- China

- /

- Household Products

- /

- SZSE:301327

3 Growth Companies With Insider Ownership Up To 24%

Reviewed by Simply Wall St

As global markets continue to show resilience, with major indices like the Dow Jones Industrial Average and S&P 500 Index reaching record highs, investor sentiment remains buoyed by a mix of domestic policy developments and geopolitical factors. Amidst this backdrop, identifying growth companies with significant insider ownership can be appealing as it often signals confidence in the company's potential and aligns management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

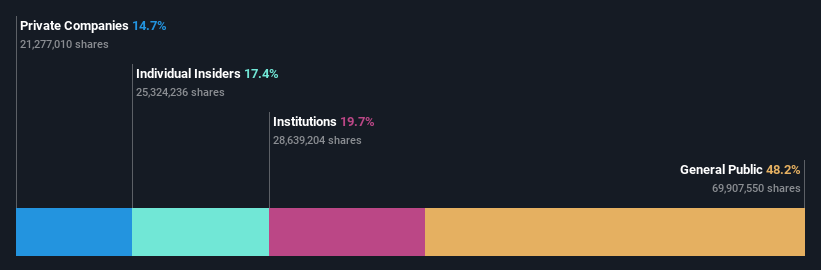

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topsec Technologies Group Inc., along with its subsidiaries, offers cybersecurity, big data, and cloud services in China and has a market cap of approximately CN¥8.42 billion.

Operations: The company's revenue is primarily derived from its cybersecurity segment, which generated CN¥3.06 billion.

Insider Ownership: 10.9%

Topsec Technologies Group shows potential as a growth company with high insider ownership, despite some challenges. Its revenue is expected to grow faster than the Chinese market but slower than 20% annually. The company is forecasted to become profitable within three years, indicating above-average market growth in profitability. While recent earnings reported a net loss of CNY 169.28 million, this was an improvement from the previous year, and it trades at good value compared to peers and industry standards.

- Take a closer look at Topsec Technologies Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that Topsec Technologies Group's share price might be on the cheaper side.

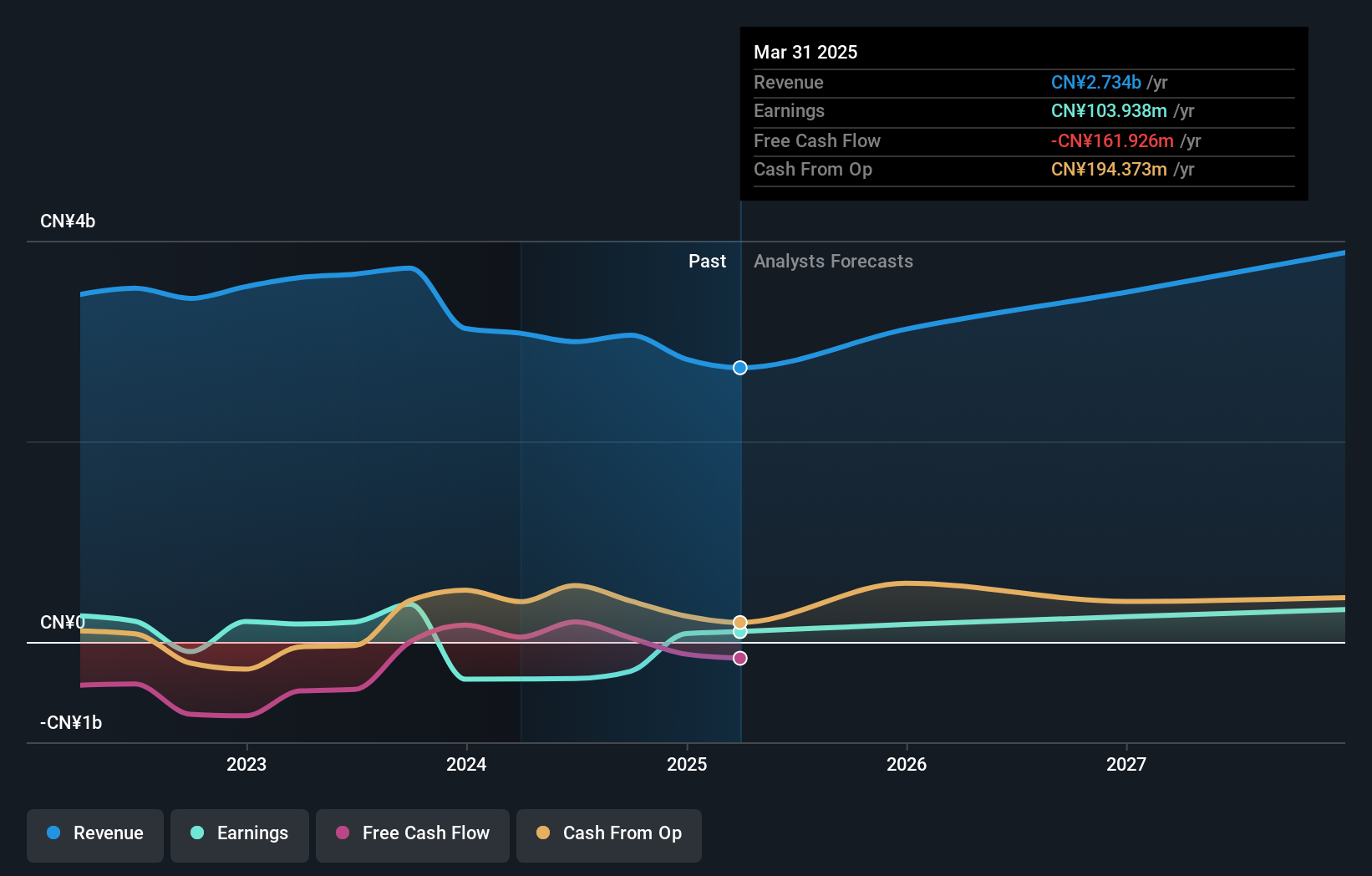

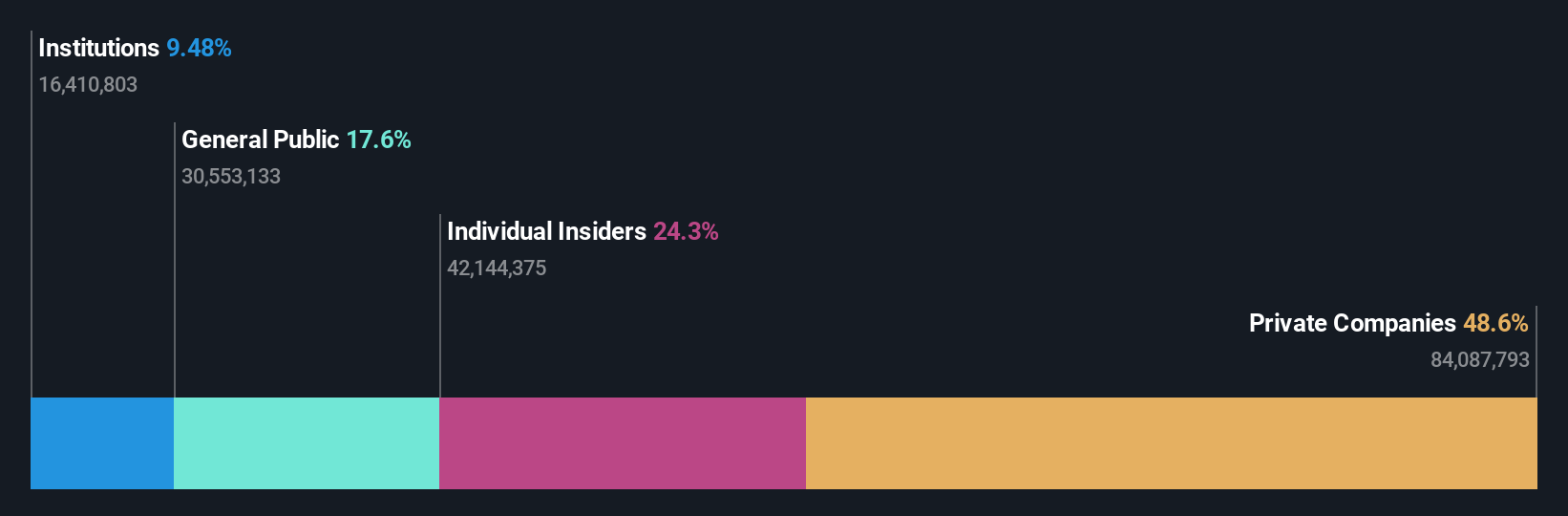

Shenzhen Hello Tech Energy (SZSE:301327)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Hello Tech Energy Co., Ltd. is involved in the research, development, manufacture, and sale of portable power products in China with a market cap of CN¥10.08 billion.

Operations: The company generates revenue through the research, development, manufacturing, and sale of portable power products within China.

Insider Ownership: 24.3%

Shenzhen Hello Tech Energy demonstrates growth potential, with earnings forecasted to grow significantly faster than the Chinese market. Recent results show a transition to profitability, reporting net income of CNY 159.43 million for the first nine months of 2024, compared to a loss last year. Despite an unstable dividend track record and low future return on equity expectations, it trades at a substantial discount to its estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Hello Tech Energy.

- The analysis detailed in our Shenzhen Hello Tech Energy valuation report hints at an deflated share price compared to its estimated value.

Kinik (TWSE:1560)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kinik Company manufactures and distributes abrasives, cutting tools, and reclaimed wafers both in Taiwan and globally, with a market cap of NT$44.98 billion.

Operations: The company's revenue is derived from two main segments: the Electronics Sector, contributing NT$3.39 billion, and the Traditional Sectors, also generating NT$3.39 billion.

Insider Ownership: 15.9%

Kinik's earnings are projected to grow significantly faster than the Taiwanese market, with a forecasted annual growth of 35.4%. Despite recent volatility in its share price, analysts expect a 21.2% rise, and it trades at a substantial discount to its estimated fair value. Recent earnings reports show sales growth but slight declines in quarterly net income and EPS compared to last year, reflecting both opportunities and challenges for investors.

- Click to explore a detailed breakdown of our findings in Kinik's earnings growth report.

- In light of our recent valuation report, it seems possible that Kinik is trading behind its estimated value.

Next Steps

- Delve into our full catalog of 1512 Fast Growing Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301327

Shenzhen Hello Tech Energy

Engages in the research and development, manufacture, and sale of portable power products in China.

High growth potential with excellent balance sheet.