More Unpleasant Surprises Could Be In Store For Shanghai Menon Animal Nutrition Technology Co., Ltd.'s (SZSE:301156) Shares After Tumbling 37%

The Shanghai Menon Animal Nutrition Technology Co., Ltd. (SZSE:301156) share price has softened a substantial 37% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

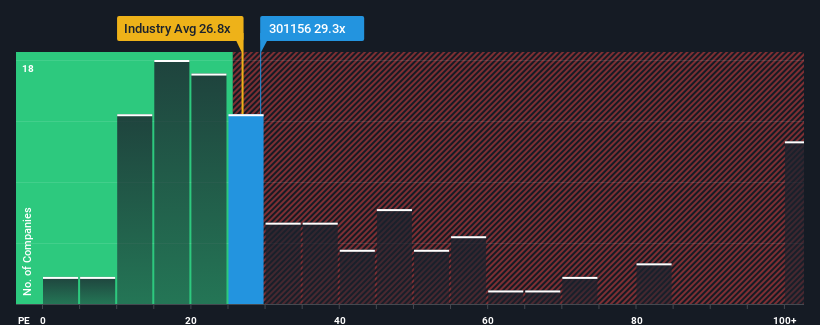

Even after such a large drop in price, there still wouldn't be many who think Shanghai Menon Animal Nutrition Technology's price-to-earnings (or "P/E") ratio of 29.3x is worth a mention when the median P/E in China is similar at about 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The earnings growth achieved at Shanghai Menon Animal Nutrition Technology over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Shanghai Menon Animal Nutrition Technology

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Shanghai Menon Animal Nutrition Technology's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 35% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

With this information, we find it concerning that Shanghai Menon Animal Nutrition Technology is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Shanghai Menon Animal Nutrition Technology's P/E?

Following Shanghai Menon Animal Nutrition Technology's share price tumble, its P/E is now hanging on to the median market P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shanghai Menon Animal Nutrition Technology currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Shanghai Menon Animal Nutrition Technology (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Shanghai Menon Animal Nutrition Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301156

Shanghai Menon Animal Nutrition Technology

Shanghai Menon Animal Nutrition Technology Co., Ltd.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives