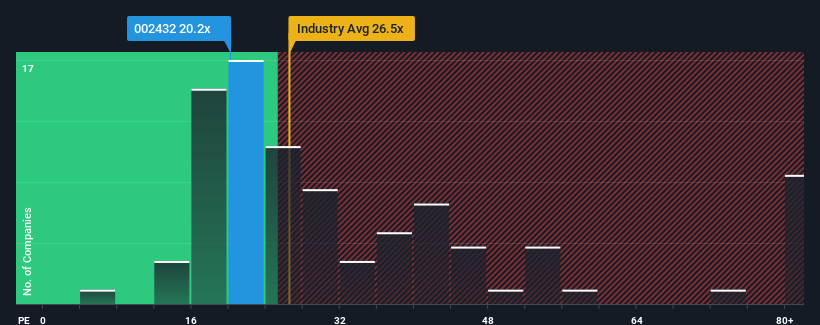

With a price-to-earnings (or "P/E") ratio of 20.2x Andon Health Co., Ltd. (SZSE:002432) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 29x and even P/E's higher than 53x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Andon Health's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Andon Health

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Andon Health's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 261% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 36% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Andon Health's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Andon Health's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Andon Health currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Andon Health, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Andon Health. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Andon Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002432

Andon Health

Develops, manufactures, and sells health electronics and intelligent hardware products.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives