- China

- /

- Hospitality

- /

- SZSE:000007

Undiscovered Gems Three Promising Stocks With Solid Foundations

Reviewed by Simply Wall St

In a week marked by volatile earnings reports and mixed economic signals, small-cap stocks have shown resilience, holding up better than their larger counterparts amidst broader market fluctuations. As investors navigate this landscape of uncertainty, identifying stocks with solid foundations becomes crucial; these undiscovered gems often combine strong fundamentals with growth potential, making them worthy of closer attention in today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Tianjin Port Holdings (SHSE:600717)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Port Holdings Co., Ltd. is involved in cargo loading and unloading operations in China, with a market capitalization of CN¥14.12 billion.

Operations: The company generates revenue primarily from cargo loading and unloading activities. It has a market capitalization of CN¥14.12 billion.

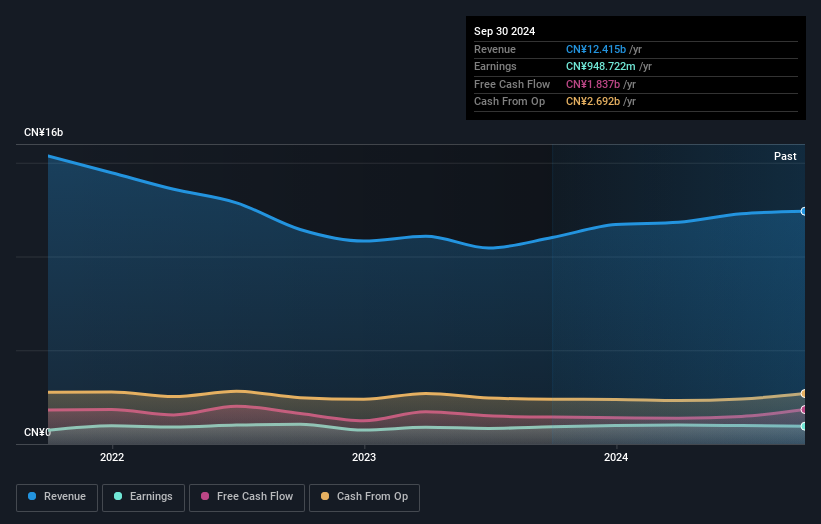

Tianjin Port Holdings, a smaller player in the industry, showcases promising aspects with its earnings growing 3.5% over the past year, outpacing the Infrastructure sector's 3.1%. The company trades at a notable 43.6% below estimated fair value, suggesting potential undervaluation. Over five years, its debt-to-equity ratio improved from 42.3% to 18.5%, reflecting stronger financial health and reduced leverage concerns. Recent earnings reports indicate stable performance with net income of CNY 892 million for nine months ending September compared to CNY 926 million last year despite sales growth from CNY 8,270 million to CNY 8,982 million during the same period.

- Navigate through the intricacies of Tianjin Port Holdings with our comprehensive health report here.

Shenzhen Quanxinhao (SZSE:000007)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Quanxinhao Co., Ltd. operates in the property leasing and management sector both in China and internationally, with a market cap of CN¥2.71 billion.

Operations: The company generates revenue primarily from property leasing and management activities. A key financial metric to note is its net profit margin, which reflects the efficiency of its operations and profitability.

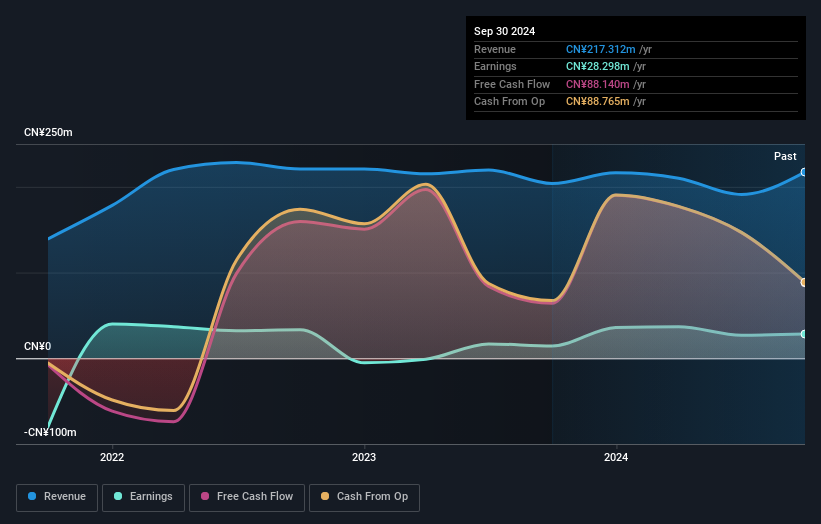

Shenzhen Quanxinhao, a smaller player in its sector, has shown notable financial resilience. Over the past year, earnings surged by 96%, significantly outpacing the hospitality industry's -6.9% performance. The company maintains a healthy balance sheet with cash exceeding total debt and a debt-to-equity ratio rising to 29.1% over five years, indicating increased leverage but still within manageable limits. Recent earnings reports reveal sales of CNY 154 million for nine months ending September 2024, with net income dropping to CNY 3.18 million from CNY 10.85 million last year, reflecting challenges in sustaining profitability despite revenue growth.

- Get an in-depth perspective on Shenzhen Quanxinhao's performance by reading our health report here.

Explore historical data to track Shenzhen Quanxinhao's performance over time in our Past section.

Jiangxi Huangshanghuang Group Food (SZSE:002695)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Huangshanghuang Group Food Co., Ltd. develops, produces, and sells braised meat products in China with a market cap of CN¥4.46 billion.

Operations: The company generates revenue primarily from its braised meat products. It reported a market capitalization of CN¥4.46 billion.

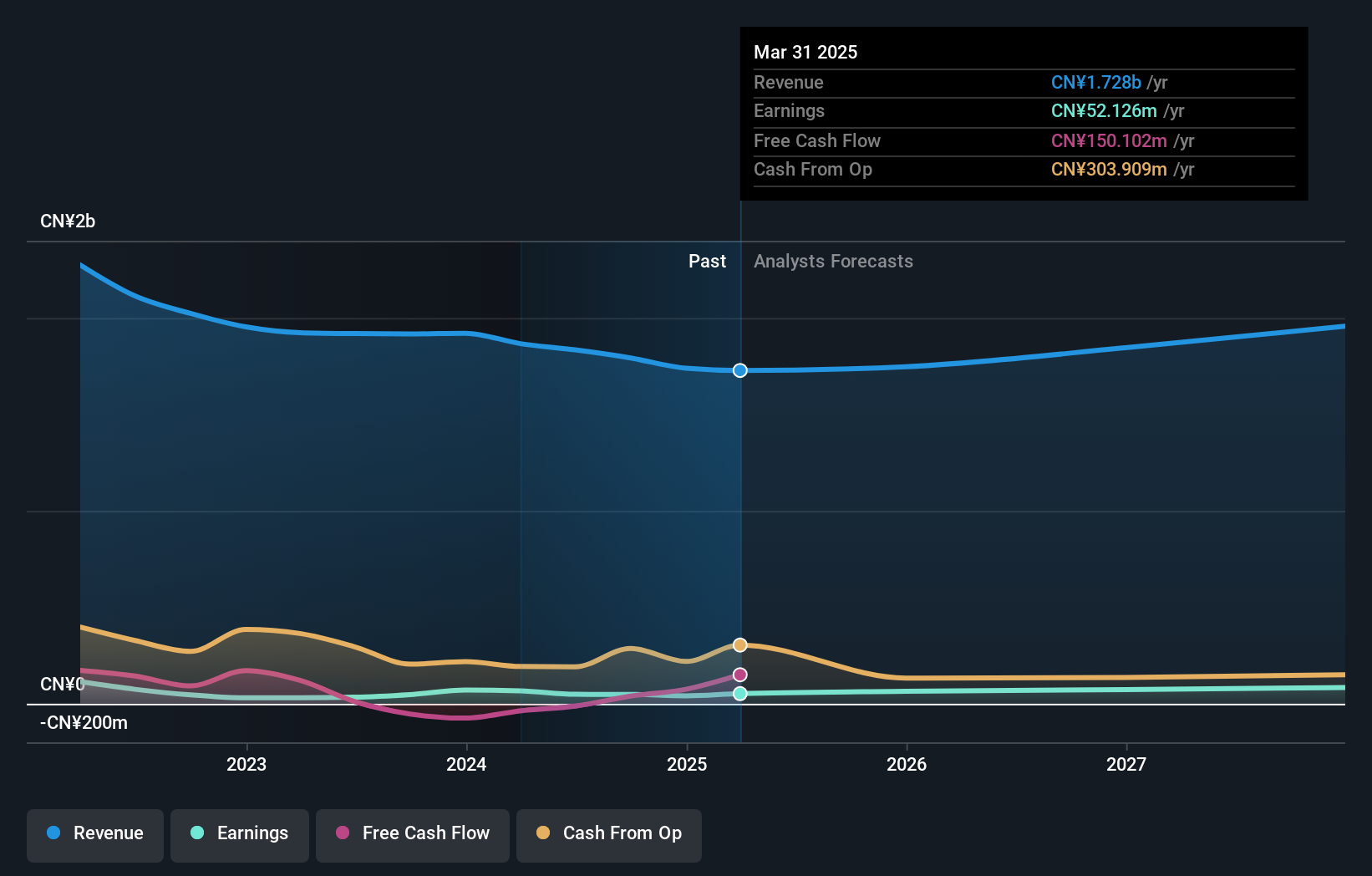

Jiangxi Huangshanghuang Group Food, a smaller player in the food industry, has shown resilience with earnings growth of 2.2% over the past year, surpassing the industry's -6% trend. The company's debt to equity ratio has impressively dropped from 4.4 to 0.05 over five years, indicating strong financial health. Despite a dip in sales and net income for the nine months ending September 2024—CNY 1,452 million and CNY 79 million respectively—the firm remains profitable with free cash flow positivity and trades at about 4.5% below its estimated fair value, suggesting potential undervaluation in its current market position.

Turning Ideas Into Actions

- Navigate through the entire inventory of 4731 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000007

Shenzhen Quanxinhao

Engages in property leasing and management business in China and internationally.

Outstanding track record with excellent balance sheet.