- China

- /

- Electronic Equipment and Components

- /

- SHSE:603773

High Growth Tech Stocks To Watch This December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious sentiment driven by the Federal Reserve's recent rate cuts and forecasts, U.S. stocks have experienced broad-based declines, with smaller-cap indexes facing particular challenges amid political uncertainties and economic data releases. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to changing market dynamics while maintaining strong fundamentals despite broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

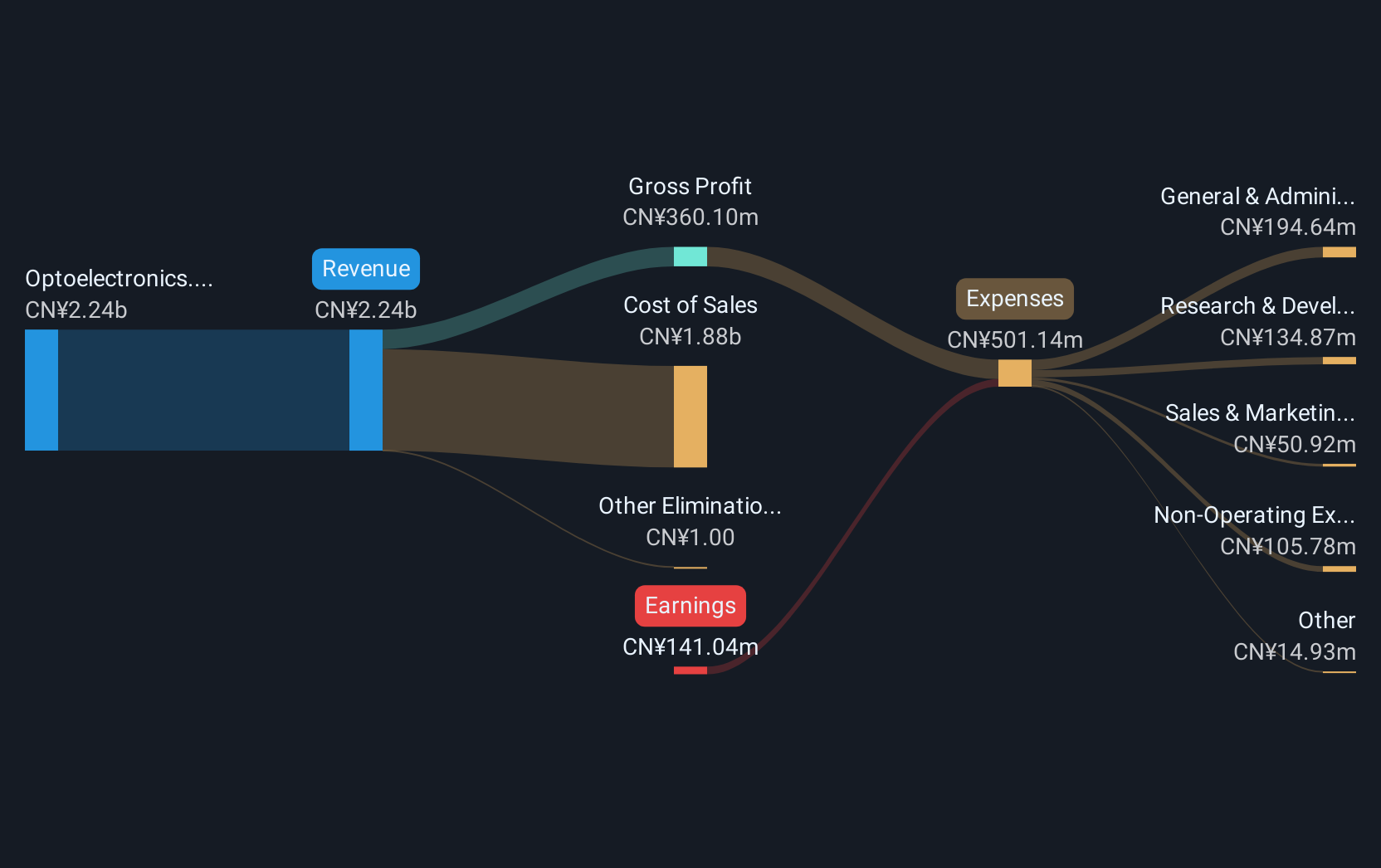

Overview: WG TECH (Jiang Xi) Co., Ltd. specializes in the photoelectric glass finishing industry in China and has a market capitalization of approximately CN¥5.92 billion.

Operations: WG TECH (Jiang Xi) Co., Ltd. generates revenue primarily from its optoelectronics segment, amounting to approximately CN¥2.21 billion. The company operates within the photoelectric glass finishing sector in China.

WG TECH (Jiang Xi) displays a dynamic growth trajectory with an anticipated revenue increase of 26.5% annually, outpacing the Chinese market's average of 13.7%. Despite current unprofitability, the firm is expected to shift towards profitability within three years, with earnings forecasted to surge by 126.88% per year. This growth is underpinned by substantial R&D investment and recent strategic moves including a significant share acquisition by Shenzhen Zhongjincheng Asset Management, reflecting confidence in WG TECH’s future market position and technological advancements in electronics.

Fujian Star-net Communication (SZSE:002396)

Simply Wall St Growth Rating: ★★★★☆☆

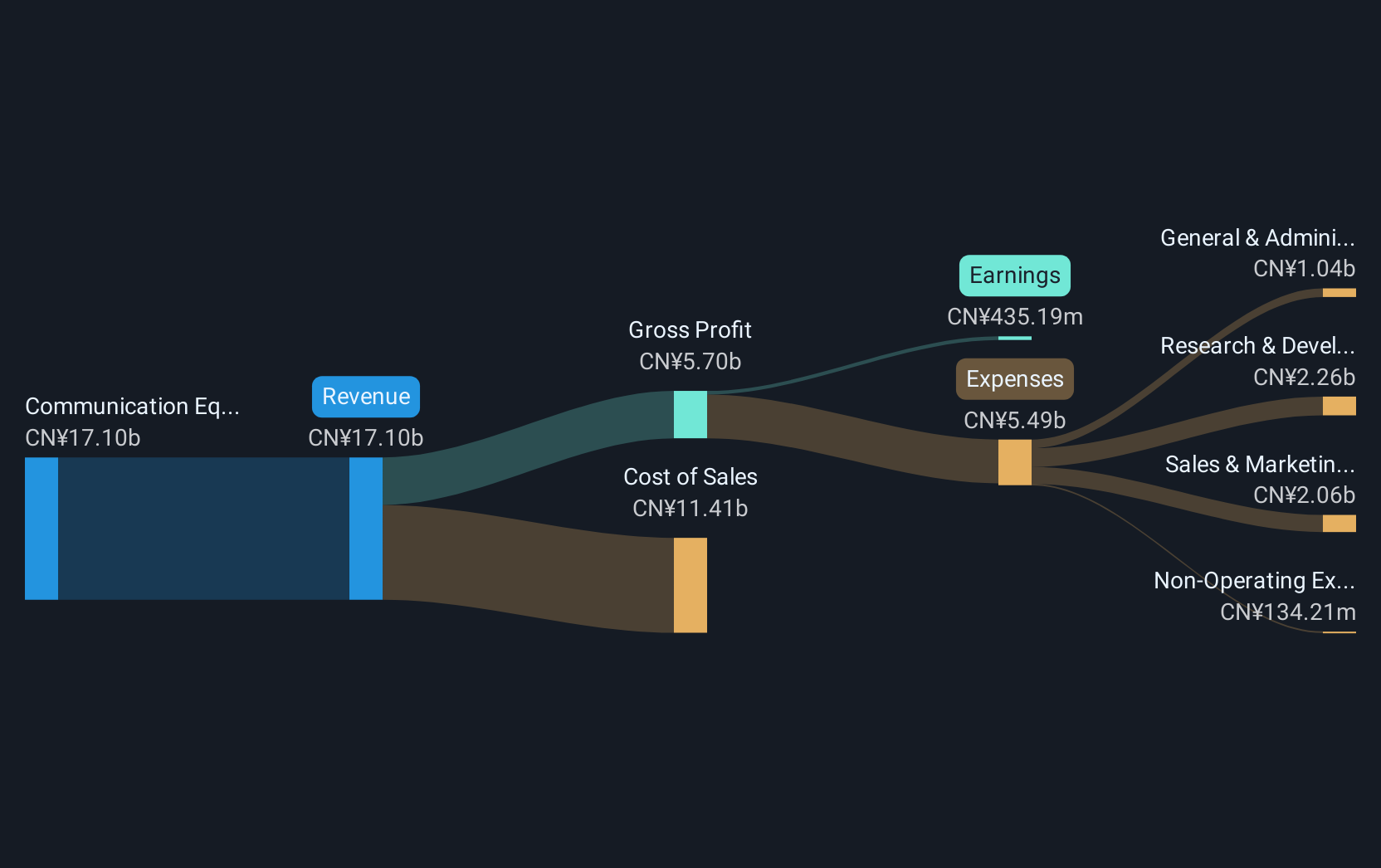

Overview: Fujian Star-net Communication Co., LTD. offers ICT infrastructure and AI application solutions in China, with a market cap of CN¥11.65 billion.

Operations: The company specializes in communication equipment manufacturing, generating a revenue of CN¥16.74 billion. It focuses on ICT infrastructure and AI application solutions within China.

Fujian Star-net Communication, recently ousted from the Shenzhen Stock Exchange Component A Share Index, still shows robust fundamentals with a notable 18.9% annual revenue growth and an impressive 35.5% expected earnings growth over the next three years. Despite a dip in net income from CNY 302.81 million to CNY 262.78 million in the latest nine-month report, the company's aggressive R&D strategy and recent board reshuffles suggest a strategic pivot aiming to enhance its competitive edge in communications technology.

- Delve into the full analysis health report here for a deeper understanding of Fujian Star-net Communication.

Understand Fujian Star-net Communication's track record by examining our Past report.

Kraken Robotics (TSXV:PNG)

Simply Wall St Growth Rating: ★★★★★☆

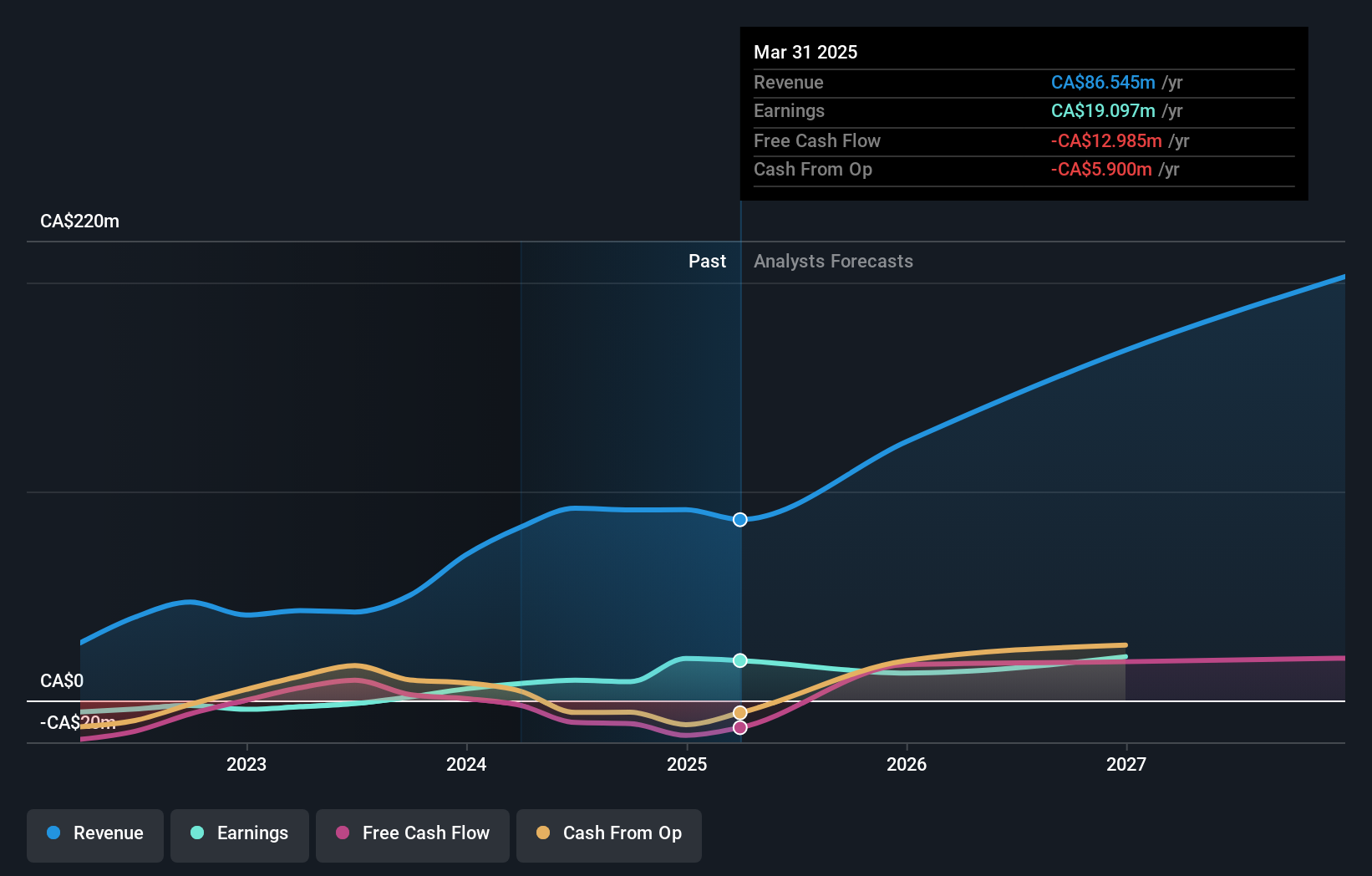

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally; it has a market cap of CA$708.89 million.

Operations: With a market cap of CA$708.89 million, Kraken Robotics generates revenue through two main segments: Products (CA$67.40 million) and Services (CA$23.79 million).

Kraken Robotics, amidst a challenging market, reported a significant revenue increase to CAD 63.18 million over nine months, up from CAD 41.58 million the previous year, reflecting a robust growth trajectory. This surge is supported by innovative product launches like the Autonomous Launch and Recovery System for their KATFISH™ technology, which has already captivated more than 40 naval customers with its advanced capabilities in real-time seafloor imaging. Moreover, Kraken's strategic move to secure orders worth $13 million for its high-performance SeaPower subsea batteries underscores its strong positioning in niche markets with high barriers to entry. These developments not only enhance Kraken's product portfolio but also solidify its reputation as a leader in maritime robotics and subsea technology.

- Click here to discover the nuances of Kraken Robotics with our detailed analytical health report.

Review our historical performance report to gain insights into Kraken Robotics''s past performance.

Key Takeaways

- Navigate through the entire inventory of 1273 High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WG TECH (Jiang Xi) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603773

WG TECH (Jiang Xi)

Provides glass-based circuit boards and related electronic devices in China.

Exceptional growth potential and fair value.

Market Insights

Community Narratives