- China

- /

- Personal Products

- /

- SHSE:600439

Henan Rebecca Hair Products Co., Ltd.'s (SHSE:600439) Shares Climb 28% But Its Business Is Yet to Catch Up

Despite an already strong run, Henan Rebecca Hair Products Co., Ltd. (SHSE:600439) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 37%.

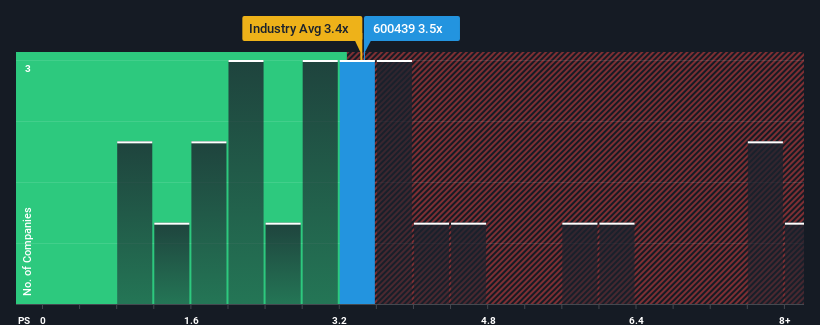

Although its price has surged higher, you could still be forgiven for feeling indifferent about Henan Rebecca Hair Products' P/S ratio of 3.5x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in China is also close to 3.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Henan Rebecca Hair Products

What Does Henan Rebecca Hair Products' Recent Performance Look Like?

It looks like revenue growth has deserted Henan Rebecca Hair Products recently, which is not something to boast about. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Henan Rebecca Hair Products, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Henan Rebecca Hair Products would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 19% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this in mind, we find it worrying that Henan Rebecca Hair Products' P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Henan Rebecca Hair Products appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that Henan Rebecca Hair Products trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Henan Rebecca Hair Products (2 are a bit unpleasant!) that you need to be mindful of.

If you're unsure about the strength of Henan Rebecca Hair Products' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Henan Rebecca Hair Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600439

Henan Rebecca Hair Products

Engages in production and sale of hair products.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives