As global markets show resilience with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts, investors are exploring diverse opportunities to capitalize on this momentum. Penny stocks, although considered niche investments today, remain a compelling area for those seeking growth potential in smaller or newer companies. By focusing on financial strength and market positioning, certain penny stocks can offer unique opportunities for investors looking to uncover promising under-the-radar companies poised for success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.41 | £179.57M | ★★★★★☆ |

Click here to see the full list of 5,799 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Jiaze Renewables (SHSE:601619)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited is involved in the development, construction, sale, operation, and maintenance of new energy projects with a market cap of CN¥7.86 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥2.39 billion.

Market Cap: CN¥7.86B

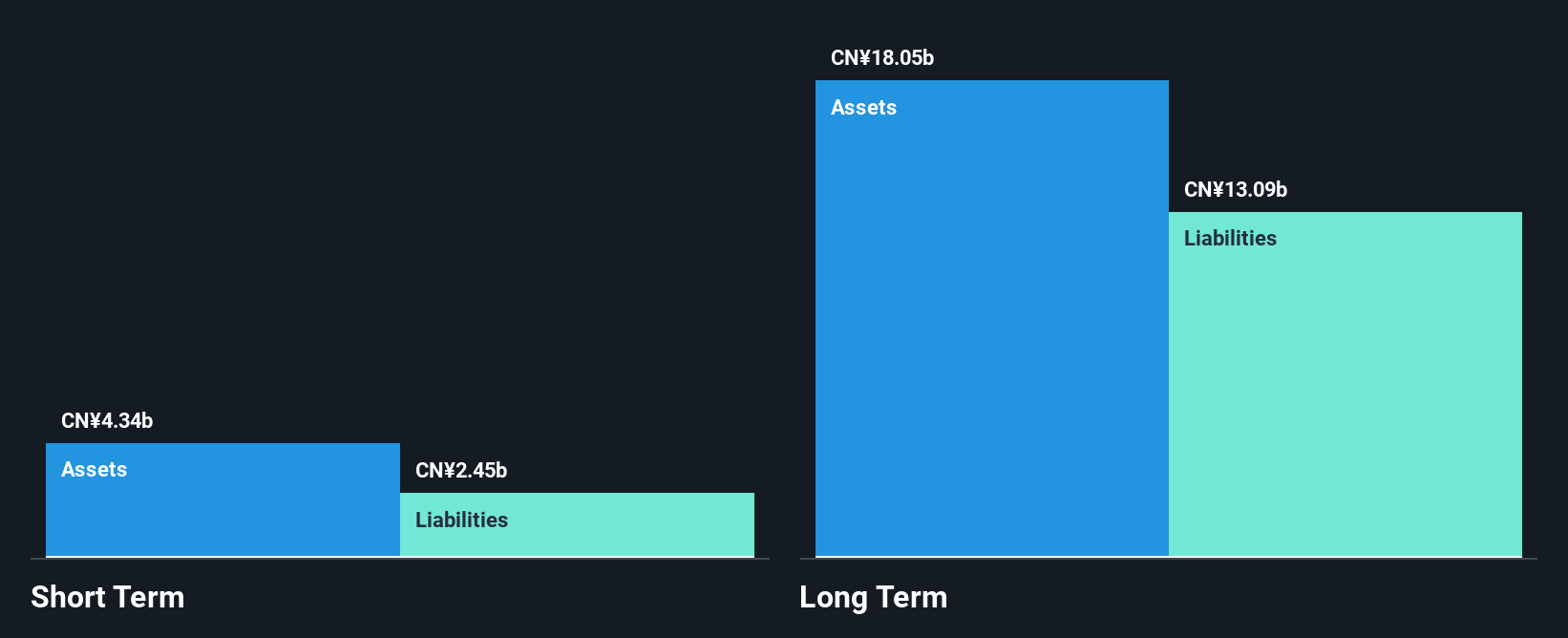

Jiaze Renewables Corporation Limited has shown a reduction in its debt to equity ratio from 163.8% to 87.2% over five years, indicating improved financial management, though its net debt remains high at 78.6%. The company's short-term assets of CN¥4.3 billion cover its short-term liabilities but not long-term ones of CN¥12.8 billion, highlighting potential liquidity concerns. Despite stable weekly volatility and high-quality earnings, Jiaze's recent earnings have declined with a net profit margin decrease from 33.5% to 29.5%. A recent private placement aims to raise nearly CN¥1.2 billion, potentially strengthening financial stability if approved by regulatory bodies.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiaze Renewables.

- Assess Jiaze Renewables' previous results with our detailed historical performance reports.

Goldlok Holdings(Guangdong)Ltd (SZSE:002348)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Goldlok Holdings (Guangdong) Co., Ltd. operates in the toys and Internet education sectors in China, with a market cap of CN¥3.49 billion.

Operations: Goldlok Holdings (Guangdong) Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.49B

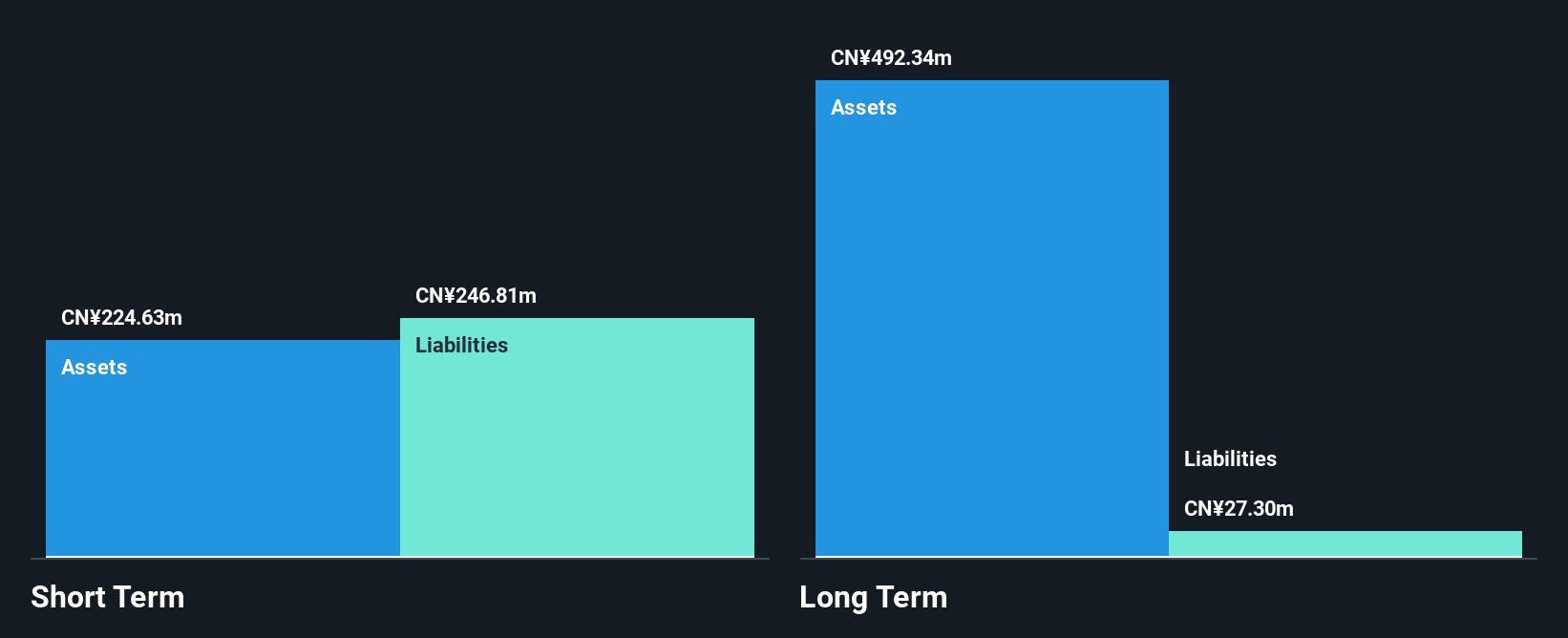

Goldlok Holdings (Guangdong) Co., Ltd. faces challenges as it remains unprofitable, with a net loss of CN¥34.24 million for the nine months ending September 2024, widening from the previous year's loss. Despite this, its short-term assets of CN¥261.6 million cover both short and long-term liabilities, providing some financial stability. The company has not diluted shareholders recently and maintains a satisfactory net debt to equity ratio of 32.5%. However, management's inexperience could pose risks as they navigate strategic changes discussed in recent shareholder meetings aimed at altering business scope and governance structures.

- Jump into the full analysis health report here for a deeper understanding of Goldlok Holdings(Guangdong)Ltd.

- Understand Goldlok Holdings(Guangdong)Ltd's track record by examining our performance history report.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. specializes in the research, development, production, and sale of fermented meat products both in China and internationally, with a market capitalization of approximately CN¥5.80 billion.

Operations: There are no specific revenue segments reported for Jinzi Ham Co., Ltd.

Market Cap: CN¥5.8B

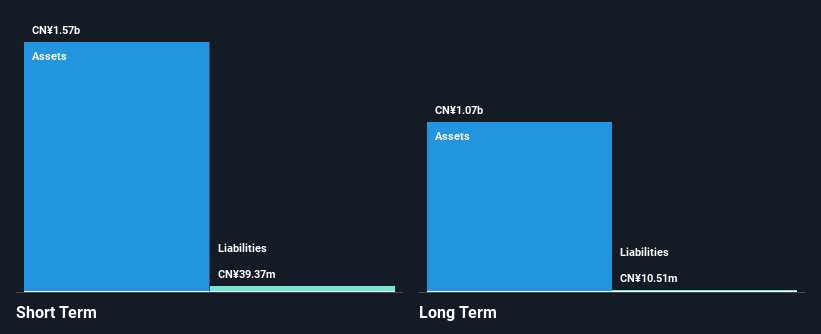

Jinzi Ham Co., Ltd. demonstrates financial stability with short-term assets of CN¥1.6 billion significantly exceeding its liabilities, and it operates debt-free, reducing financial risk. Despite a low return on equity of 1.6%, the company has shown robust earnings growth of 79.8% over the past year, outperforming industry trends and improving net profit margins to 12.6%. However, challenges persist with an inexperienced board averaging a tenure of 2.9 years and declining earnings over five years at an average rate of 6.6% annually, which could impact long-term performance despite recent revenue increases to CN¥258.41 million for nine months ending September 2024.

- Click here to discover the nuances of Jinzi HamLtd with our detailed analytical financial health report.

- Evaluate Jinzi HamLtd's historical performance by accessing our past performance report.

Seize The Opportunity

- Take a closer look at our Penny Stocks list of 5,799 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Goldlok Holdings(Guangdong)Ltd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002348

Goldlok Holdings(Guangdong)Ltd

Engages in the toys and Internet education businesses in China.

Excellent balance sheet minimal.

Market Insights

Community Narratives