Global markets have been experiencing a turbulent week, marked by geopolitical tensions and concerns over consumer spending, leading to declines in major indexes. In such uncertain times, investors often look for opportunities that balance affordability with potential growth. Penny stocks, though an outdated term, continue to represent smaller or newer companies that can offer surprising value when backed by strong financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.275 | MYR765.09M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.92 | SEK293.94M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.14 | THB2.48B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.91 | £445.66M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.58 | £289.22M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.91 | HK$45B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.135 | £311.79M | ★★★★☆☆ |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.995 | MYR1.55B | ★★★★★☆ |

Click here to see the full list of 5,705 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Zhejiang Hengtong HoldingLtd (SHSE:600226)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Hengtong Holding Co., Ltd. engages in the research, development, production, and sale of biological pesticides, veterinary drugs, and animal feed additives both in China and internationally with a market capitalization of approximately CN¥8.57 billion.

Operations: Zhejiang Hengtong Holding Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥8.57B

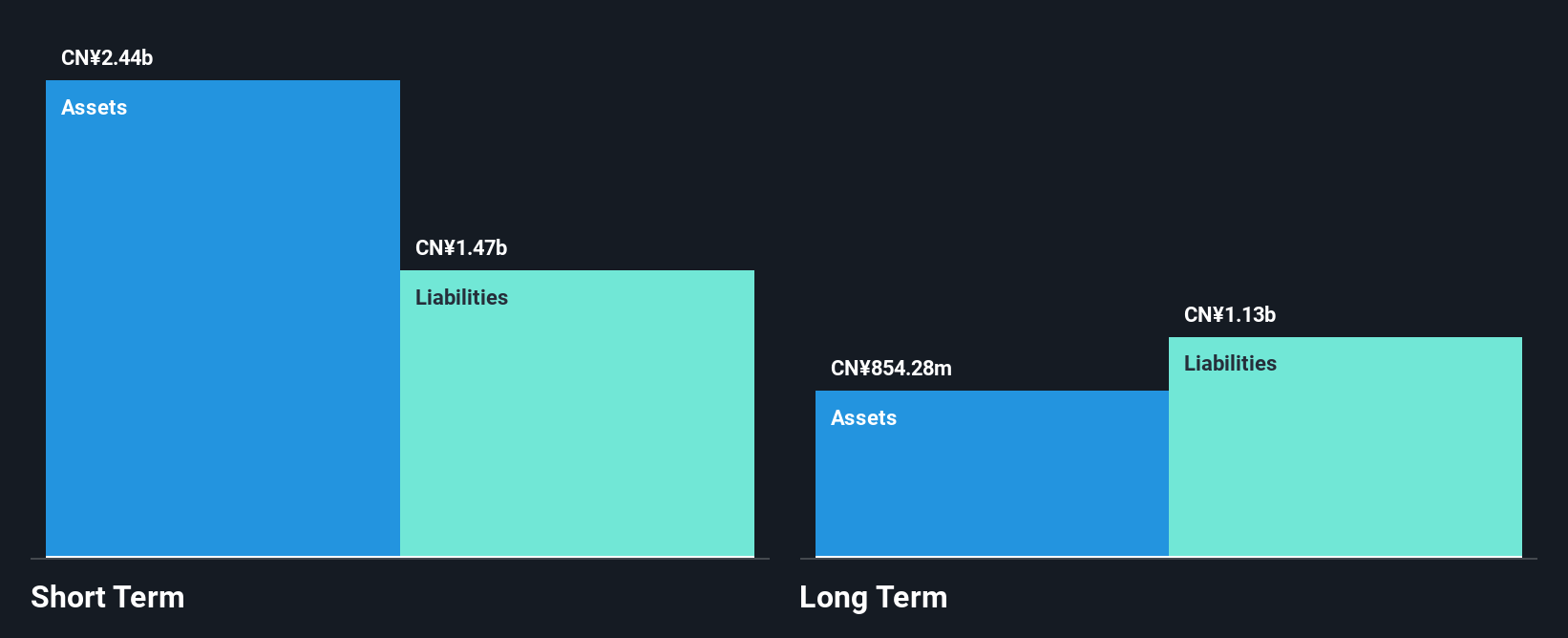

Zhejiang Hengtong Holding Co., Ltd. demonstrates strong financial health with short-term assets of CN¥1.5 billion exceeding both its short-term and long-term liabilities, indicating robust liquidity. The company has a solid earnings growth trajectory, with profits increasing by 94.2% over the past year, surpassing industry averages significantly. Despite a low Return on Equity at 4.6%, the company's high-quality earnings and stable weekly volatility suggest resilience in volatile markets. However, negative operating cash flow raises concerns about debt coverage, and an inexperienced board may impact strategic direction amidst recent shareholder meetings signaling potential governance changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Hengtong HoldingLtd.

- Gain insights into Zhejiang Hengtong HoldingLtd's historical outcomes by reviewing our past performance report.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally with a market cap of CN¥5.27 billion.

Operations: No specific revenue segments are reported for V V Food & Beverage Co., Ltd.

Market Cap: CN¥5.27B

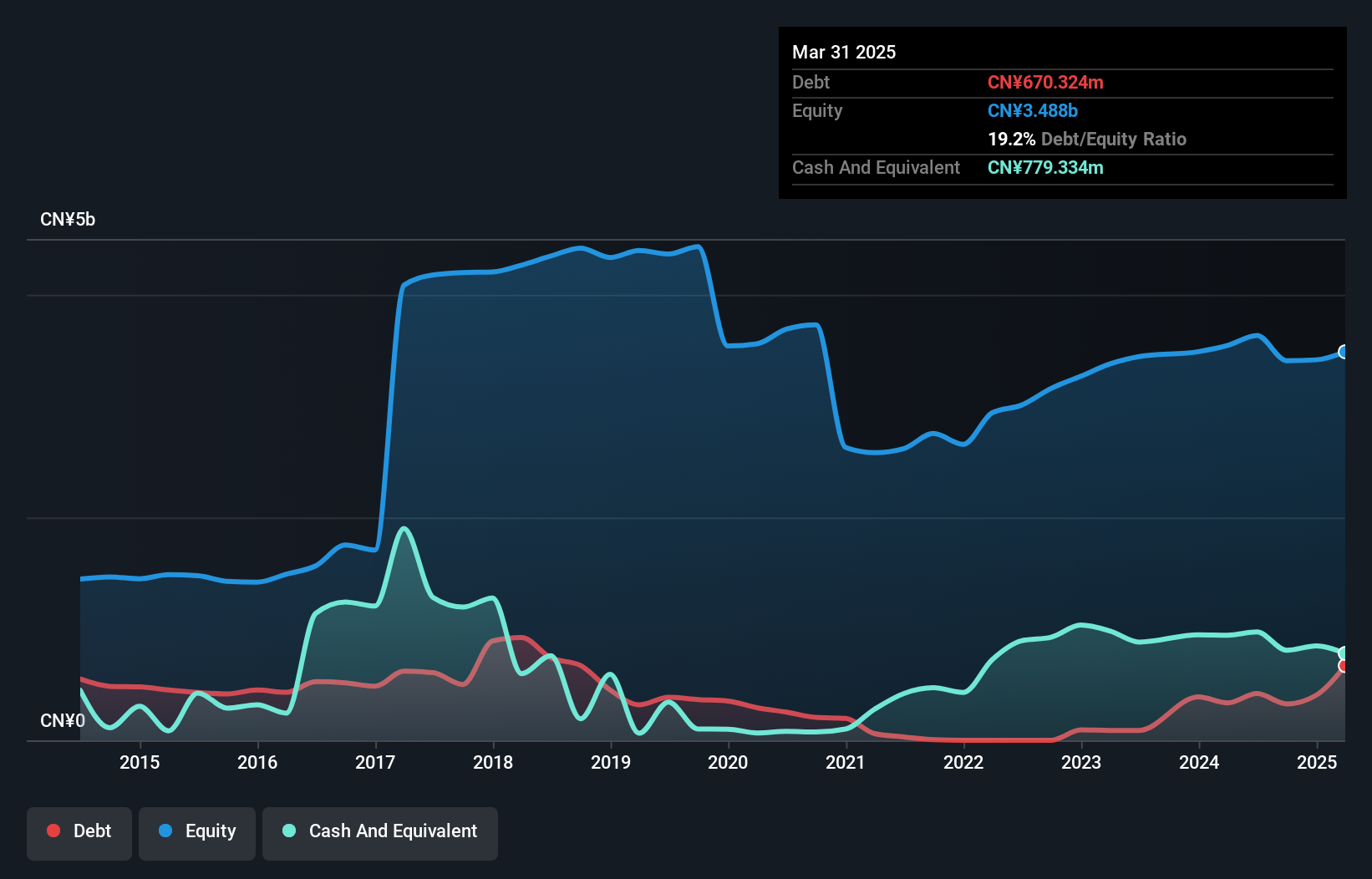

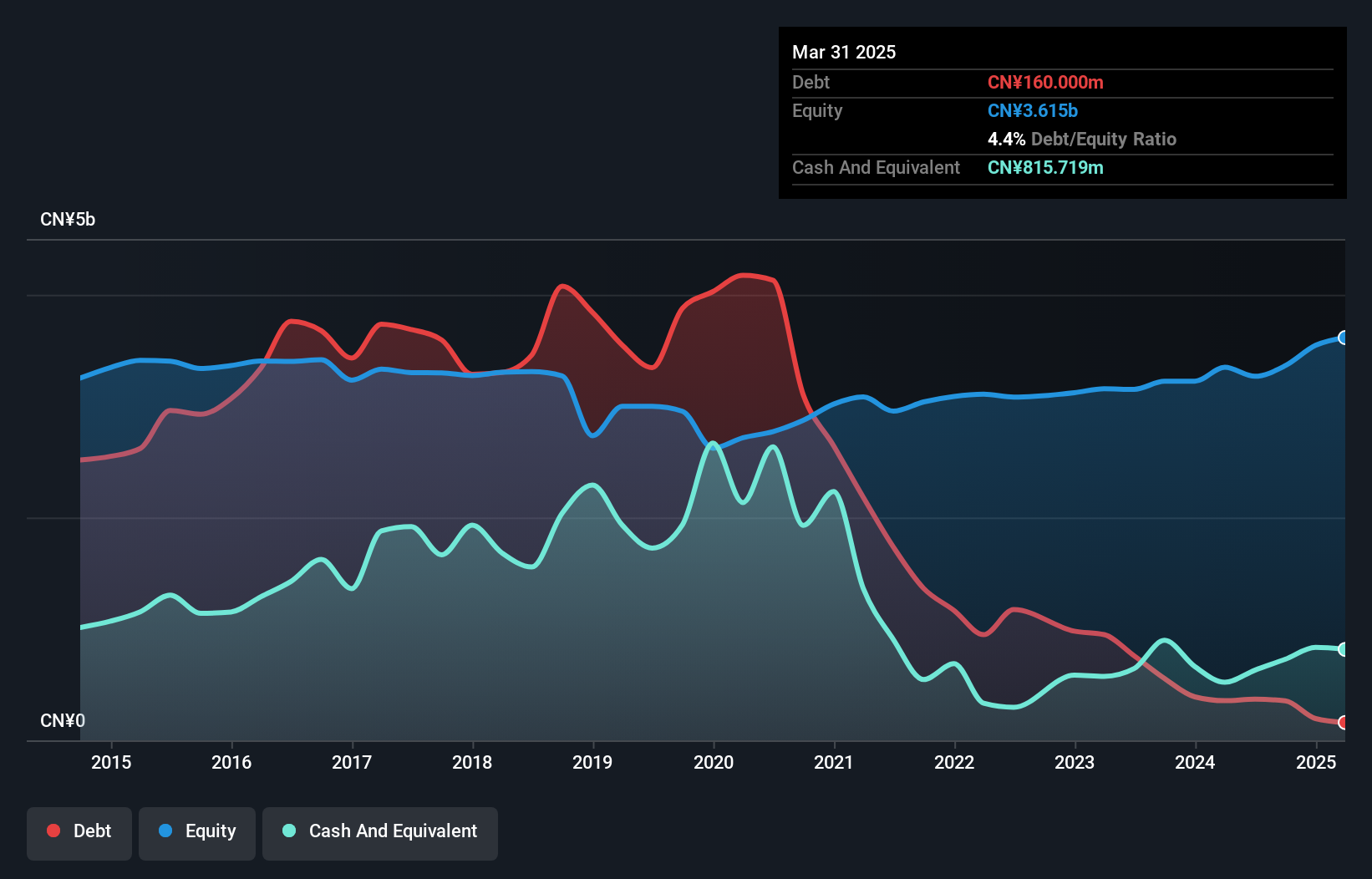

V V Food & Beverage Co., Ltd. shows a promising financial profile with its debt to equity ratio significantly reduced from 131.4% to 10.5% over five years, and interest payments well covered by EBIT at 95.7 times, indicating strong debt management. The company's short-term assets of CN¥1.8 billion comfortably cover both short and long-term liabilities, reflecting solid liquidity. Despite a low Return on Equity of 9.5%, earnings have grown impressively by 146% in the past year, surpassing industry averages and supported by improved profit margins from 3.1% to 9.5%. However, large one-off gains impact earnings quality, and dividends remain unsustainable due to insufficient free cash flows despite having more cash than total debt.

- Take a closer look at V V Food & BeverageLtd's potential here in our financial health report.

- Understand V V Food & BeverageLtd's track record by examining our performance history report.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd operates in China, producing and selling commercial concrete and cement, with a market cap of CN¥4.02 billion.

Operations: The company generates its revenue of CN¥1.52 billion entirely from its operations in China.

Market Cap: CN¥4.02B

Hainan RuiZe New Building Material Co., Ltd. faces challenges with profitability, as it remains unprofitable with declining earnings over the past five years at a rate of 16.7% annually. Despite this, the company maintains a solid cash runway exceeding three years due to positive free cash flow growth of 17.3% per year. Short-term assets (CN¥2.7 billion) comfortably cover both short and long-term liabilities, indicating sound liquidity management despite a high net debt to equity ratio of 135.5%. The board and management are experienced, though share price volatility remains high over recent months.

- Unlock comprehensive insights into our analysis of Hainan RuiZe New Building MaterialLtd stock in this financial health report.

- Learn about Hainan RuiZe New Building MaterialLtd's historical performance here.

Make It Happen

- Reveal the 5,705 hidden gems among our Global Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hengtong HoldingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600226

Zhejiang Hengtong HoldingLtd

Researches and develops, produces, and sells biological pesticides, veterinary drugs, and animal feed additive products in People's Republic of China and Internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives