- China

- /

- Medical Equipment

- /

- SZSE:300981

Zhonghong Pulin Medical Products Co., Ltd.'s (SZSE:300981) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Zhonghong Pulin Medical Products Co., Ltd. (SZSE:300981) shares have continued their recent momentum with a 29% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

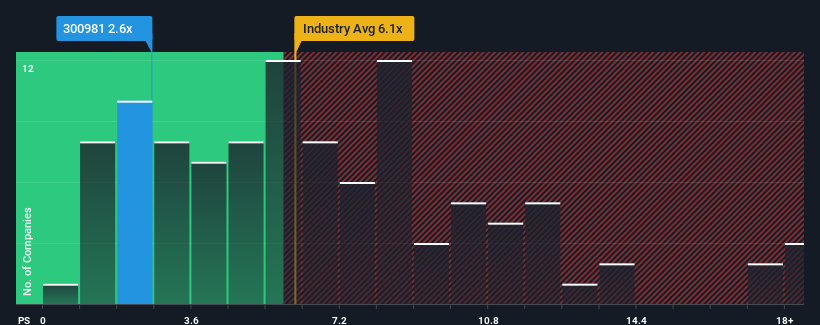

Even after such a large jump in price, considering about half the companies operating in China's Medical Equipment industry have price-to-sales ratios (or "P/S") above 6.1x, you may still consider Zhonghong Pulin Medical Products as an great investment opportunity with its 2.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Zhonghong Pulin Medical Products

What Does Zhonghong Pulin Medical Products' Recent Performance Look Like?

Zhonghong Pulin Medical Products certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhonghong Pulin Medical Products.How Is Zhonghong Pulin Medical Products' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Zhonghong Pulin Medical Products' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 62% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 13% over the next year. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

In light of this, it's understandable that Zhonghong Pulin Medical Products' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Zhonghong Pulin Medical Products' P/S?

Zhonghong Pulin Medical Products' recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Zhonghong Pulin Medical Products' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Zhonghong Pulin Medical Products you should be aware of, and 2 of them are significant.

If these risks are making you reconsider your opinion on Zhonghong Pulin Medical Products, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhonghong Pulin Medical Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300981

Zhonghong Pulin Medical Products

Zhonghong Pulin Medical Products Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives