- China

- /

- Metals and Mining

- /

- SHSE:600010

Inner Mongolia Baotou Steel Union Co., Ltd.'s (SHSE:600010) Share Price Not Quite Adding Up

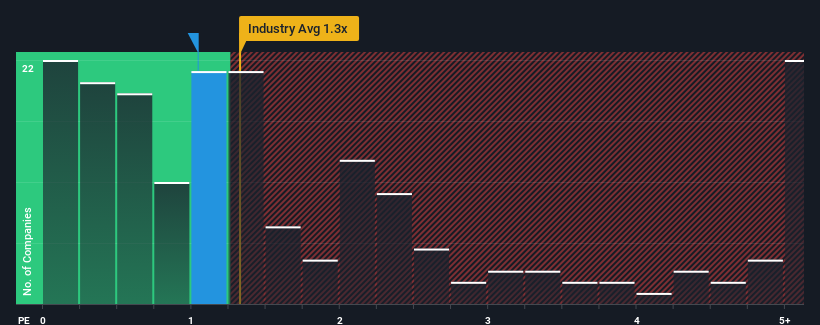

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Metals and Mining industry in China, you could be forgiven for feeling indifferent about Inner Mongolia Baotou Steel Union Co., Ltd.'s (SHSE:600010) P/S ratio of 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Inner Mongolia Baotou Steel Union

How Has Inner Mongolia Baotou Steel Union Performed Recently?

Inner Mongolia Baotou Steel Union could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Inner Mongolia Baotou Steel Union's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Inner Mongolia Baotou Steel Union's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.2%. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 2.6% during the coming year according to the sole analyst following the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

In light of this, it's somewhat alarming that Inner Mongolia Baotou Steel Union's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Inner Mongolia Baotou Steel Union's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Inner Mongolia Baotou Steel Union currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Inner Mongolia Baotou Steel Union that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600010

Inner Mongolia Baotou Steel Union

Inner Mongolia Baotou Steel Union Co., Ltd.

Very low and overvalued.