As global markets experience mixed performances, with major indices like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 Index sees a decline, investors are increasingly attentive to small-cap stocks. In this dynamic environment, identifying promising small-cap companies can be pivotal, especially those that demonstrate resilience and growth potential amidst economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Skjern Bank (CPSE:SKJE)

Simply Wall St Value Rating: ★★★★★★

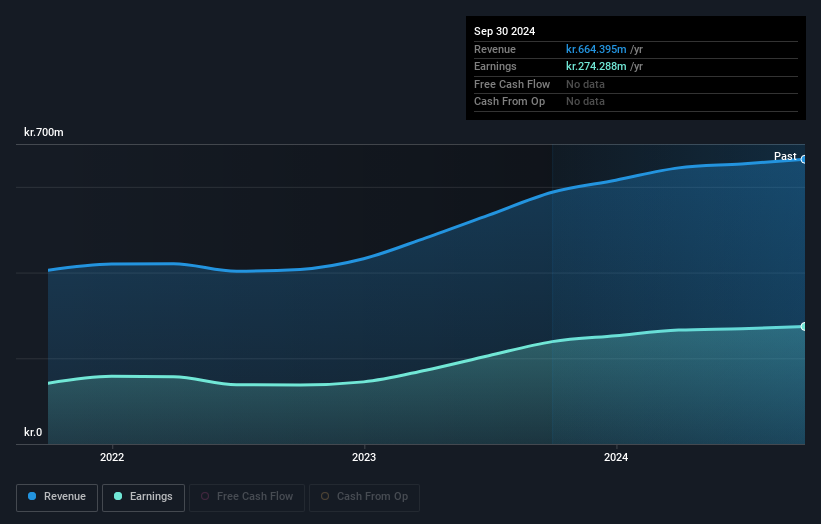

Overview: Skjern Bank A/S offers a range of banking products and services to individual and business clients in Denmark, with a market capitalization of DKK1.79 billion.

Operations: Revenue from banking operations is DKK664.40 million.

Skjern Bank, a small player in the banking sector, showcases a solid financial foundation with total assets of DKK12.7 billion and equity of DKK1.7 billion. The bank's total deposits stand at DKK10.3 billion while loans amount to DKK7 billion, reflecting a stable balance sheet structure. With an appropriate bad loans ratio of 0.7% and a sufficient allowance for bad loans at 569%, Skjern Bank demonstrates prudent risk management practices. Earnings have grown at an impressive annual rate of 20.6% over the past five years, although recent growth slightly lagged behind industry averages, indicating room for improvement in competitive positioning.

- Click here to discover the nuances of Skjern Bank with our detailed analytical health report.

Understand Skjern Bank's track record by examining our Past report.

Baolingbao BiologyLtd (SZSE:002286)

Simply Wall St Value Rating: ★★★★★★

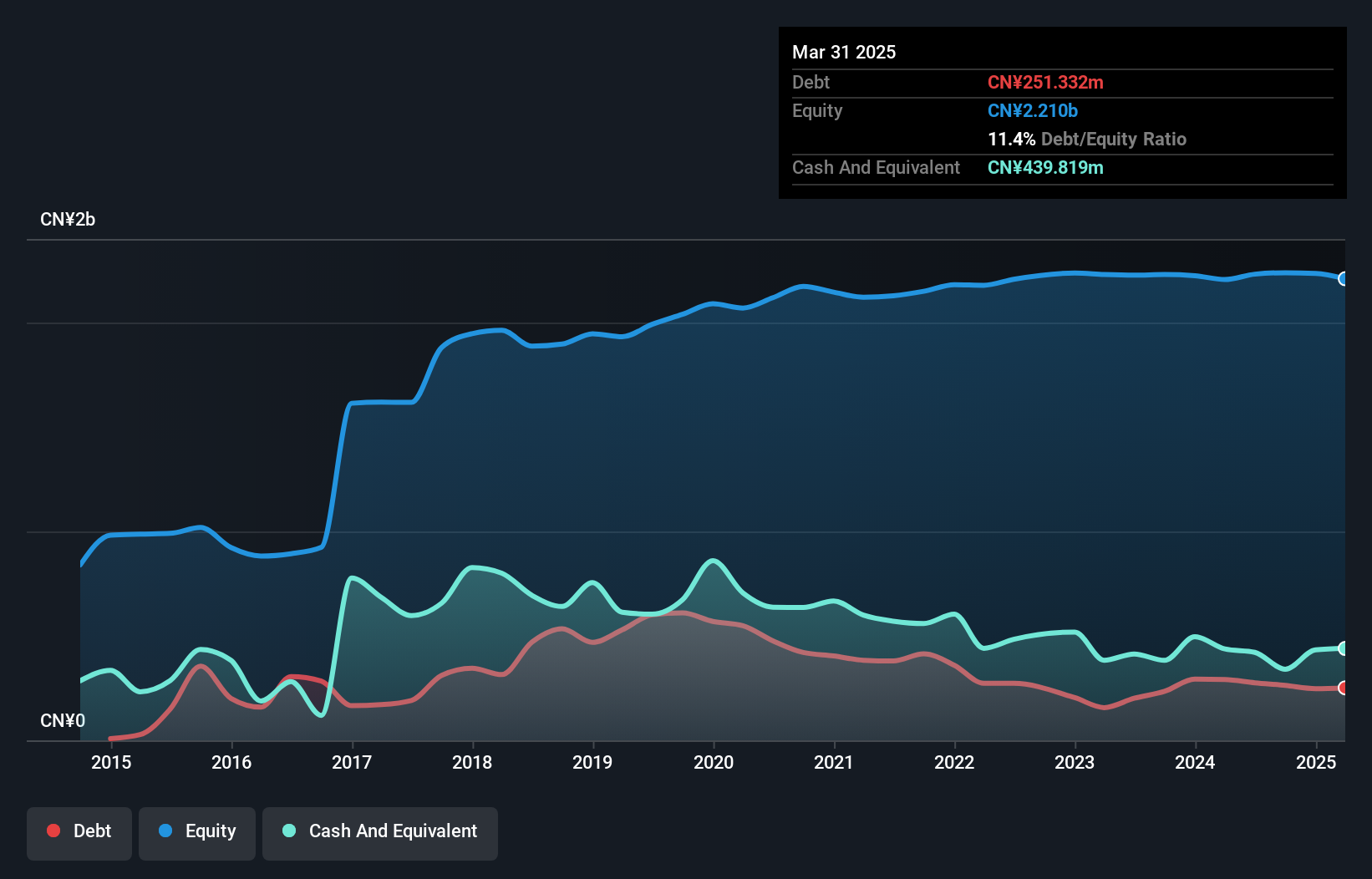

Overview: Baolingbao Biology Co., Ltd. engages in the research, development, manufacturing, and sale of functional sugars in China with a market cap of CN¥3.12 billion.

Operations: The company generates revenue primarily through the sale of functional sugars. It incurs costs related to research, development, and manufacturing processes. The net profit margin has shown variability over recent periods.

Baolingbao Biology, a nimble player in the food industry, has demonstrated impressive earnings growth of 59% over the past year, outpacing the industry's -5.8%. Despite sales dipping to CN¥1.83 billion from CN¥1.97 billion year-on-year, net income surged to CN¥101 million from CN¥46 million. The company's price-to-earnings ratio stands at 28.7x, offering better value than the broader Chinese market at 37.6x. A noteworthy one-off gain of CN¥28.5 million bolstered recent results, while its net debt to equity ratio improved significantly over five years to a satisfactory 17.9%, indicating prudent financial management amidst profitability and robust interest coverage of 13.6x EBIT.

- Dive into the specifics of Baolingbao BiologyLtd here with our thorough health report.

Explore historical data to track Baolingbao BiologyLtd's performance over time in our Past section.

Beijing Jiaxun Feihong Electrical (SZSE:300213)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Jiaxun Feihong Electrical Co., Ltd. operates in the electrical equipment industry and has a market cap of CN¥5.42 billion.

Operations: Beijing Jiaxun Feihong Electrical generates revenue primarily from its electrical equipment operations. The company has a market cap of CN¥5.42 billion, reflecting its presence in the industry.

Jiaxun Feihong, a company in the electrical sector, shows a mixed financial landscape. Over the past year, its earnings grew by 0.6%, outpacing the broader Communications industry decline of -3%. Despite this modest growth, its earnings have decreased by 19.6% annually over five years. The company's recent nine-month sales reached CNY 736 million compared to CNY 675 million last year, with net income rising to CNY 36.75 million from CNY 33 million. Notably, it maintains more cash than total debt and has an EBIT that covers interest payments by a factor of 8.3 times, suggesting strong financial management amidst challenges.

Taking Advantage

- Click here to access our complete index of 4626 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baolingbao BiologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002286

Baolingbao BiologyLtd

Researches and develops, manufactures, and sells a range of functional sugars in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives