Revenues Not Telling The Story For Haoxiangni Health Food Co.,Ltd. (SZSE:002582)

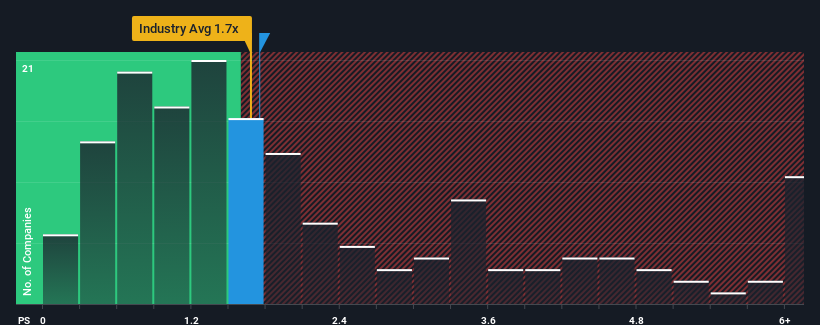

There wouldn't be many who think Haoxiangni Health Food Co.,Ltd.'s (SZSE:002582) price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S for the Food industry in China is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Haoxiangni Health FoodLtd

What Does Haoxiangni Health FoodLtd's Recent Performance Look Like?

For example, consider that Haoxiangni Health FoodLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Haoxiangni Health FoodLtd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Haoxiangni Health FoodLtd?

Haoxiangni Health FoodLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 67% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's somewhat alarming that Haoxiangni Health FoodLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What We Can Learn From Haoxiangni Health FoodLtd's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Haoxiangni Health FoodLtd currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Haoxiangni Health FoodLtd (1 makes us a bit uncomfortable) you should be aware of.

If these risks are making you reconsider your opinion on Haoxiangni Health FoodLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Haoxiangni Health FoodLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002582

Haoxiangni Health FoodLtd

Engages in the research, development, procurement, production, and sale of healthy foods in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives