- China

- /

- Medical Equipment

- /

- SHSE:688277

There's Reason For Concern Over Tinavi Medical Technologies Co.,Ltd.'s (SHSE:688277) Massive 25% Price Jump

Tinavi Medical Technologies Co.,Ltd. (SHSE:688277) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

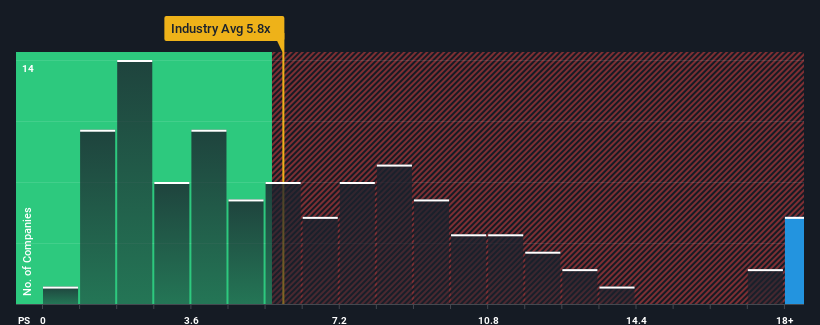

Following the firm bounce in price, Tinavi Medical TechnologiesLtd may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 21.3x, since almost half of all companies in the Medical Equipment industry in China have P/S ratios under 5.8x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Tinavi Medical TechnologiesLtd

How Tinavi Medical TechnologiesLtd Has Been Performing

Tinavi Medical TechnologiesLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tinavi Medical TechnologiesLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Tinavi Medical TechnologiesLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Tinavi Medical TechnologiesLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. Pleasingly, revenue has also lifted 54% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Tinavi Medical TechnologiesLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Tinavi Medical TechnologiesLtd's P/S Mean For Investors?

The strong share price surge has lead to Tinavi Medical TechnologiesLtd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Tinavi Medical TechnologiesLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Tinavi Medical TechnologiesLtd (1 doesn't sit too well with us) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tinavi Medical TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688277

Tinavi Medical TechnologiesLtd

Engages in the research and development, production, sale, market, service, and clinical application of orthopedic surgery robots and related technologies.

Excellent balance sheet minimal.

Similar Companies

Market Insights

Community Narratives