- China

- /

- General Merchandise and Department Stores

- /

- SHSE:601010

Global Market Insights: 3 Penny Stocks Under US$2B Market Cap

Reviewed by Simply Wall St

Global markets have experienced significant volatility recently, with the announcement of higher-than-expected tariffs leading to sharp declines in major indices and fueling concerns about economic growth and inflation. Amidst this uncertainty, investors often seek opportunities that offer potential for growth at a lower cost. While the term "penny stocks" might evoke thoughts of past market eras, these smaller or newer companies can still present valuable opportunities when they are backed by strong financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.33 | SGD133.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.87 | SGD7.38B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.42 | SEK256.45M | ✅ 4 ⚠️ 3 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.22 | MYR612.08M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.465 | MYR2.31B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.17 | HK$662.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.295 | £228.25M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.40 | £274.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.07 | £347.83M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.644 | £2.01B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,671 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Pengxin International MiningLtd (SHSE:600490)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pengxin International Mining Co., Ltd operates in the non-ferrous metal industry globally and has a market capitalization of CN¥7.59 billion.

Operations: No specific revenue segments are reported for Pengxin International Mining Co., Ltd.

Market Cap: CN¥7.59B

Pengxin International Mining Co., Ltd, with a market capitalization of CN¥7.59 billion, is currently pre-revenue and unprofitable, with losses increasing over the past five years at a rate of 50.5% annually. Despite this, the company maintains financial stability as its short-term assets (CN¥3.1 billion) exceed both its short-term (CN¥1.6 billion) and long-term liabilities (CN¥140.5 million), and it holds more cash than total debt while reducing its debt-to-equity ratio from 27.2% to 12.1% over five years without significant shareholder dilution recently.

- Dive into the specifics of Pengxin International MiningLtd here with our thorough balance sheet health report.

- Understand Pengxin International MiningLtd's track record by examining our performance history report.

Wenfeng Great World Chain Development (SHSE:601010)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wenfeng Great World Chain Development Corporation operates a commercial retail chain in China with a market cap of CN¥5.15 billion.

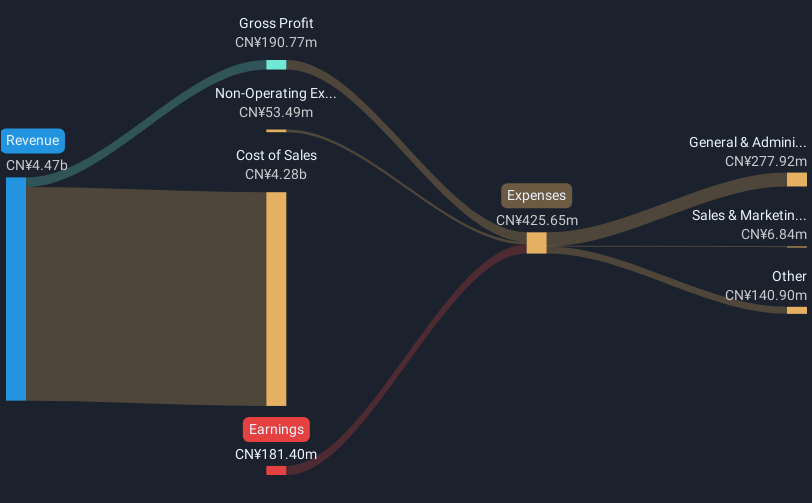

Operations: The company's revenue is derived entirely from its operations in China, totaling CN¥1.93 billion.

Market Cap: CN¥5.15B

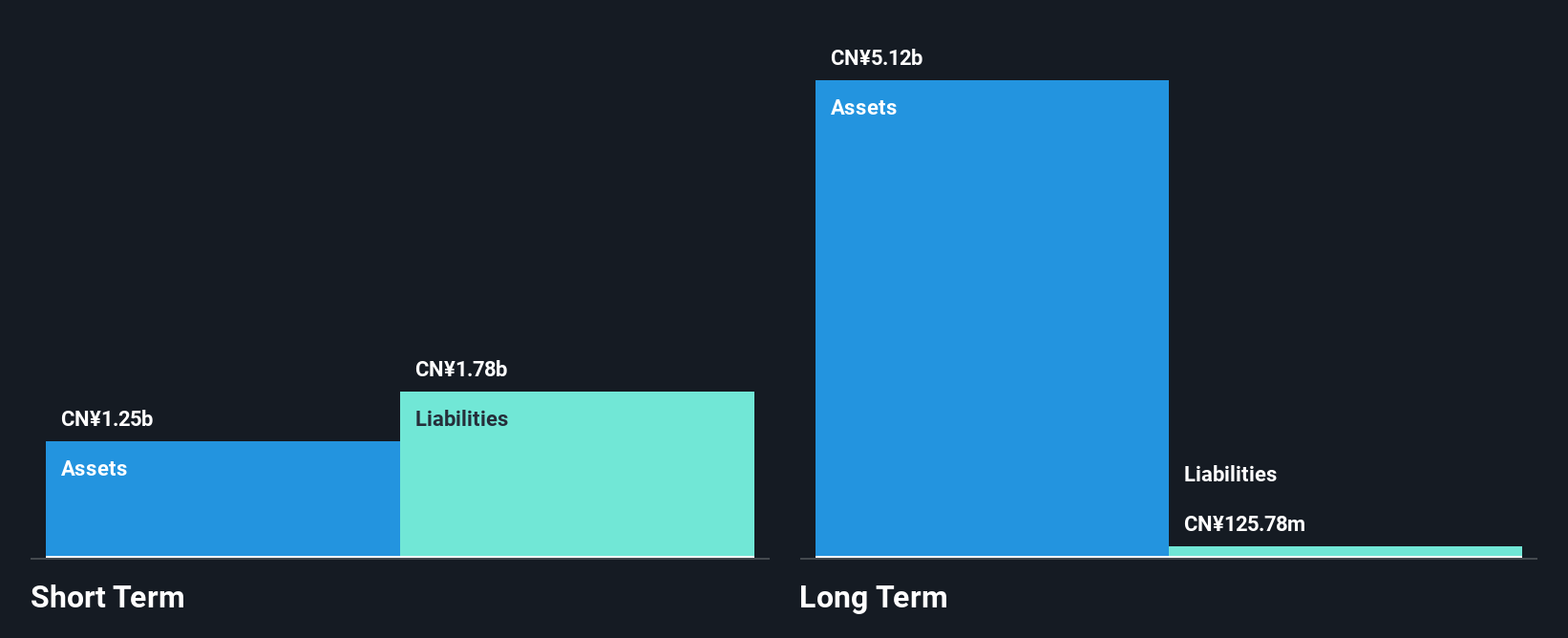

Wenfeng Great World Chain Development, with a market cap of CN¥5.15 billion and revenue of CN¥1.93 billion, faces challenges typical for penny stocks. The company has experienced negative earnings growth over the past year and five years, with a return on equity at 2.6%, considered low for the industry. Despite having more cash than debt and high-quality earnings, its short-term assets (CN¥1.3 billion) fall short of covering short-term liabilities (CN¥1.8 billion). Additionally, both management and board members are relatively inexperienced with tenures under two years, reflecting potential operational instability amidst volatile share prices recently observed.

- Click to explore a detailed breakdown of our findings in Wenfeng Great World Chain Development's financial health report.

- Evaluate Wenfeng Great World Chain Development's historical performance by accessing our past performance report.

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Top E-Commerce Co., Ltd. operates in the cross-border e-commerce sector both within China and internationally, with a market capitalization of approximately CN¥4.52 billion.

Operations: Global Top E-Commerce Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.52B

Global Top E-Commerce Co., Ltd., with a market cap of CN¥4.52 billion, faces significant challenges as it remains unprofitable, reporting a net loss of CN¥478.81 million for 2024. Despite this, the company has reduced its debt to equity ratio significantly over five years and maintains a positive cash runway exceeding three years due to growing free cash flow. However, its short-term assets (CN¥1.6 billion) do not cover short-term liabilities (CN¥1.7 billion), and share price volatility remains high compared to peers in China. Both management and board members are experienced, potentially aiding future strategic decisions amidst current financial instability.

- Jump into the full analysis health report here for a deeper understanding of Global Top E-Commerce.

- Gain insights into Global Top E-Commerce's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Gain an insight into the universe of 5,671 Global Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wenfeng Great World Chain Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601010

Wenfeng Great World Chain Development

Operates commercial retail chain in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives