- China

- /

- Medical Equipment

- /

- SHSE:688468

Chemclin Diagnostics Co., Ltd. (SHSE:688468) Shares Fly 25% But Investors Aren't Buying For Growth

Chemclin Diagnostics Co., Ltd. (SHSE:688468) shareholders have had their patience rewarded with a 25% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 7.4% isn't as attractive.

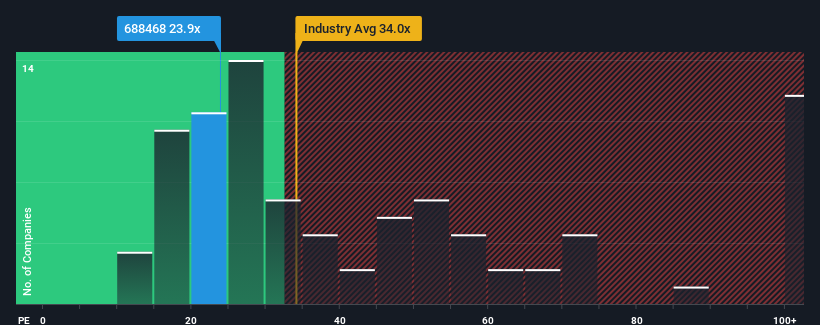

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 38x, you may still consider Chemclin Diagnostics as an attractive investment with its 23.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Chemclin Diagnostics' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Chemclin Diagnostics

What Are Growth Metrics Telling Us About The Low P/E?

Chemclin Diagnostics' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 12% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Chemclin Diagnostics is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Chemclin Diagnostics' P/E

The latest share price surge wasn't enough to lift Chemclin Diagnostics' P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chemclin Diagnostics maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Chemclin Diagnostics you should know about.

Of course, you might also be able to find a better stock than Chemclin Diagnostics. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688468

Chemclin Diagnostics

Engages in the research and development, production, and sale of clinical immune chemiluminescence diagnostic reagents and instruments.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives