Shanghai Menon Animal Nutrition Technology Co., Ltd. (SZSE:301156) Held Back By Insufficient Growth Even After Shares Climb 27%

Those holding Shanghai Menon Animal Nutrition Technology Co., Ltd. (SZSE:301156) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

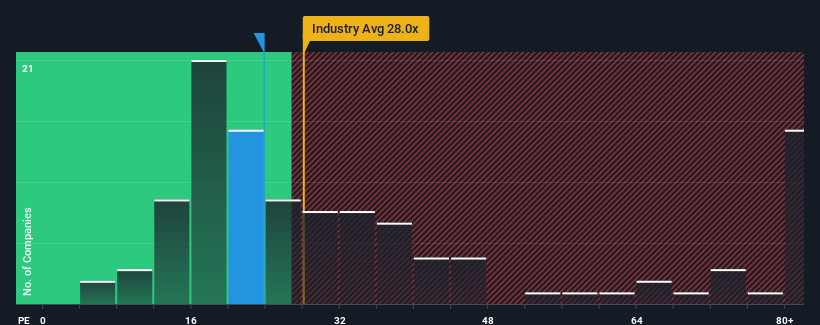

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Shanghai Menon Animal Nutrition Technology as an attractive investment with its 23.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Shanghai Menon Animal Nutrition Technology's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Shanghai Menon Animal Nutrition Technology

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Shanghai Menon Animal Nutrition Technology would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 12% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

In light of this, it's understandable that Shanghai Menon Animal Nutrition Technology's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Shanghai Menon Animal Nutrition Technology's P/E?

Despite Shanghai Menon Animal Nutrition Technology's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Menon Animal Nutrition Technology maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shanghai Menon Animal Nutrition Technology you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301156

Shanghai Menon Animal Nutrition Technology

Shanghai Menon Animal Nutrition Technology Co., Ltd.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives