- China

- /

- Healthcare Services

- /

- SZSE:002044

Meinian Onehealth Healthcare Holdings (SZSE:002044) investors are sitting on a loss of 67% if they invested five years ago

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the Meinian Onehealth Healthcare Holdings Co., Ltd. (SZSE:002044) share price managed to fall 67% over five long years. That is extremely sub-optimal, to say the least. Furthermore, it's down 11% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 8.5% decline in the broader market, throughout the period.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Meinian Onehealth Healthcare Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

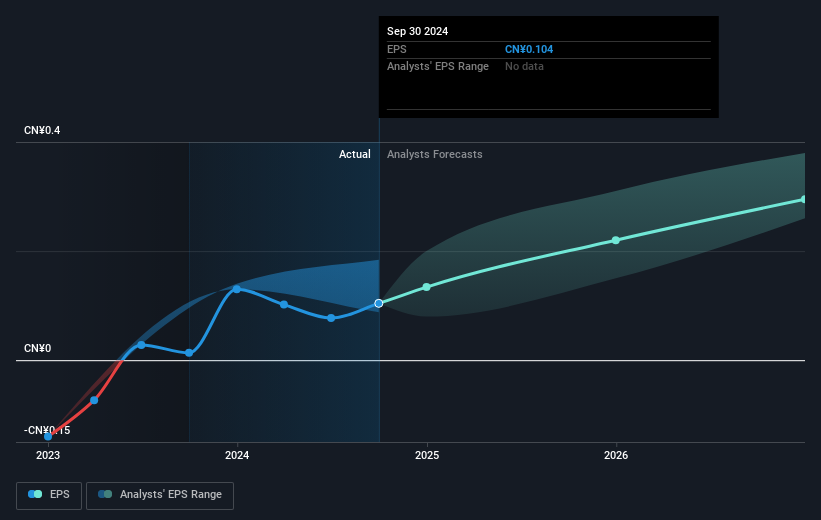

Looking back five years, both Meinian Onehealth Healthcare Holdings' share price and EPS declined; the latter at a rate of 18% per year. This change in EPS is reasonably close to the 20% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Meinian Onehealth Healthcare Holdings has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Meinian Onehealth Healthcare Holdings will grow revenue in the future.

A Different Perspective

Meinian Onehealth Healthcare Holdings shareholders are down 17% for the year (even including dividends), but the market itself is up 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Is Meinian Onehealth Healthcare Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002044

Meinian Onehealth Healthcare Holdings

Meinian Onehealth Healthcare Holdings Co., Ltd.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives