It's A Story Of Risk Vs Reward With Beijing Shunxin Agriculture Co.,Ltd (SZSE:000860)

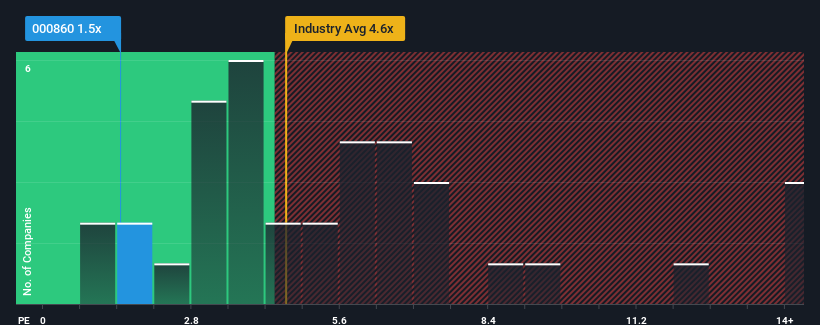

Beijing Shunxin Agriculture Co.,Ltd's (SZSE:000860) price-to-sales (or "P/S") ratio of 1.5x might make it look like a strong buy right now compared to the Beverage industry in China, where around half of the companies have P/S ratios above 4.6x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Beijing Shunxin AgricultureLtd

How Beijing Shunxin AgricultureLtd Has Been Performing

Beijing Shunxin AgricultureLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Shunxin AgricultureLtd.Do Revenue Forecasts Match The Low P/S Ratio?

Beijing Shunxin AgricultureLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 38% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Beijing Shunxin AgricultureLtd's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Beijing Shunxin AgricultureLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Beijing Shunxin AgricultureLtd with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Shunxin AgricultureLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000860

Beijing Shunxin AgricultureLtd

Primarily engages in the brewing and sale of liquor products under the Niu Lanshan and Ningcheng brands.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives