- China

- /

- Medical Equipment

- /

- SHSE:688626

Further Upside For Xiangyu Medical Co.,Ltd (SHSE:688626) Shares Could Introduce Price Risks After 41% Bounce

Xiangyu Medical Co.,Ltd (SHSE:688626) shareholders would be excited to see that the share price has had a great month, posting a 41% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

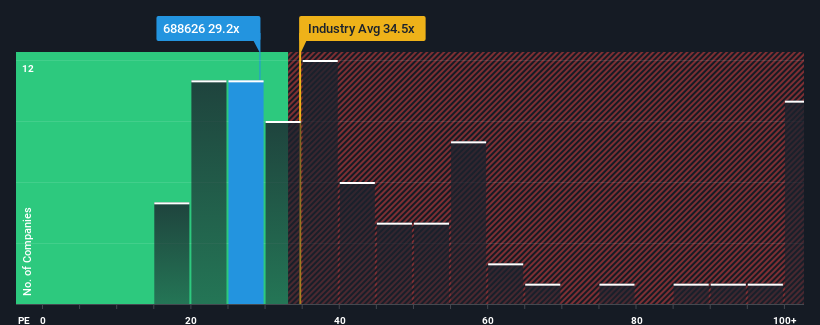

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Xiangyu MedicalLtd as an attractive investment with its 29.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Xiangyu MedicalLtd as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Xiangyu MedicalLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Xiangyu MedicalLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.4%. The last three years don't look nice either as the company has shrunk EPS by 27% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the three analysts watching the company. With the market only predicted to deliver 19% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Xiangyu MedicalLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Xiangyu MedicalLtd's P/E?

The latest share price surge wasn't enough to lift Xiangyu MedicalLtd's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Xiangyu MedicalLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Xiangyu MedicalLtd has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688626

Xiangyu MedicalLtd

Engages in the research, development, manufacturing, and marketing of rehabilitation and physiotherapy equipment.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives