- China

- /

- Personal Products

- /

- SHSE:688793

Even With A 25% Surge, Cautious Investors Are Not Rewarding Shenzhen Breo Technology Co., Ltd.'s (SHSE:688793) Performance Completely

Shenzhen Breo Technology Co., Ltd. (SHSE:688793) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

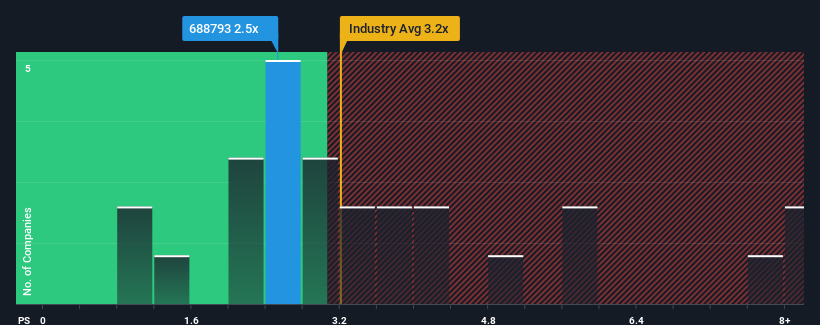

In spite of the firm bounce in price, given about half the companies operating in China's Personal Products industry have price-to-sales ratios (or "P/S") above 3.2x, you may still consider Shenzhen Breo Technology as an attractive investment with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Shenzhen Breo Technology

How Has Shenzhen Breo Technology Performed Recently?

While the industry has experienced revenue growth lately, Shenzhen Breo Technology's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Breo Technology will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Shenzhen Breo Technology?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shenzhen Breo Technology's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. As a result, revenue from three years ago have also fallen 8.8% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 57% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 21%, which is noticeably less attractive.

With this information, we find it odd that Shenzhen Breo Technology is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Shenzhen Breo Technology's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Shenzhen Breo Technology's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You always need to take note of risks, for example - Shenzhen Breo Technology has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688793

Shenzhen Breo Technology

Researches and develops portable massage products for headache swelling, eye fatigue, and shoulder and neck pain.

Exceptional growth potential and good value.

Market Insights

Community Narratives