- South Korea

- /

- Biotech

- /

- KOSDAQ:A145020

Global Market: Three Companies That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

Amid a backdrop of easing trade tensions between the U.S. and China, global markets have experienced a notable rally, with major indices posting significant gains as investor sentiment improves. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market optimism and favorable economic developments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$220.50 | NT$440.50 | 49.9% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.75 | €105.29 | 49.9% |

| Airbus (ENXTPA:AIR) | €161.84 | €322.14 | 49.8% |

| Shandong Sunway Chemical Group (SZSE:002469) | CN¥9.24 | CN¥18.47 | 50% |

| adidas (XTRA:ADS) | €220.70 | €439.05 | 49.7% |

| Lectra (ENXTPA:LSS) | €23.75 | €47.40 | 49.9% |

| GEM (SZSE:002340) | CN¥6.26 | CN¥12.49 | 49.9% |

| Medley (TSE:4480) | ¥3085.00 | ¥6163.04 | 49.9% |

| Cosmax (KOSE:A192820) | ₩204000.00 | ₩404258.69 | 49.5% |

| InnoCare Pharma (SEHK:9969) | HK$10.60 | HK$21.19 | 50% |

Let's take a closer look at a couple of our picks from the screened companies.

Hugel (KOSDAQ:A145020)

Overview: Hugel, Inc. is a biopharmaceutical company that develops and manufactures products in South Korea and internationally, with a market cap of ₩3.70 trillion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling ₩373.05 billion.

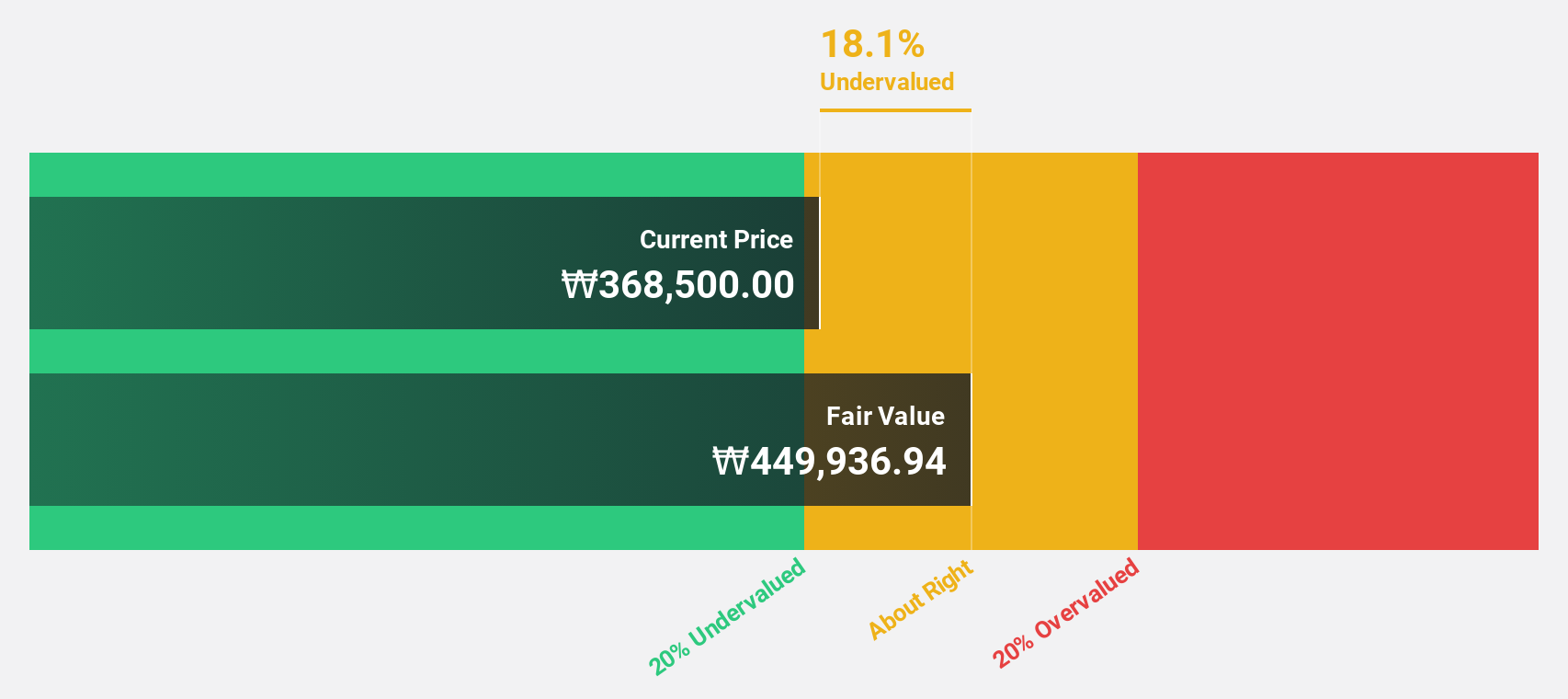

Estimated Discount To Fair Value: 12.8%

Hugel is trading at ₩366,000, approximately 12.8% below its estimated fair value of ₩419,961.33, indicating potential undervaluation based on cash flows. Despite revenue growth forecasts of 17.8% per year being slower than expected, earnings are projected to grow significantly at 20.9% annually over the next three years and outperform the KR market average of 20.4%. Recent share buybacks further enhance shareholder value by reducing shares outstanding.

- Insights from our recent growth report point to a promising forecast for Hugel's business outlook.

- Click to explore a detailed breakdown of our findings in Hugel's balance sheet health report.

Shanghai Allist Pharmaceuticals (SHSE:688578)

Overview: Shanghai Allist Pharmaceuticals Co., Ltd. (SHSE:688578) operates in the pharmaceutical industry and has a market capitalization of CN¥38.16 billion.

Operations: Shanghai Allist Pharmaceuticals generates its revenue from various segments within the pharmaceutical industry, although specific segment details are not provided in the available text.

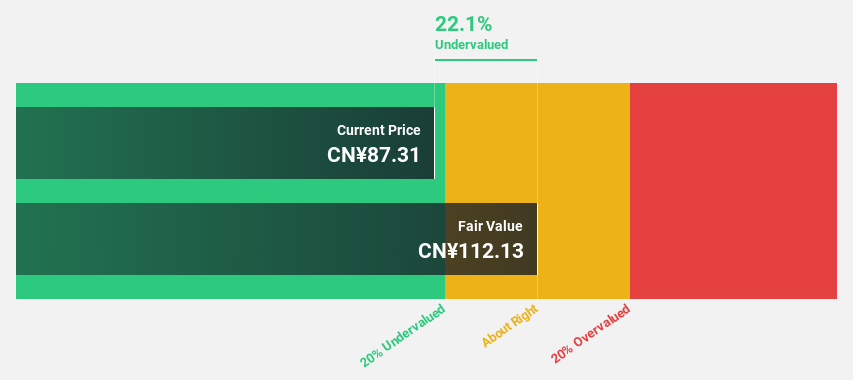

Estimated Discount To Fair Value: 21.3%

Shanghai Allist Pharmaceuticals is trading at CN¥88.28, about 21.3% below its estimated fair value of CN¥112.13, highlighting potential undervaluation based on cash flows. The company's revenue is forecast to grow at 20.1% annually, outpacing the Chinese market average of 12.4%, though earnings growth of 18.9% lags behind the market's 23.6%. Recent strategic alliances and robust financial performance underscore its operational strength despite slower earnings growth projections compared to the market.

- Upon reviewing our latest growth report, Shanghai Allist Pharmaceuticals' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Shanghai Allist Pharmaceuticals stock in this financial health report.

APT Medical (SHSE:688617)

Overview: APT Medical Inc. is involved in the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China, with a market cap of CN¥39.43 billion.

Operations: The company generates revenue of CN¥2.17 billion from its medical products segment, focusing on electrophysiology and vascular interventional devices in China.

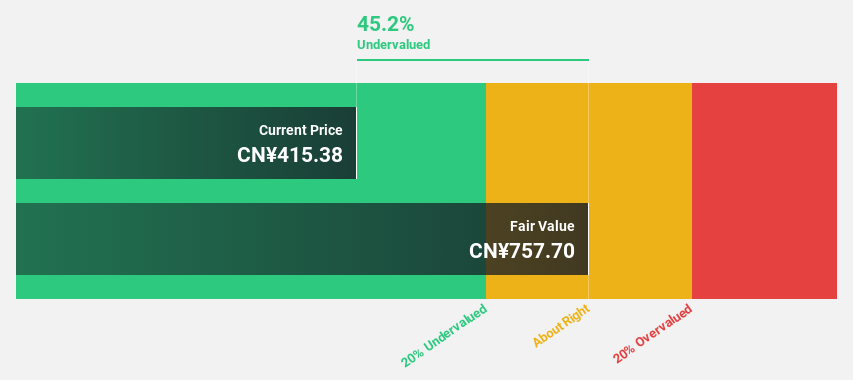

Estimated Discount To Fair Value: 44.5%

APT Medical is trading at CN¥419.86, significantly below its estimated fair value of CN¥756.1, indicating it may be undervalued based on cash flows. The company's revenue and earnings are expected to grow substantially at rates of 25.6% and 26.6% annually, surpassing the broader Chinese market's growth projections. Recent financial results showed a strong performance with first-quarter sales increasing to CN¥564.28 million from CN¥455.33 million year-on-year, reinforcing its growth trajectory.

- In light of our recent growth report, it seems possible that APT Medical's financial performance will exceed current levels.

- Dive into the specifics of APT Medical here with our thorough financial health report.

Summing It All Up

- Click here to access our complete index of 511 Undervalued Global Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hugel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hugel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A145020

Hugel

Develops and manufactures biopharmaceuticals in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives