- Japan

- /

- Semiconductors

- /

- TSE:6871

Top Asian Growth Companies With Insider Ownership In October 2025

Reviewed by Simply Wall St

Amidst the backdrop of reignited U.S.-China trade tensions and fluctuating global markets, Asian equities have shown mixed performance, with Japan's stock markets experiencing a notable rise while China's indices displayed modest changes. In this environment of uncertainty, companies with strong insider ownership can often signal confidence in their growth potential, making them an intriguing focus for investors seeking stability and promise in volatile times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 26.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.4% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 31.8% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's uncover some gems from our specialized screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Seojin System Co.,Ltd, with a market cap of ₩1.38 trillion, supplies telecom equipment, repeaters, mechanical products, and LED and other equipment.

Operations: The company's revenue is primarily derived from the EMS Sector, which accounts for ₩1.30 billion, and the Semiconductor Sector, contributing ₩243.34 million.

Insider Ownership: 32.4%

Earnings Growth Forecast: 108.3% p.a.

Seojin System Ltd's revenue is forecast to grow at 32.4% annually, significantly outpacing the Korean market's growth rate of 8.1%. The company plans a share buyback program to enhance shareholder value, indicating strong insider confidence. Despite trading at 82.5% below its estimated fair value and expected profitability within three years, its return on equity is projected to be modest at 16.4%, and interest payments are not well covered by earnings.

- Click here to discover the nuances of Seojin SystemLtd with our detailed analytical future growth report.

- The analysis detailed in our Seojin SystemLtd valuation report hints at an deflated share price compared to its estimated value.

Sino Medical Sciences Technology (SHSE:688108)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sino Medical Sciences Technology Inc. is a Chinese medical device company focused on the research, development, production, and distribution of interventional devices, with a market cap of CN¥12.59 billion.

Operations: The company generates revenue of CN¥485.52 million from its medical products segment, which involves interventional devices.

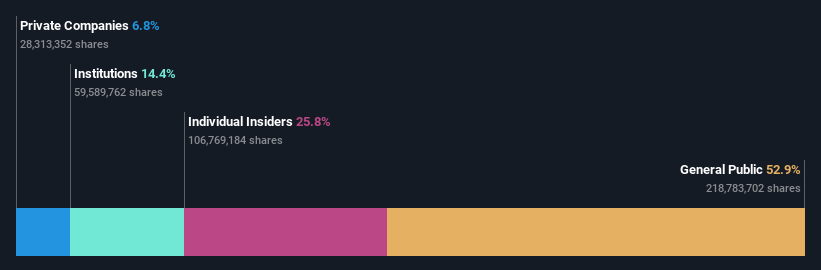

Insider Ownership: 26%

Earnings Growth Forecast: 78.1% p.a.

Sino Medical Sciences Technology's earnings are anticipated to grow significantly at 78.1% annually, surpassing the Chinese market's 26.3%. Its revenue is projected to increase by 28.1% per year, outstripping the broader market growth of 13.7%. Despite a recent rise in net income from CNY 3.49 million to CNY 13.84 million, the company faces challenges with low forecasted return on equity and share price volatility over the past three months.

- Navigate through the intricacies of Sino Medical Sciences Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Sino Medical Sciences Technology implies its share price may be too high.

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells body measuring equipment as well as semiconductor and liquid crystal display inspection equipment globally, with a market cap of ¥269.41 billion.

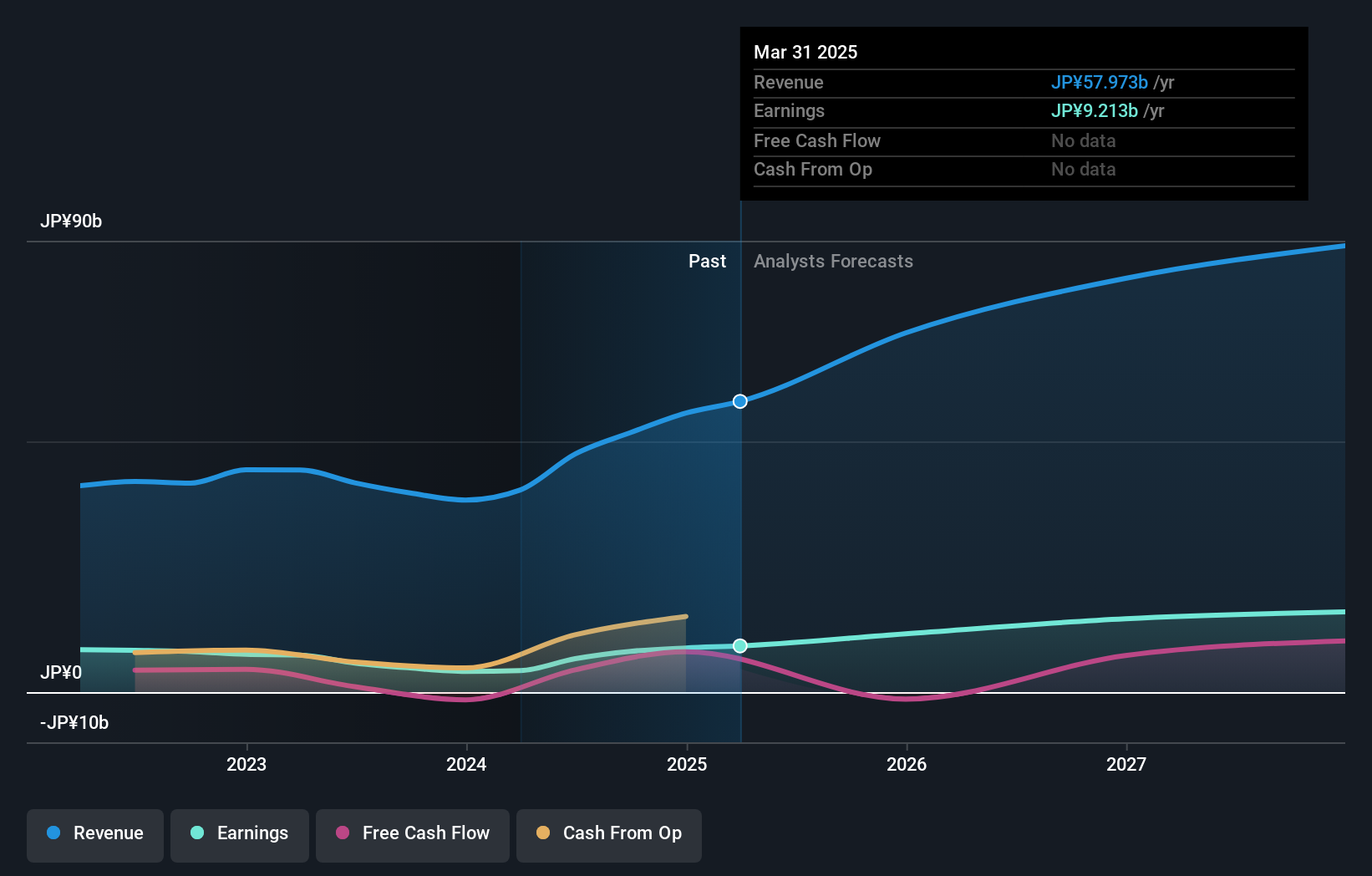

Operations: The company's revenue is primarily derived from the Probe Card Business, which accounts for ¥60.71 billion, and the TE Business, contributing ¥1.88 billion.

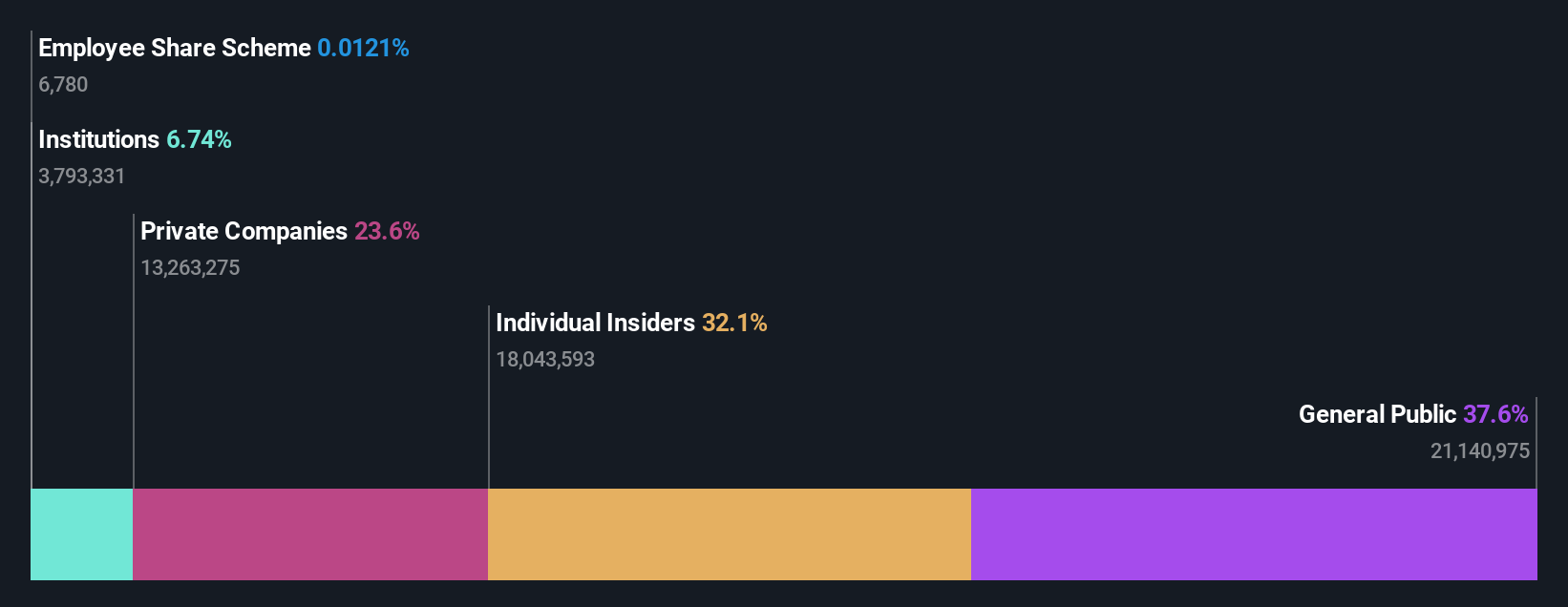

Insider Ownership: 15.3%

Earnings Growth Forecast: 22.1% p.a.

Micronics Japan is forecasted to experience robust earnings growth of 22.1% annually, outpacing the Japanese market's average. Revenue growth is expected at 13.4%, driven by demand in memory semiconductors, particularly from generative AI advancements. Despite recent third-quarter guidance revisions due to equipment malfunctions impacting shipments, the company maintains a positive full-year outlook and increased its annual dividend to ¥72 per share. However, share price volatility remains a concern for investors seeking stability.

- Click here and access our complete growth analysis report to understand the dynamics of Micronics Japan.

- The analysis detailed in our Micronics Japan valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Gain an insight into the universe of 615 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6871

Micronics Japan

Develops, manufactures, and sells body measuring equipment, semiconductor, and liquid crystal display inspection equipment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives