What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. In light of that, when we looked at Byhealth (SZSE:300146) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Byhealth is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.055 = CN¥649m ÷ (CN¥14b - CN¥1.8b) (Based on the trailing twelve months to September 2024).

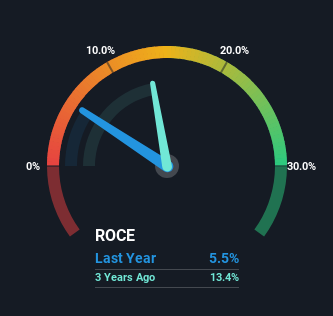

So, Byhealth has an ROCE of 5.5%. On its own, that's a low figure but it's around the 6.6% average generated by the Personal Products industry.

See our latest analysis for Byhealth

In the above chart we have measured Byhealth's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Byhealth for free.

The Trend Of ROCE

When we looked at the ROCE trend at Byhealth, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 5.5% from 13% five years ago. And considering revenue has dropped while employing more capital, we'd be cautious. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

The Bottom Line

In summary, we're somewhat concerned by Byhealth's diminishing returns on increasing amounts of capital. Long term shareholders who've owned the stock over the last five years have experienced a 24% depreciation in their investment, so it appears the market might not like these trends either. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know more about Byhealth, we've spotted 3 warning signs, and 1 of them shouldn't be ignored.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Byhealth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300146

Byhealth

Provides dietary supplements in Mainland China, Hong Kong, Australia, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives