- China

- /

- Electrical

- /

- SHSE:688128

Exploring Three Undiscovered Gems in Global Markets with Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap stocks have shown resilience, advancing amid fluctuating interest rate expectations and mixed economic signals. As investors navigate these dynamic conditions, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 31.08% | 1.17% | 31.28% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Savior Lifetec | NA | -11.44% | 15.18% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| China New City Group | 85.52% | 30.33% | 17.38% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

| DINE. de | 78.90% | 35.52% | -13.75% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

China National Electric Apparatus Research Institute (SHSE:688128)

Simply Wall St Value Rating: ★★★★★☆

Overview: China National Electric Apparatus Research Institute Co., Ltd. focuses on research and development in the electric apparatus industry, with a market cap of approximately CN¥10.95 billion.

Operations: The primary revenue streams for China National Electric Apparatus Research Institute Co., Ltd. include research and development activities in the electric apparatus sector. The company has a market cap of approximately CN¥10.95 billion, reflecting its significant presence in the industry.

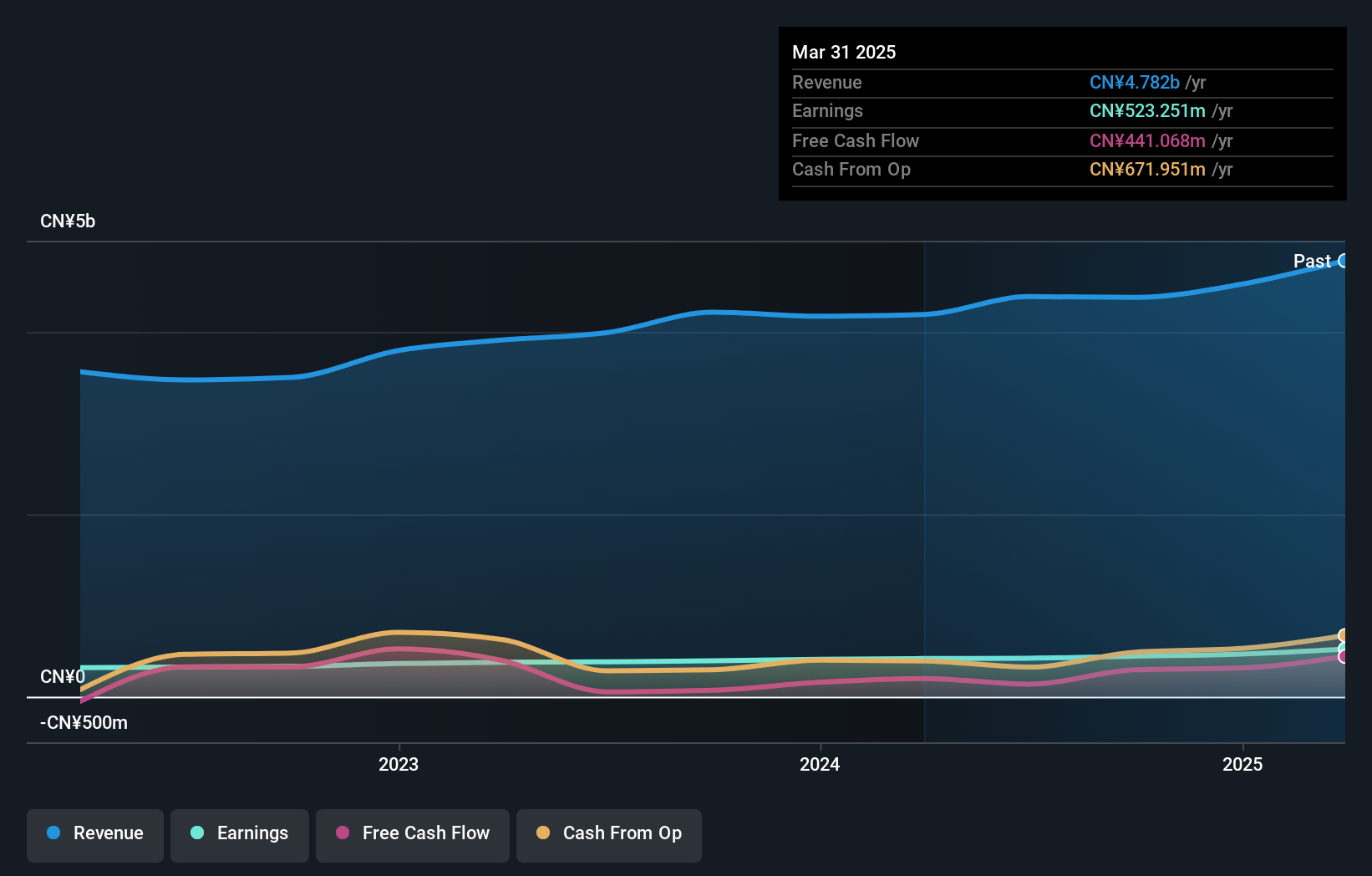

Operating in the electrical sector, China National Electric Apparatus Research Institute has shown promising growth with earnings rising 25% over the past year, outpacing the industry's -1.2%. The company's recent financials reveal sales of CNY 2.3 billion and net income of CNY 258 million for the first half of 2025, reflecting a solid performance compared to last year's figures. Despite an increased debt-to-equity ratio from 1.3% to 2.3% over five years, it holds more cash than total debt and trades at a significant discount to estimated fair value, suggesting potential undervaluation in its market position.

Shandong Weigao Orthopaedic Device (SHSE:688161)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Weigao Orthopaedic Device Co., Ltd. specializes in the development, manufacturing, and sale of orthopedic medical devices with a market cap of CN¥12.49 billion.

Operations: Weigao Orthopaedic generates revenue primarily through the sale of orthopedic medical devices. The company has a market cap of CN¥12.49 billion.

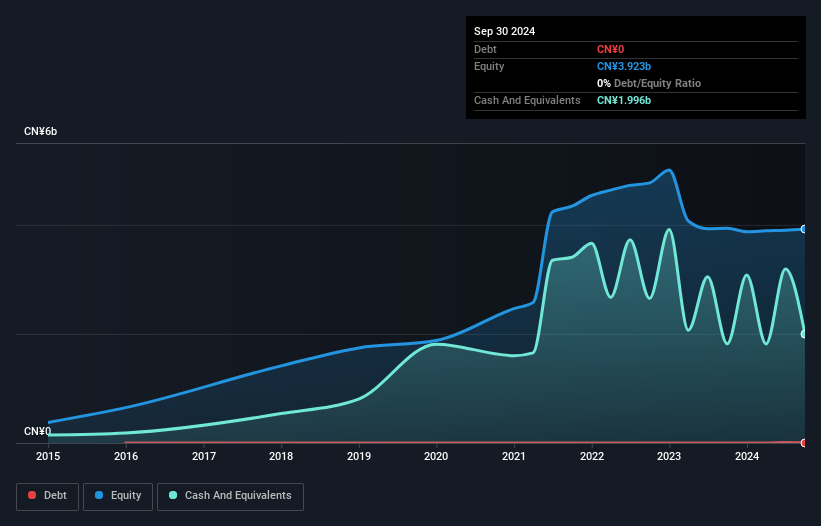

Shandong Weigao Orthopaedic Device has demonstrated impressive financial health, with no debt over the past five years and a robust earnings growth of 190.9% in the last year, outpacing the Medical Equipment industry's -3.1%. For the first half of 2025, they reported net income of CNY 141.96 million, up from CNY 93.13 million in the previous year, reflecting high-quality earnings and profitability. Despite a slight dip in sales to CNY 740.92 million from CNY 750.54 million last year, their basic earnings per share rose to CNY 0.35 from CNY 0.23, showcasing resilience and potential for future growth within its market niche.

Wiselink (TPEX:8932)

Simply Wall St Value Rating: ★★★★★★

Overview: Wiselink Co., Ltd. is a global manufacturer and seller of zippers under the MAX Zipper brand name, with a market cap of NT$39.62 billion.

Operations: Wiselink Co., Ltd. generates revenue primarily from the Taiwan Area (NT$390.91 million), Mainland China Region (NT$461.03 million), and Other Asia Pacific Regions (NT$1.25 billion).

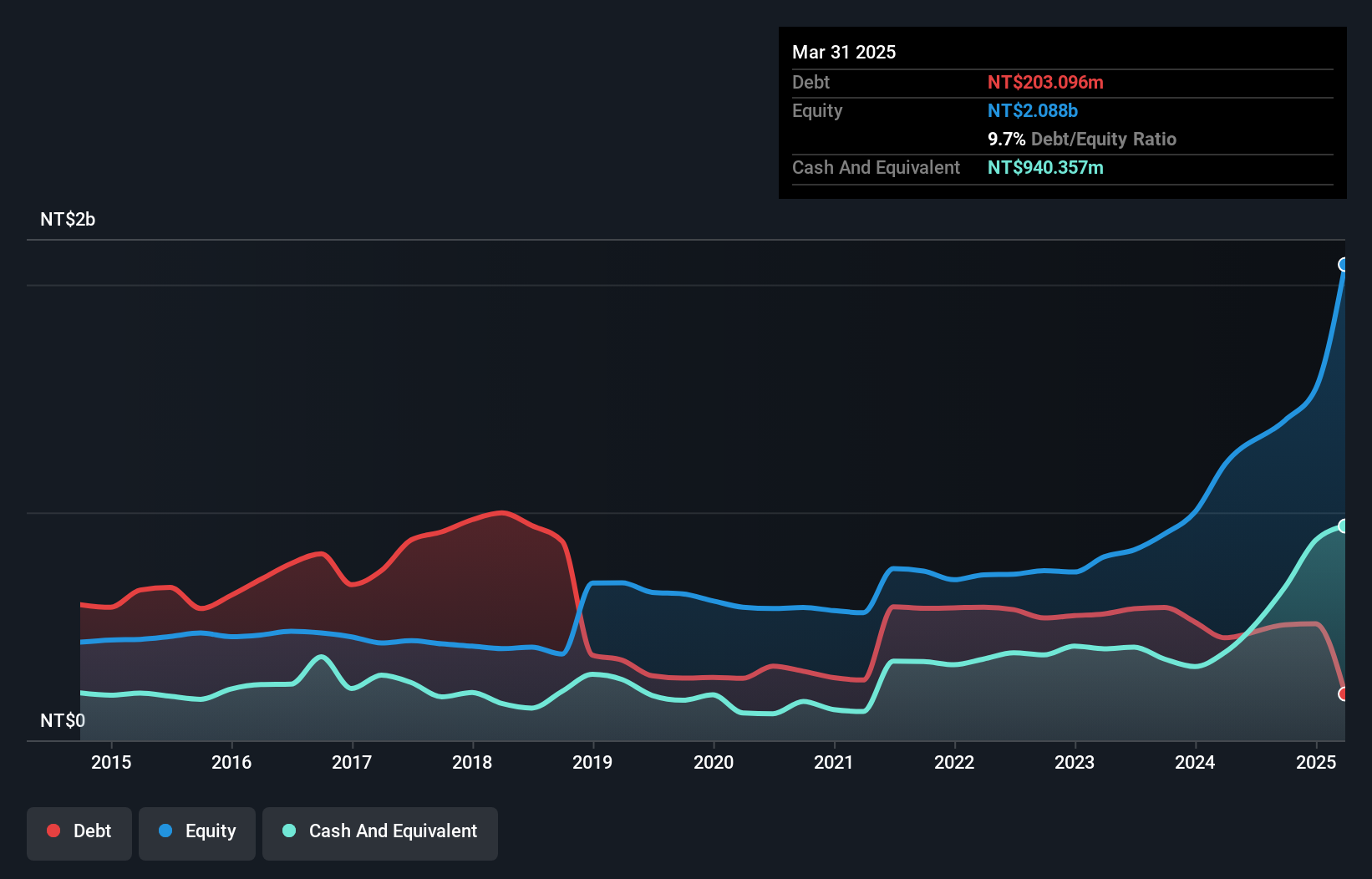

Wiselink has shown impressive financial strength with its debt to equity ratio dropping from 56.3% to 15% over five years, reflecting effective management of liabilities. The company reported a significant earnings growth of 154.3%, outpacing the luxury industry which experienced a -15.9% change, highlighting its robust performance in a challenging market. Recent buybacks saw Wiselink repurchasing 1,141,000 shares for TWD 113.92 million, indicating confidence in its valuation and future prospects. Net income surged to TWD 158.4 million this quarter compared to TWD 82.03 million last year, demonstrating strong profitability and operational efficiency amidst volatility concerns in share prices recently observed over three months.

- Click to explore a detailed breakdown of our findings in Wiselink's health report.

Gain insights into Wiselink's past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 2937 Global Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688128

China National Electric Apparatus Research Institute

China National Electric Apparatus Research Institute Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026