- China

- /

- Personal Products

- /

- SHSE:600439

Subdued Growth No Barrier To Henan Rebecca Hair Products Co., Ltd. (SHSE:600439) With Shares Advancing 29%

The Henan Rebecca Hair Products Co., Ltd. (SHSE:600439) share price has done very well over the last month, posting an excellent gain of 29%. Notwithstanding the latest gain, the annual share price return of 7.8% isn't as impressive.

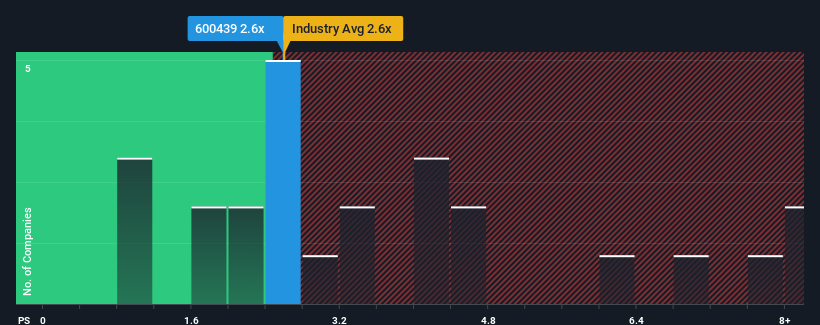

Even after such a large jump in price, there still wouldn't be many who think Henan Rebecca Hair Products' price-to-sales (or "P/S") ratio of 2.6x is worth a mention when it essentially matches the median P/S in China's Personal Products industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Henan Rebecca Hair Products

What Does Henan Rebecca Hair Products' Recent Performance Look Like?

For example, consider that Henan Rebecca Hair Products' financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Henan Rebecca Hair Products will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Henan Rebecca Hair Products' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.4%. The last three years don't look nice either as the company has shrunk revenue by 18% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Henan Rebecca Hair Products is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Henan Rebecca Hair Products' P/S Mean For Investors?

Its shares have lifted substantially and now Henan Rebecca Hair Products' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Henan Rebecca Hair Products revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 4 warning signs for Henan Rebecca Hair Products (2 are potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Henan Rebecca Hair Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600439

Henan Rebecca Hair Products

Engages in production and sale of hair products.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives