3 Top Dividend Stocks Yielding Up To 4.4% To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, investors are keenly observing how these factors influence stock performance. In such a climate, dividend stocks can offer a reliable income stream and potential stability to portfolios, making them an attractive option for those seeking to enhance their investment strategy amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.45% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

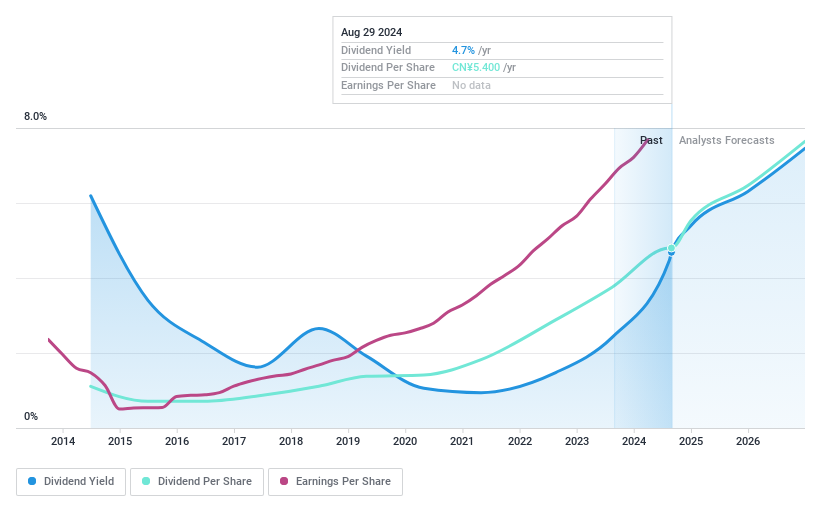

Luzhou LaojiaoLtd (SZSE:000568)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzhou Laojiao Co., Ltd is a company that provides liquor products in China with a market capitalization of CN¥170.72 billion.

Operations: Luzhou Laojiao Co., Ltd generates its revenue primarily from liquor products in China.

Dividend Yield: 4.5%

Luzhou Laojiao Ltd. offers a dividend yield of 4.48%, placing it in the top 25% of CN market dividend payers, though its dividend history has been volatile over the past decade. Despite this, dividends are covered by earnings and cash flow with payout ratios at 69.5% and 62%, respectively. The company recently affirmed a cash dividend for Q3 2024 at CNY 13.58 per 10 shares, reflecting ongoing shareholder returns amidst amendments to its articles of association.

- Click to explore a detailed breakdown of our findings in Luzhou LaojiaoLtd's dividend report.

- The analysis detailed in our Luzhou LaojiaoLtd valuation report hints at an deflated share price compared to its estimated value.

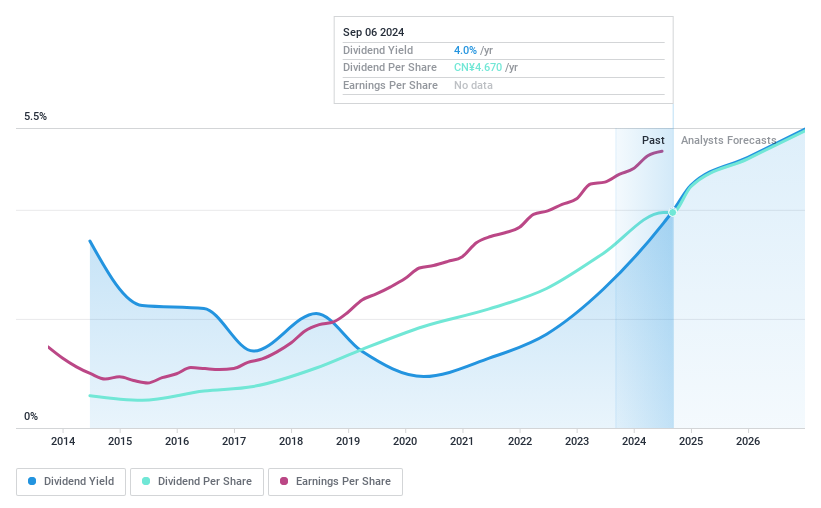

Wuliangye YibinLtd (SZSE:000858)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Wuliangye Yibin Co., Ltd. is a company that manufactures and sells liquor and wine products under the Wuliangye brand in China, with a market cap of CN¥495.68 billion.

Operations: Wuliangye Yibin Co., Ltd. generates its revenue primarily from the production and sale of liquor and wine products under the Wuliangye brand in China.

Dividend Yield: 3.9%

Wuliangye Yibin Ltd. offers a dividend yield of 3.92%, ranking in the top quartile among CN market dividend payers. Its dividends are well-supported by earnings and cash flow, with payout ratios at 87% and 42.5%, respectively, ensuring sustainability. The company has consistently increased its dividends over the past decade, affirming a recent cash dividend of CNY 25.76 per 10 shares for Q3 2024, underscoring its commitment to shareholder returns amidst global expansion efforts.

- Unlock comprehensive insights into our analysis of Wuliangye YibinLtd stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Wuliangye YibinLtd shares in the market.

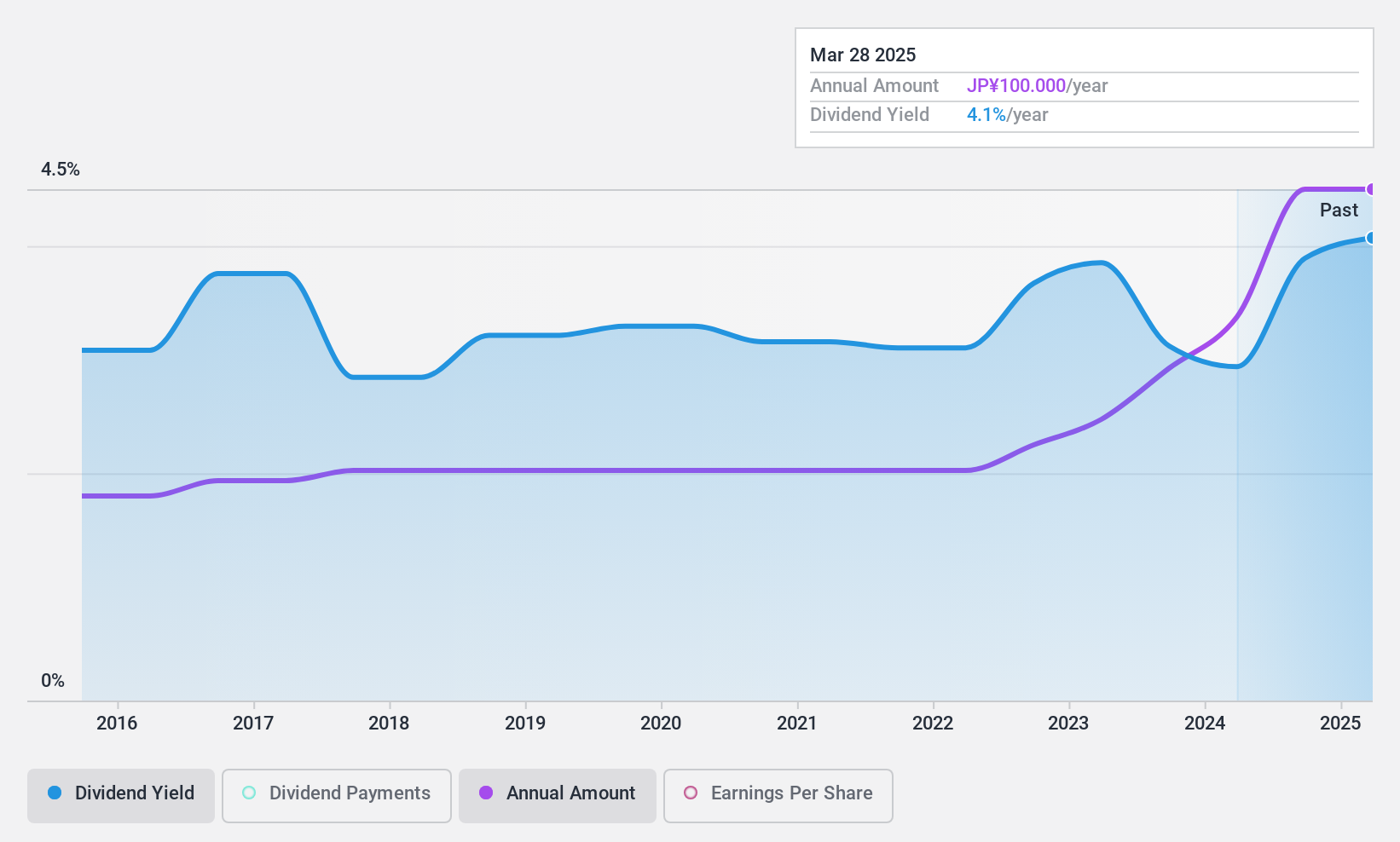

Fujii Sangyo (TSE:9906)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Fujii Sangyo Corporation operates in Japan, selling electrical construction materials, equipment, machine tools, information equipment, and civil engineering and construction machinery with a market cap of ¥21.86 billion.

Operations: Fujii Sangyo Corporation's revenue segments include Material Innovations Company with ¥51.52 billion, Infrastructure Solutions Company with ¥32.17 billion, and Komatsu Construction Equipment Sales and Service Japan, Ltd. with ¥7.23 billion.

Dividend Yield: 3.8%

Fujii Sangyo's dividend yield of 3.77% places it among the top 25% in the JP market, supported by a low payout ratio of 23.3%, ensuring sustainability. With stable and growing dividends over the past decade, its payments are well-covered by both earnings and cash flow, with a cash payout ratio of just 25.1%. Additionally, trading at approximately 80.5% below estimated fair value suggests potential for capital appreciation alongside reliable income generation.

- Dive into the specifics of Fujii Sangyo here with our thorough dividend report.

- Upon reviewing our latest valuation report, Fujii Sangyo's share price might be too pessimistic.

Make It Happen

- Reveal the 1967 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000568

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives