- China

- /

- Medical Equipment

- /

- SZSE:002950

Little Excitement Around Allmed Medical Products Co.,Ltd's (SZSE:002950) Revenues

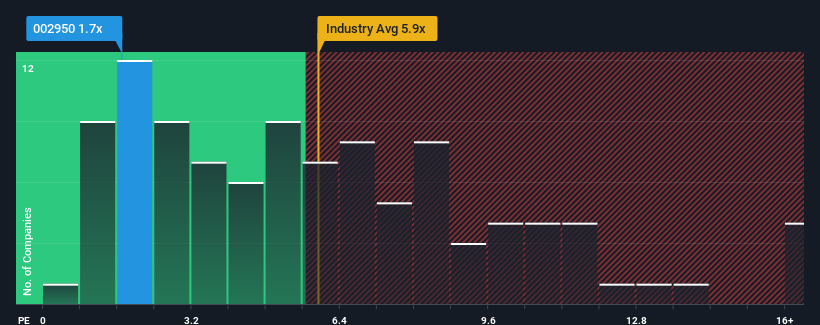

Allmed Medical Products Co.,Ltd's (SZSE:002950) price-to-sales (or "P/S") ratio of 1.7x might make it look like a strong buy right now compared to the Medical Equipment industry in China, where around half of the companies have P/S ratios above 5.9x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Allmed Medical ProductsLtd

What Does Allmed Medical ProductsLtd's P/S Mean For Shareholders?

For instance, Allmed Medical ProductsLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Allmed Medical ProductsLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Allmed Medical ProductsLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. This means it has also seen a slide in revenue over the longer-term as revenue is down 34% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that Allmed Medical ProductsLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Allmed Medical ProductsLtd's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Allmed Medical ProductsLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Allmed Medical ProductsLtd (1 is potentially serious!) that you should be aware of.

If you're unsure about the strength of Allmed Medical ProductsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002950

Allmed Medical ProductsLtd

Engages in the manufacture and sale of wound care and nursing material products in China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives