chinese market. Recent share buybacks totaling CN¥93.37 million indicate efforts to support shareholder value amidst concerns over profit margins and management's relatively inexperienced team tenure of 1.4 years on average.

- Get an in-depth perspective on Fangda Special Steel Technology's performance by reading our balance sheet health report here.

- Explore Fangda Special Steel Technology's analyst forecasts in our growth report.

Next Steps

- Click through to start exploring the rest of the 5,744 Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9922

Jiumaojiu International Holdings

Engages in managing and operating Chinese cuisine restaurant brands in the People’s Republic of China, Singapore, Canada, Malaysia, Thailand, and the United States.

Flawless balance sheet with solid track record.