- China

- /

- Medical Equipment

- /

- SHSE:688468

Little Excitement Around Chemclin Diagnostics Co., Ltd.'s (SHSE:688468) Earnings

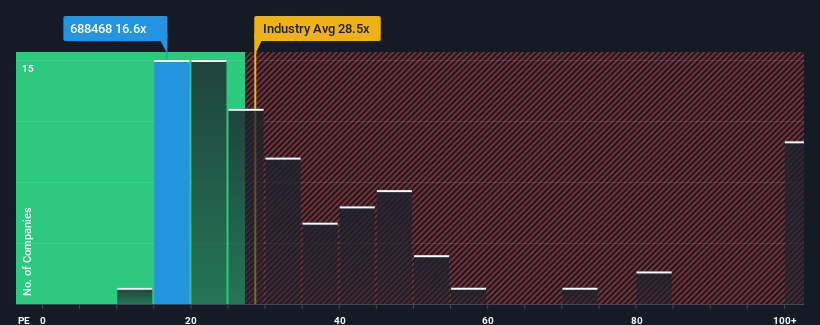

With a price-to-earnings (or "P/E") ratio of 16.6x Chemclin Diagnostics Co., Ltd. (SHSE:688468) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 29x and even P/E's higher than 54x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Chemclin Diagnostics' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Chemclin Diagnostics

How Is Chemclin Diagnostics' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Chemclin Diagnostics' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.6%. This means it has also seen a slide in earnings over the longer-term as EPS is down 12% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Chemclin Diagnostics is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Chemclin Diagnostics maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Chemclin Diagnostics (1 shouldn't be ignored!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Chemclin Diagnostics. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688468

Chemclin Diagnostics

Engages in the research and development, production, and sale of clinical immune chemiluminescence diagnostic reagents and instruments.

Excellent balance sheet and slightly overvalued.