- China

- /

- Electronic Equipment and Components

- /

- SZSE:002979

Exploring High Growth Tech Stocks for January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing out a robust 2024 despite recent volatility and economic indicators like the Chicago PMI showing contraction, investors are keenly observing sectors poised for growth. In this context, high-growth tech stocks emerge as compelling opportunities, characterized by their potential for innovation and resilience amid shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1255 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the R&D, production, and sale of energy metering and energy efficiency management solutions across various global markets, with a market cap of HK$6.82 billion.

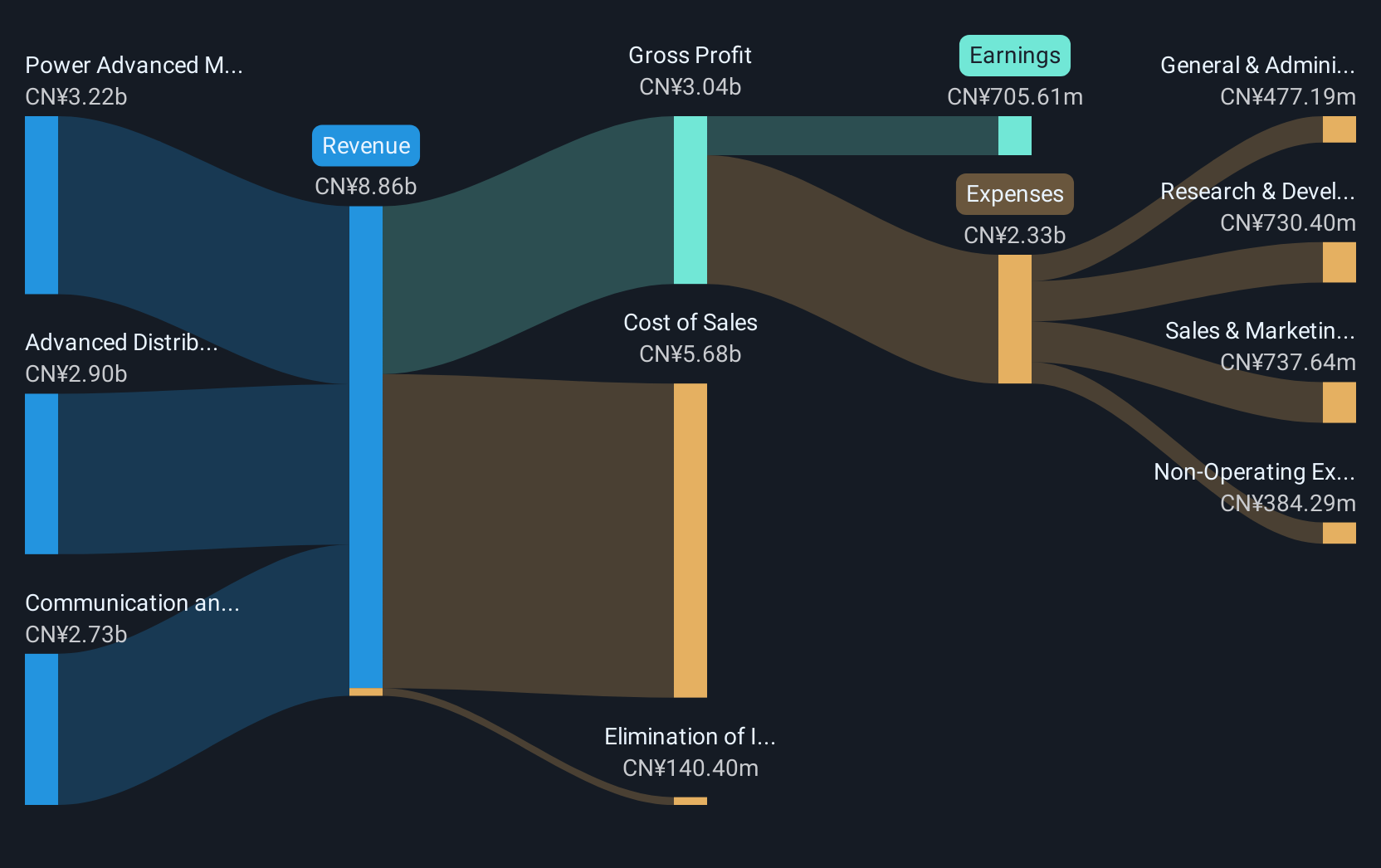

Operations: The company generates revenue through three primary segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion), and Advanced Distribution Operations (CN¥2.51 billion).

Wasion Holdings, demonstrating a robust growth trajectory, has outpaced the Electronic industry with a notable 61.9% earnings increase over the past year. This performance is significantly higher than the industry's average of 11.7%. Looking ahead, Wasion is expected to maintain strong momentum with projected annual revenue and earnings growth rates of 19.2% and 22.6%, respectively—both figures comfortably exceeding Hong Kong's market averages of 7.5% for revenue and 11.1% for earnings growth. Additionally, the company's commitment to innovation is evident from its R&D investments, which are crucial in sustaining long-term competitiveness in the rapidly evolving tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Wasion Holdings.

Explore historical data to track Wasion Holdings' performance over time in our Past section.

China Leadshine Technology (SZSE:002979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Leadshine Technology Co., Ltd. is engaged in the design, manufacturing, and sale of motion control equipment and components in China, with a market cap of CN¥9.15 billion.

Operations: Leadshine focuses on motion control equipment and components, leveraging its expertise in design and manufacturing to drive sales within China. The company operates with a market cap of approximately CN¥9.15 billion, reflecting its significant presence in the industry.

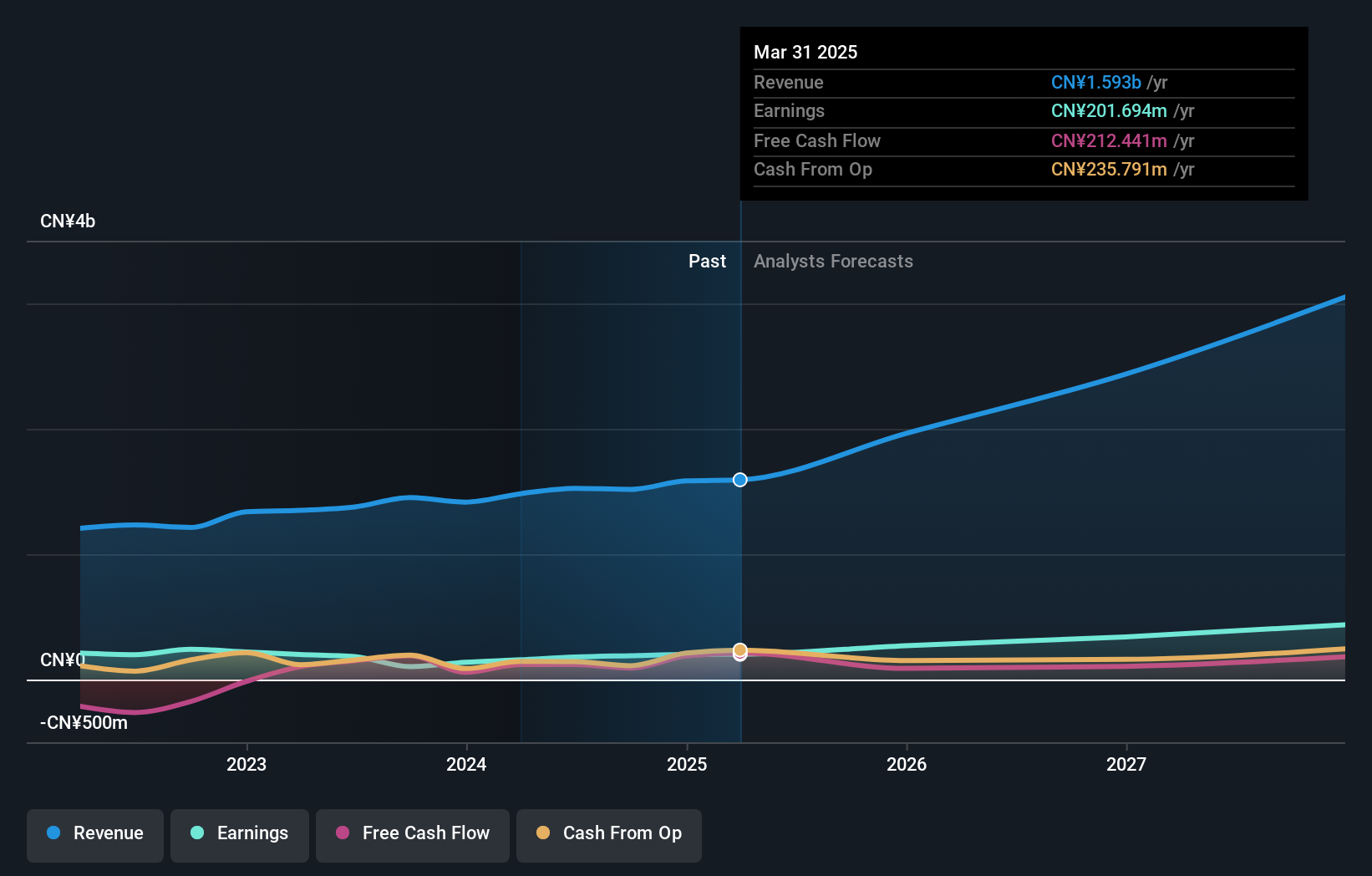

China Leadshine Technology has shown a promising trajectory with a 21.1% annual revenue growth, outpacing the broader CN market's 13.5%. This growth is complemented by an impressive earnings increase of 28.6% per year, significantly higher than the market average of 25.2%. The company's focus on R&D is evident from its consistent investment in innovation, crucial for maintaining its competitive edge in the tech sector. Recent financials reveal robust sales and net income improvements, with earnings per share rising from CNY 0.3 to CNY 0.47 over nine months, reflecting strong operational efficiency and market demand for its offerings.

- Click here and access our complete health analysis report to understand the dynamics of China Leadshine Technology.

Gain insights into China Leadshine Technology's past trends and performance with our Past report.

Beijing YJK Building SoftwareLtd (SZSE:300935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing YJK Building Software Co., Ltd. specializes in the development and sale of building structure design software and BIM-related products, serving both domestic and international markets, with a market cap of CN¥1.87 billion.

Operations: YJK Building Software focuses on creating and distributing software for building structure design and BIM-related products, catering to both local and international clients. The company generates revenue through software sales, emphasizing innovation in structural design technology.

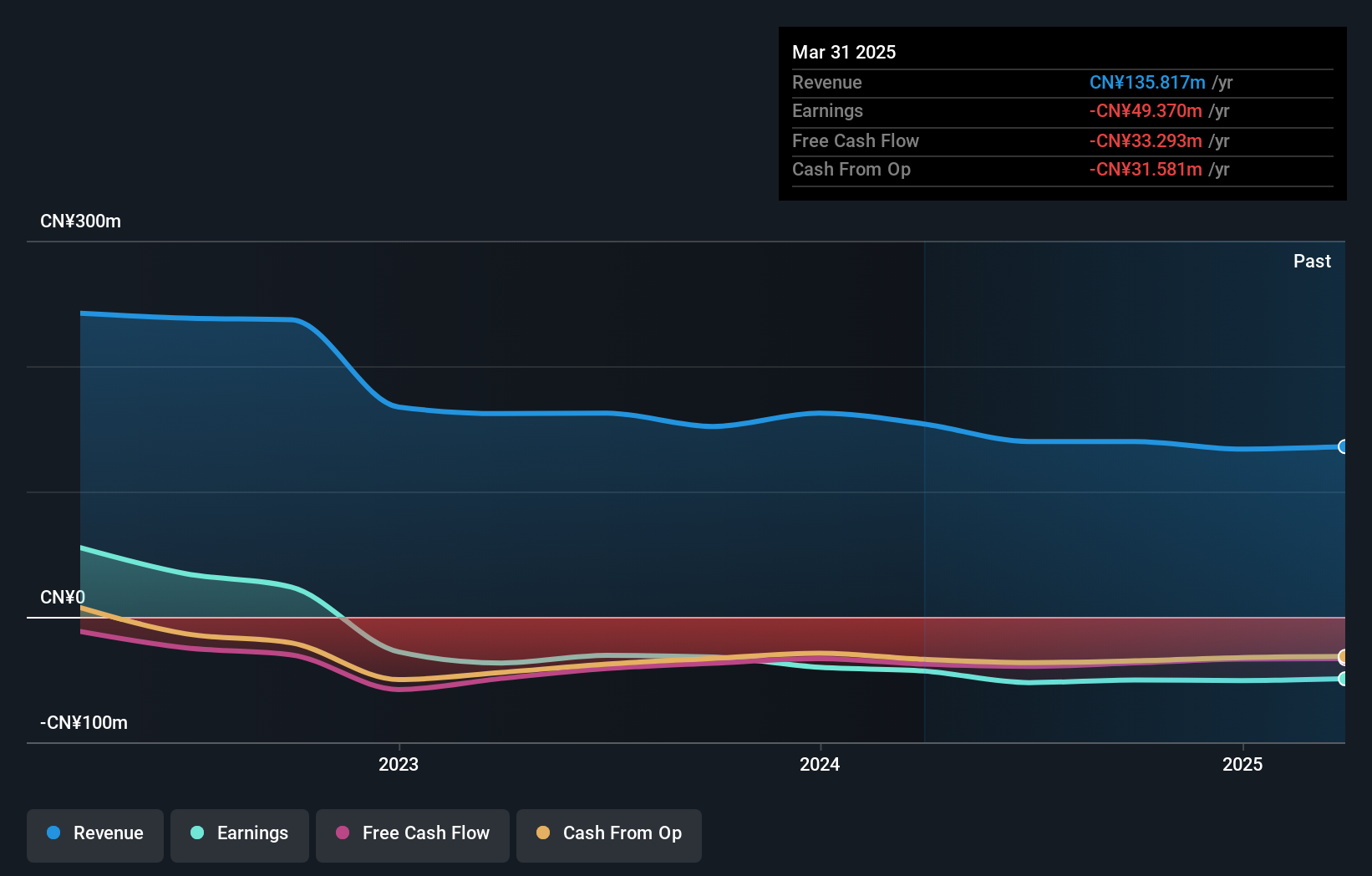

Despite recent setbacks, Beijing YJK Building SoftwareLtd. is poised for significant growth, with revenue expected to increase by 24.9% annually, outstripping the broader CN market's projection of 13.5%. This optimism is bolstered by forecasts of a sharp turnaround in profitability, with earnings potentially soaring by 108.84% per year over the next three years. However, challenges persist as evidenced by a net loss widening to CNY 37.67 million from CNY 27.53 million year-over-year and R&D investments that have yet to yield financial returns within the current reporting period. In light of these dynamics, Beijing YJK's ability to innovate and adapt will be crucial as it navigates through its financial recovery phase towards profitability. The firm's commitment to R&D could catalyze future successes if strategically aligned with market demands and operational efficiencies are improved—a critical factor given its current performance metrics and industry competition.

- Get an in-depth perspective on Beijing YJK Building SoftwareLtd's performance by reading our health report here.

Understand Beijing YJK Building SoftwareLtd's track record by examining our Past report.

Next Steps

- Explore the 1255 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002979

China Leadshine Technology

Designs, manufactures, and sells motion control equipment and components in China.

High growth potential with solid track record.

Market Insights

Community Narratives