- China

- /

- Semiconductors

- /

- SHSE:605111

July 2024 Insight Into High Insider Ownership Growth Companies On Chinese Exchanges

Reviewed by Simply Wall St

Amidst a backdrop of modest losses on Chinese exchanges, where underwhelming manufacturing data has cast a shadow over economic prospects, investors continue to seek resilient growth opportunities. High insider ownership in growth companies can signal strong confidence in the company's future from those who know it best, making such stocks potentially attractive in these uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 38.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

We're going to check out a few of the best picks from our screener tool.

Asia Cuanon Technology (Shanghai)Ltd (SHSE:603378)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asia Cuanon Technology (Shanghai) Ltd, operating under the ticker SHSE:603378, is a company that specializes in the production and sale of insulation materials with a market capitalization of approximately CN¥2.20 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 15.3%

Earnings Growth Forecast: 62% p.a.

Asia Cuanon Technology (Shanghai) Ltd., a company with significant insider ownership, recently completed a share buyback, repurchasing shares for CNY 50.01 million. Despite this, the firm reported a substantial decrease in quarterly revenue year-over-year and shifted from a net profit to a net loss. Looking ahead, the company's revenue growth is projected to surpass the Chinese market average, yet its return on equity is expected to remain low. The financial outlook anticipates profitability within three years amidst challenging conditions.

- Delve into the full analysis future growth report here for a deeper understanding of Asia Cuanon Technology (Shanghai)Ltd.

- The valuation report we've compiled suggests that Asia Cuanon Technology (Shanghai)Ltd's current price could be quite moderate.

Wuxi NCE PowerLtd (SHSE:605111)

Simply Wall St Growth Rating: ★★★★☆☆

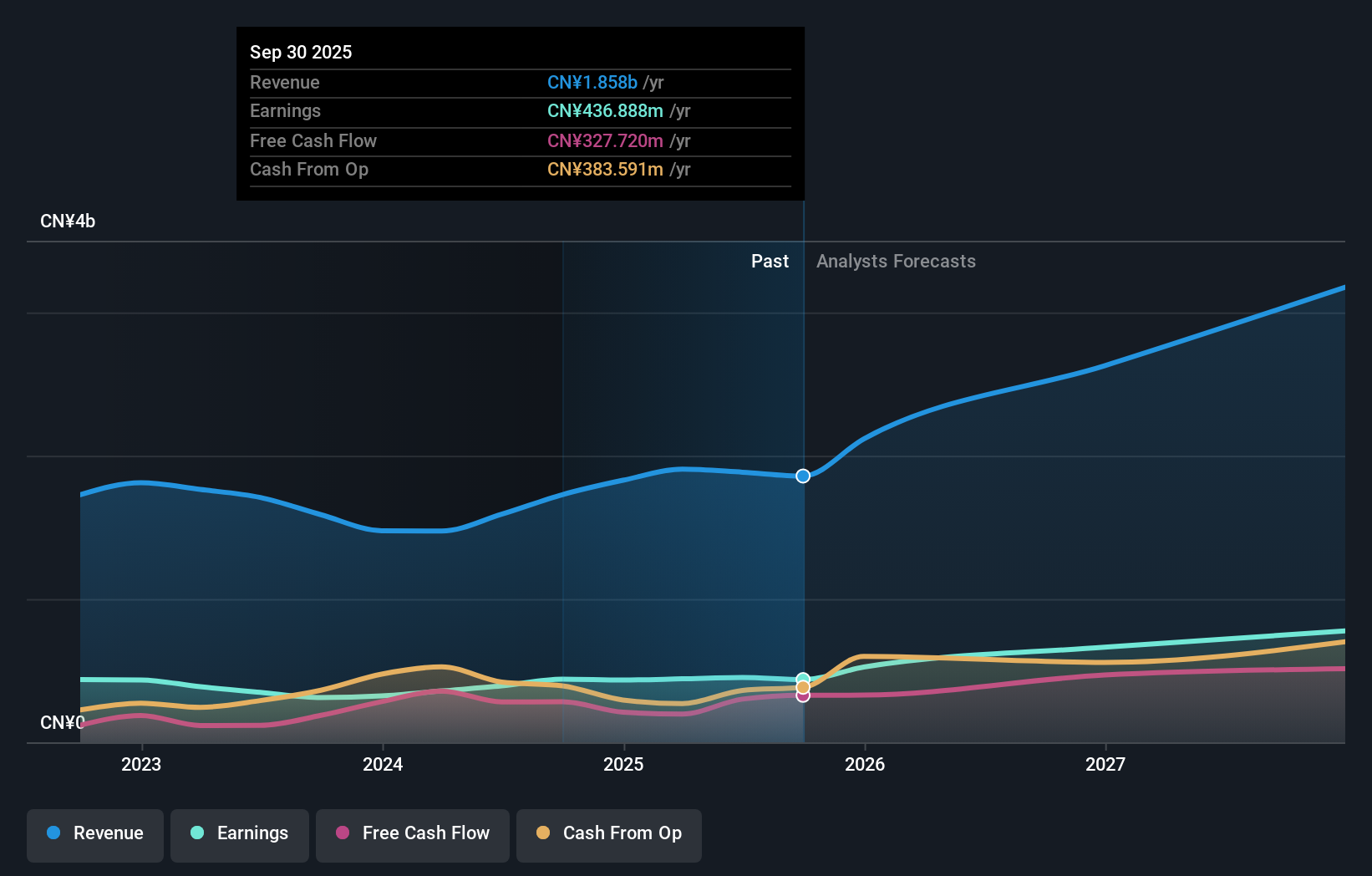

Overview: Wuxi NCE Power Co., Ltd. specializes in the research, development, and marketing of semiconductor power devices within China, with a market capitalization of approximately CN¥12.32 billion.

Operations: The company generates revenue primarily from electronic components, totaling approximately CN¥1.47 billion.

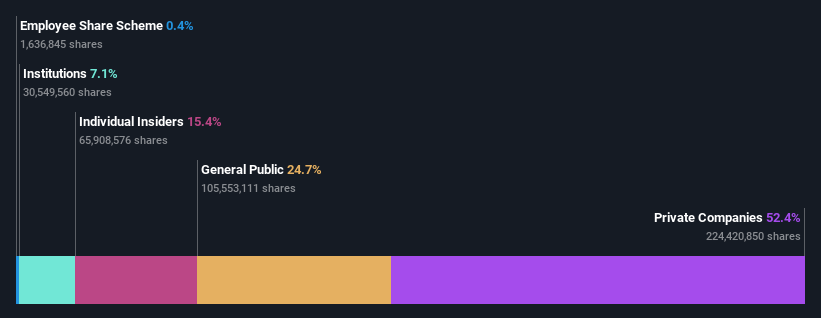

Insider Ownership: 24.7%

Earnings Growth Forecast: 20.6% p.a.

Wuxi NCE Power Co.,Ltd., despite lacking substantial insider trading in the past three months, shows promising growth prospects with earnings forecasted to grow 20.63% annually. Its price-to-earnings ratio at 34.4x stands below the semiconductor industry average of 47.9x, indicating potential value. However, its projected return on equity is low at 12.6%. Recent earnings exceeded expectations with a significant increase in net income from CNY 64.95 million to CNY 100.07 million year-over-year, suggesting operational efficiency and profitability improvements.

- Click here and access our complete growth analysis report to understand the dynamics of Wuxi NCE PowerLtd.

- Our comprehensive valuation report raises the possibility that Wuxi NCE PowerLtd is priced higher than what may be justified by its financials.

Guangzhou Wondfo BiotechLtd (SZSE:300482)

Simply Wall St Growth Rating: ★★★★☆☆

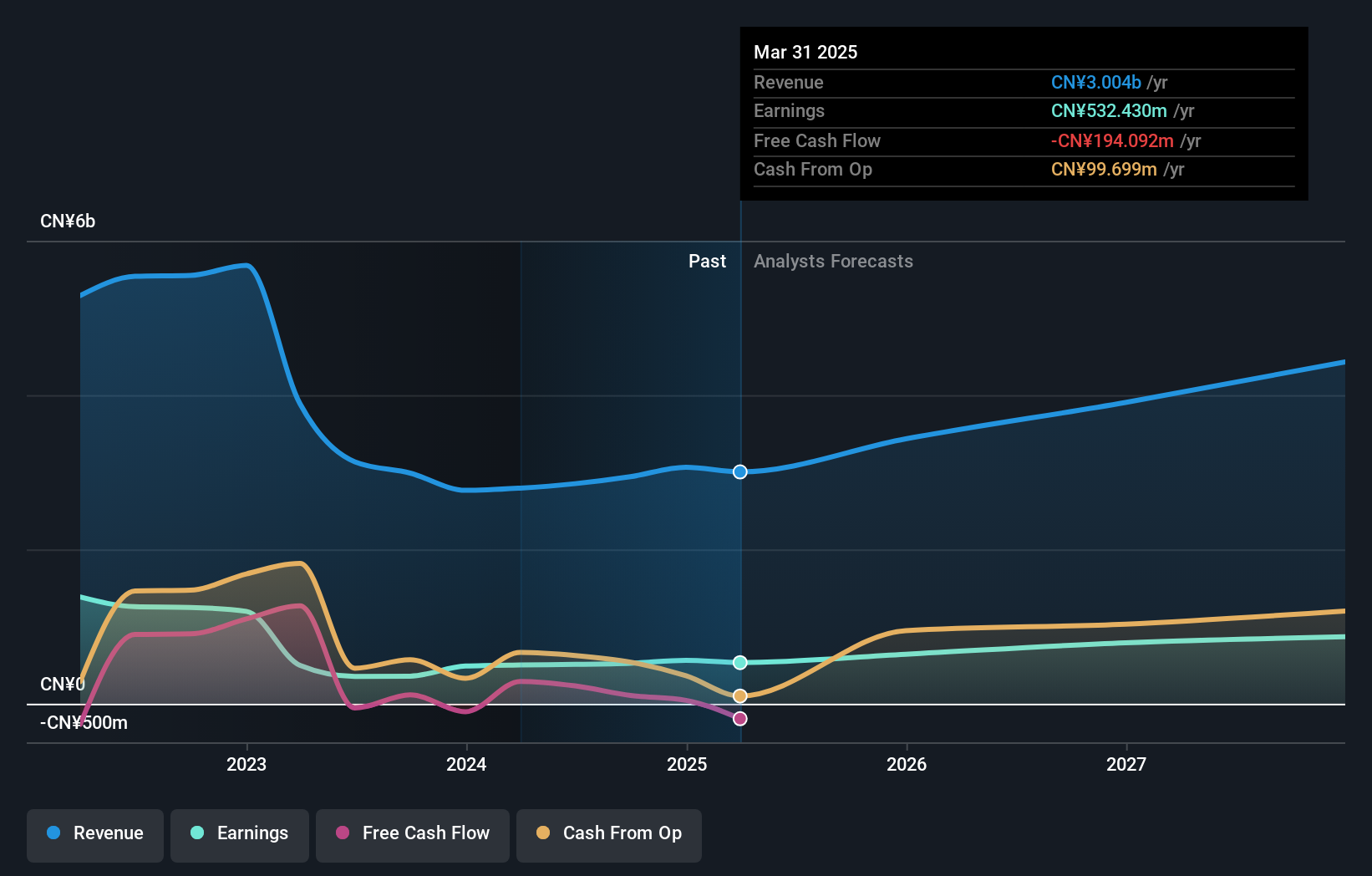

Overview: Guangzhou Wondfo Biotech Co., Ltd operates in China as an in vitro diagnostics company, focusing on the development, production, and sale of point-of-care testing products and solutions for rapid diagnosis and chronic disease management, with a market capitalization of approximately CN¥11.59 billion.

Operations: The company generates revenue primarily from the sale of diagnostic kits and equipment, totaling CN¥2.79 billion.

Insider Ownership: 31.8%

Earnings Growth Forecast: 24.4% p.a.

Guangzhou Wondfo Biotech Co., Ltd. is poised for robust growth with earnings expected to increase by 24.41% annually, outpacing the Chinese market forecast of 22.1%. Despite a recent dividend cut to CNY 4 per 10 shares, its revenue and net income have shown consistent growth, with first-quarter sales rising to CNY 861.09 million from CNY 831.63 million year-over-year. However, concerns include a low forecasted return on equity at 13.1% and an unstable dividend track record, alongside recent shareholder dilution which might weigh on investor sentiment.

- Take a closer look at Guangzhou Wondfo BiotechLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Guangzhou Wondfo BiotechLtd's share price might be on the cheaper side.

Taking Advantage

- Explore the 367 names from our Fast Growing Chinese Companies With High Insider Ownership screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi NCE PowerLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605111

Wuxi NCE PowerLtd

Engages in the research and development, design, and sale of semiconductor power devices and chips in China.

Flawless balance sheet with solid track record.