- Philippines

- /

- Metals and Mining

- /

- PSE:AT

Global Penny Stocks To Watch With Market Caps Over US$200M

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with major stock indexes finishing lower amid Treasury market volatility and renewed tariff threats from the U.S. administration. In such uncertain times, investors often look for opportunities in smaller or newer companies that can offer growth potential despite broader market challenges. Penny stocks, though an outdated term, still represent an investment area where strong financial health can lead to significant returns. We've identified three penny stocks that combine balance sheet strength with potential for outsized gains, offering a chance to discover hidden value in quality companies.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.975 | MYR1.52B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.365 | MYR1.06B | ✅ 4 ⚠️ 3 View Analysis > |

| Synergy House Berhad (KLSE:SYNERGY) | MYR0.72 | MYR360M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £421.42M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.54 | A$71M | ✅ 4 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$2.95 | A$685.73M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,656 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Atlas Consolidated Mining and Development (PSE:AT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlas Consolidated Mining and Development Corporation, with a market cap of ₱14.23 billion, operates through its subsidiaries to explore and mine metallic mineral properties in the Philippines.

Operations: The company generates revenue of ₱16.74 billion from its operations in the Philippines.

Market Cap: ₱14.23B

Atlas Consolidated Mining and Development Corporation, with a market cap of ₱14.23 billion, has shown financial resilience despite recent challenges. The company reported a net loss of ₱403.55 million for Q1 2025, reversing from a profit the previous year, yet maintains satisfactory debt levels with a net debt to equity ratio of 31.5%. Its short-term assets exceed short-term liabilities by ₱1.3 billion but fall short on long-term liabilities coverage. Recent amendments to its Articles of Incorporation to include leasing activities aim to diversify revenue streams amidst operational losses and insider selling over the past quarter highlights potential internal concerns.

- Take a closer look at Atlas Consolidated Mining and Development's potential here in our financial health report.

- Evaluate Atlas Consolidated Mining and Development's historical performance by accessing our past performance report.

Modern Innovative Digital Technology (SEHK:2322)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Modern Innovative Digital Technology Company Limited operates in trading, money lending and factoring, finance leasing, and financial services in China and Hong Kong with a market cap of approximately HK$1.87 billion.

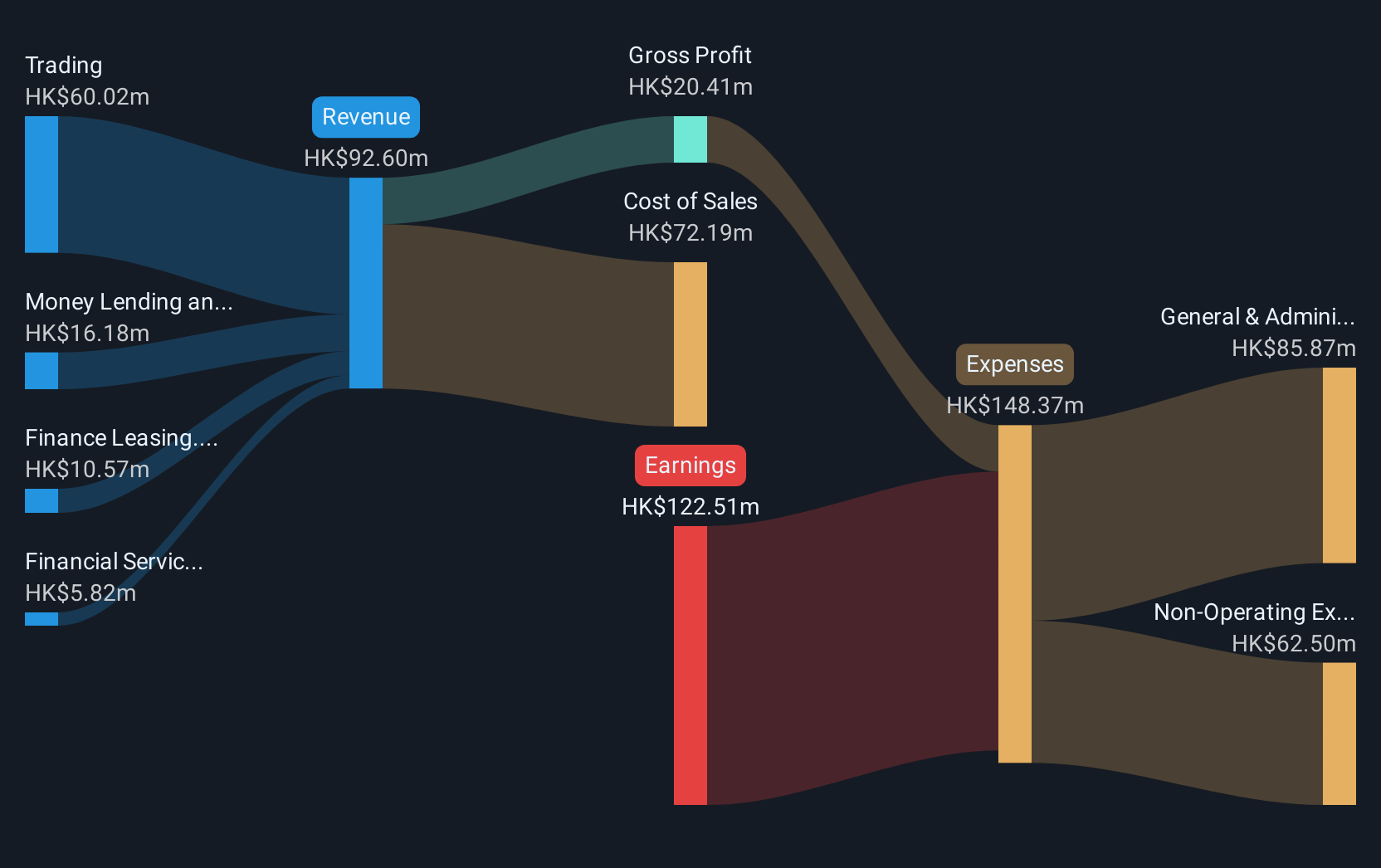

Operations: The company's revenue is primarily derived from trading (HK$60.02 million), followed by money lending and factoring (HK$16.18 million), finance leasing (HK$10.57 million), and financial services (HK$5.82 million).

Market Cap: HK$1.87B

Modern Innovative Digital Technology Company Limited, with a market cap of HK$1.87 billion, is currently unprofitable and has seen increasing losses over the past five years. Despite this, it maintains strong liquidity with short-term assets of HK$598.5 million surpassing both short- and long-term liabilities. The company is debt-free, having reduced its debt to equity ratio from 3.4% five years ago to zero today. However, the management team and board are relatively inexperienced with average tenures under one year, which could impact strategic direction amidst recent delisting from OTC Equity due to inactivity as of March 2025.

- Click to explore a detailed breakdown of our findings in Modern Innovative Digital Technology's financial health report.

- Gain insights into Modern Innovative Digital Technology's historical outcomes by reviewing our past performance report.

Pengxin International MiningLtd (SHSE:600490)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pengxin International Mining Co., Ltd operates in the non-ferrous metal industry globally and has a market cap of CN¥9.67 billion.

Operations: Revenue Segments: No Revenue Segments Reported

Market Cap: CN¥9.67B

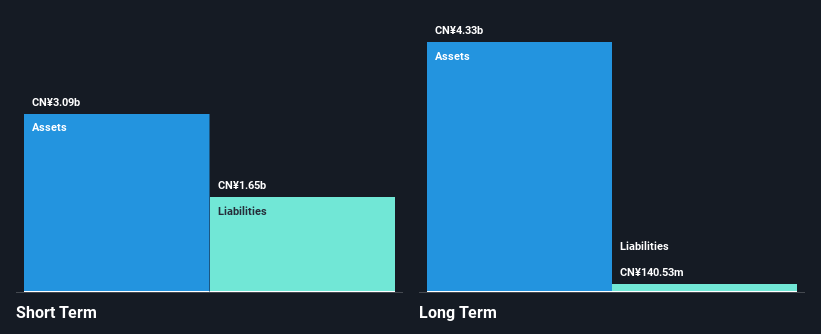

Pengxin International Mining Co., Ltd, with a market cap of CN¥9.67 billion, operates in the non-ferrous metal industry and remains unprofitable despite a reduction in net loss from CN¥107.86 million to CN¥96.77 million over the past year. The company has strong liquidity, with short-term assets of CN¥3.2 billion exceeding both its short- and long-term liabilities. While its debt to equity ratio improved from 20.2% to 10.2% over five years, negative operating cash flow suggests challenges in covering debt obligations effectively despite having more cash than total debt on hand.

- Jump into the full analysis health report here for a deeper understanding of Pengxin International MiningLtd.

- Explore historical data to track Pengxin International MiningLtd's performance over time in our past results report.

Key Takeaways

- Click this link to deep-dive into the 5,656 companies within our Global Penny Stocks screener.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:AT

Atlas Consolidated Mining and Development

Through its subsidiaries, engages in the exploration and mining of metallic mineral properties in the Philippines.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026