- China

- /

- Medical Equipment

- /

- SHSE:688050

Eyebright Medical Technology (Beijing) Co., Ltd. (SHSE:688050) Stocks Shoot Up 26% But Its P/E Still Looks Reasonable

Eyebright Medical Technology (Beijing) Co., Ltd. (SHSE:688050) shares have continued their recent momentum with a 26% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

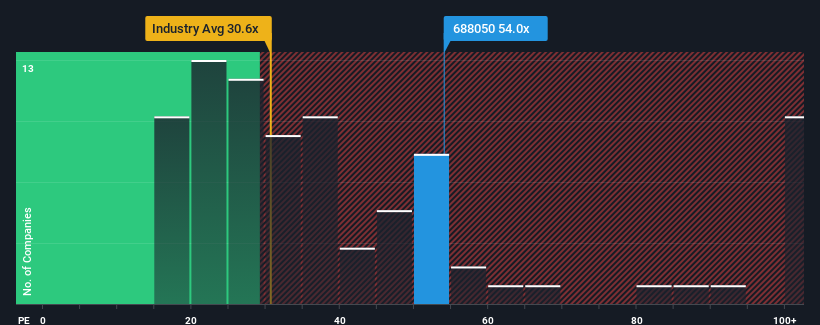

After such a large jump in price, Eyebright Medical Technology (Beijing) may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 54x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been pleasing for Eyebright Medical Technology (Beijing) as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Eyebright Medical Technology (Beijing)

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Eyebright Medical Technology (Beijing)'s is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 28% gain to the company's bottom line. The latest three year period has also seen an excellent 126% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 26% per annum over the next three years. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we can see why Eyebright Medical Technology (Beijing) is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The strong share price surge has got Eyebright Medical Technology (Beijing)'s P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Eyebright Medical Technology (Beijing) maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Eyebright Medical Technology (Beijing) has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Eyebright Medical Technology (Beijing). So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eyebright Medical Technology (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688050

Eyebright Medical Technology (Beijing)

Eyebright Medical Technology (Beijing) Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives