Global markets have recently been impacted by tariff fears, inflation concerns, and growth uncertainties, leading to a decline in major U.S. stock indexes. Despite these challenges, the search for investment opportunities continues, particularly in areas that may offer unique growth potential. Penny stocks—often overlooked due to their association with smaller or newer companies—can still present valuable opportunities when they are built on strong financials and sound fundamentals. In this article, we explore several penny stocks that combine financial strength with the potential for significant returns, highlighting their relevance as an investment area today.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| NEXG Berhad (KLSE:DSONIC) | MYR0.255 | MYR709.45M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.575 | £288.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.54 | £402.66M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.31 | HK$799.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.23 | HK$47.57B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.61 | A$75.95M | ★★★★★★ |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.28 | MYR636.19M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.93 | £291.41M | ★★★★☆☆ |

Click here to see the full list of 5,723 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. focuses on the research, development, manufacturing, and sales of medicines and general health products in China with a market cap of CN¥11.11 billion.

Operations: The company's revenue is primarily generated from the Chinese market, amounting to CN¥6.46 billion.

Market Cap: CN¥11.11B

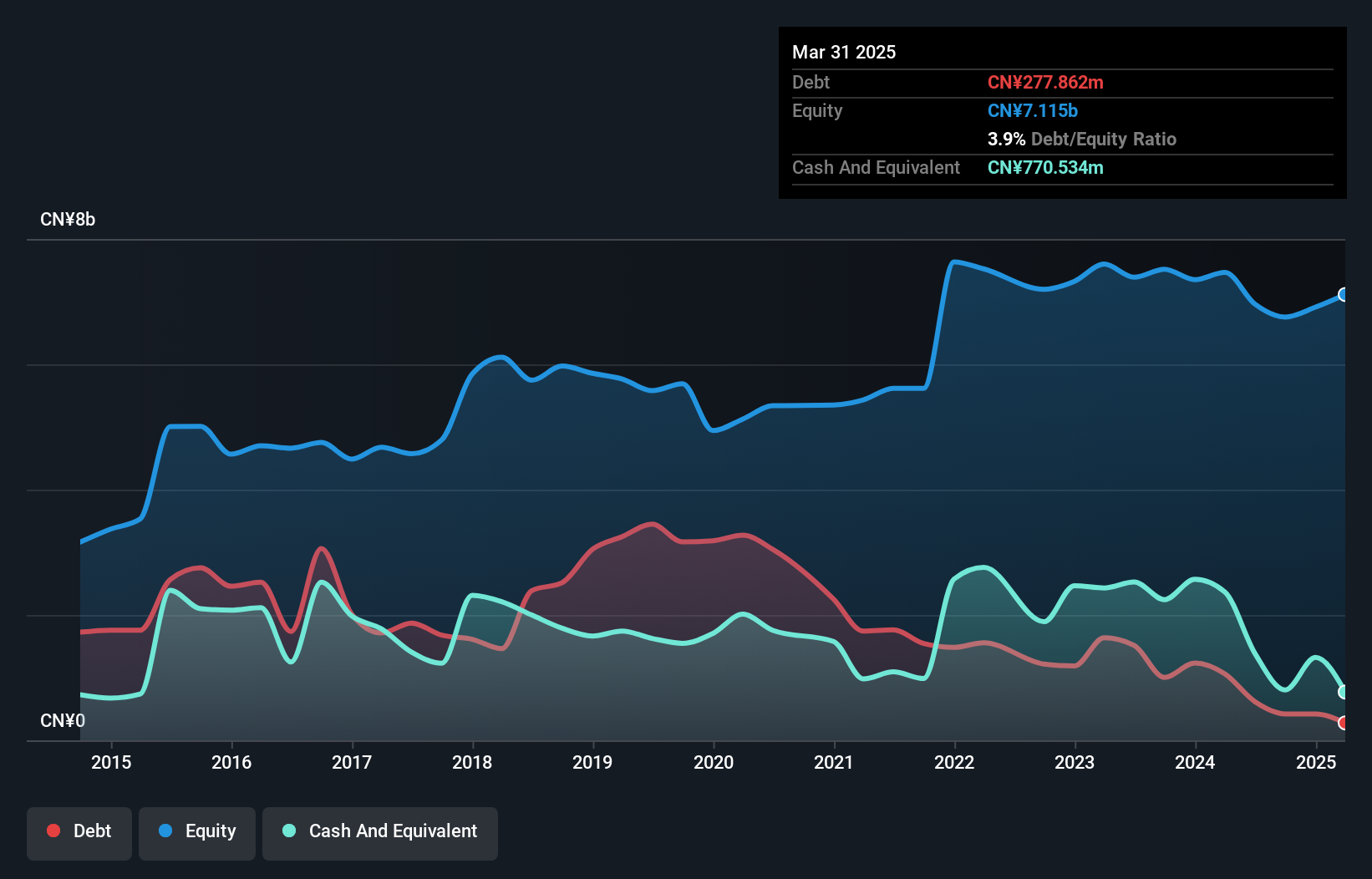

Zhejiang CONBA Pharmaceutical Ltd. has a market cap of CN¥11.11 billion and generates revenue primarily from China, totaling CN¥6.46 billion. The company demonstrates financial stability with short-term assets exceeding both short- and long-term liabilities, and more cash than total debt. However, its earnings have experienced negative growth over the past year despite significant growth in the previous five years. The company's dividend yield of 4.47% is not well covered by earnings or free cash flows, indicating potential concerns regarding sustainability. Additionally, profit margins have decreased to 7.5% from 11.2% last year due to large one-off gains impacting recent results.

- Dive into the specifics of Zhejiang CONBA PharmaceuticalLtd here with our thorough balance sheet health report.

- Gain insights into Zhejiang CONBA PharmaceuticalLtd's past trends and performance with our report on the company's historical track record.

Royal GroupLtd (SZSE:002329)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Royal Group Co.,Ltd. operates in China, focusing on the processing, production, and sale of dairy products, with a market cap of CN¥2.85 billion.

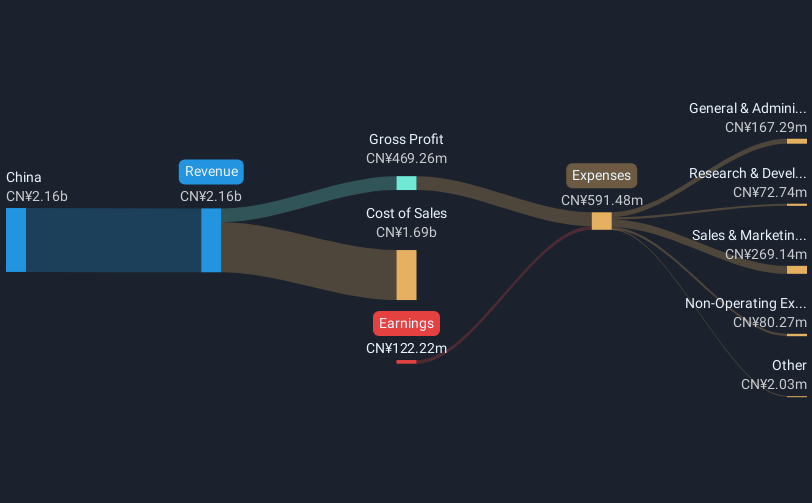

Operations: The company's revenue is entirely derived from its operations in China, amounting to CN¥2.16 billion.

Market Cap: CN¥2.85B

Royal Group Co., Ltd., with a market cap of CN¥2.85 billion, operates entirely within China, generating CN¥2.16 billion in revenue from dairy products. Despite being unprofitable, it has reduced its losses over the past five years and maintains a positive cash flow with sufficient runway for over three years. The company's short-term assets exceed both short- and long-term liabilities, providing some financial stability despite high net debt to equity ratio at 105.5%. Recent shareholder meetings approved proposals to adjust external guarantee limits and provide guarantees for village cooperatives, reflecting active investor engagement and strategic adjustments.

- Click to explore a detailed breakdown of our findings in Royal GroupLtd's financial health report.

- Evaluate Royal GroupLtd's historical performance by accessing our past performance report.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. operates in the aquaculture industry, focusing on the farming, processing, and distribution of seafood products with a market cap of CN¥4.28 billion.

Operations: There are no specific revenue segments reported for this company.

Market Cap: CN¥4.28B

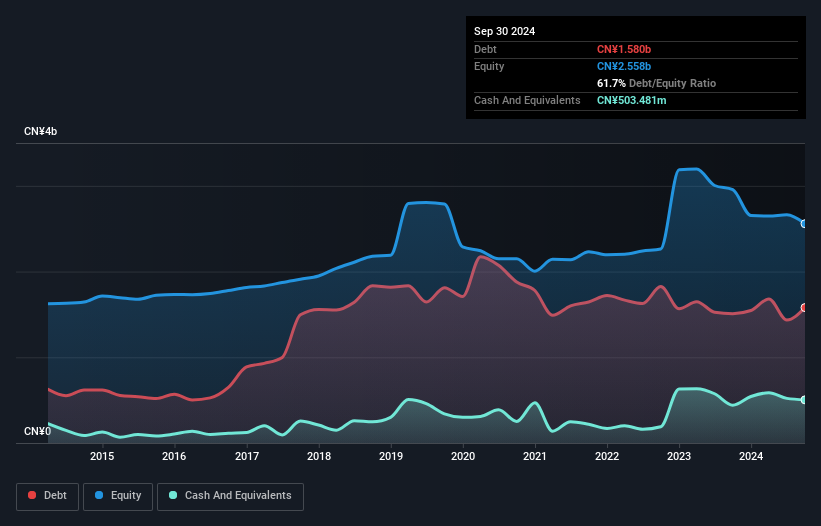

Zhanjiang Guolian Aquatic Products, with a market cap of CN¥4.28 billion, operates in the seafood industry and is currently unprofitable. Despite this, it has managed to reduce its losses by 2.1% annually over the past five years and maintains a positive free cash flow with a cash runway exceeding three years. Its short-term assets of CN¥3.5 billion comfortably cover both short- and long-term liabilities, suggesting financial resilience despite a high net debt to equity ratio of 42.1%. The management team is relatively new with an average tenure of 1.3 years, while the board is more seasoned at 4.2 years on average.

- Navigate through the intricacies of Zhanjiang Guolian Aquatic Products with our comprehensive balance sheet health report here.

- Assess Zhanjiang Guolian Aquatic Products' previous results with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 5,720 Global Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhanjiang Guolian Aquatic Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300094

Zhanjiang Guolian Aquatic Products

Zhanjiang Guolian Aquatic Products Co., Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives