- China

- /

- Medical Equipment

- /

- SZSE:300888

There's No Escaping Winner Medical Co., Ltd.'s (SZSE:300888) Muted Earnings

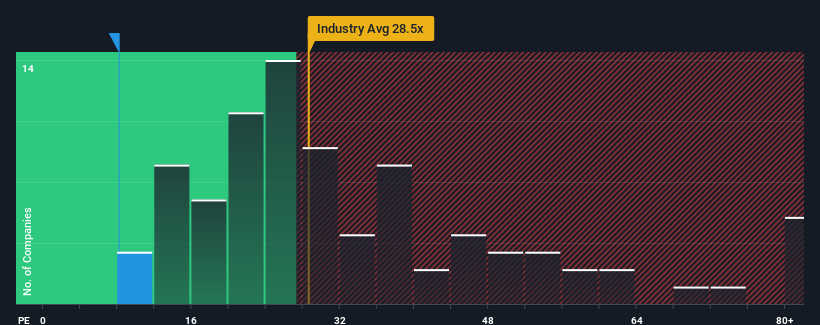

Winner Medical Co., Ltd.'s (SZSE:300888) price-to-earnings (or "P/E") ratio of 8.2x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Winner Medical has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Winner Medical

How Is Winner Medical's Growth Trending?

In order to justify its P/E ratio, Winner Medical would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 84% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 31% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 46% during the coming year according to the six analysts following the company. That's not great when the rest of the market is expected to grow by 41%.

In light of this, it's understandable that Winner Medical's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Winner Medical's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Winner Medical (2 shouldn't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Winner Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300888

Winner Medical

Engages in the research and development, manufacture, and marketing of cotton-based medical dressings and medical disposables, and consumer products in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives