Global Insights: 3 Penny Stocks With Market Caps Over US$400M To Watch

Reviewed by Simply Wall St

Global markets have recently been marked by geopolitical tensions and concerns over consumer spending, leading to a mixed performance across major indices. Amid these uncertainties, investors often look beyond the usual suspects for opportunities, turning their attention to lesser-known stocks that may offer potential growth at lower entry points. Penny stocks—often representing smaller or newer companies—remain a relevant area of interest, especially when they boast strong financials and robust fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.62B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.295 | MYR820.74M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.95 | SEK296.19M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.90 | £315.07M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.04 | THB2.42B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.90 | £444.52M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.155 | £313.78M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.46 | MYR317.99M | ★★★★★★ |

Click here to see the full list of 5,718 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products in China and internationally with a market cap of approximately HK$4.76 billion.

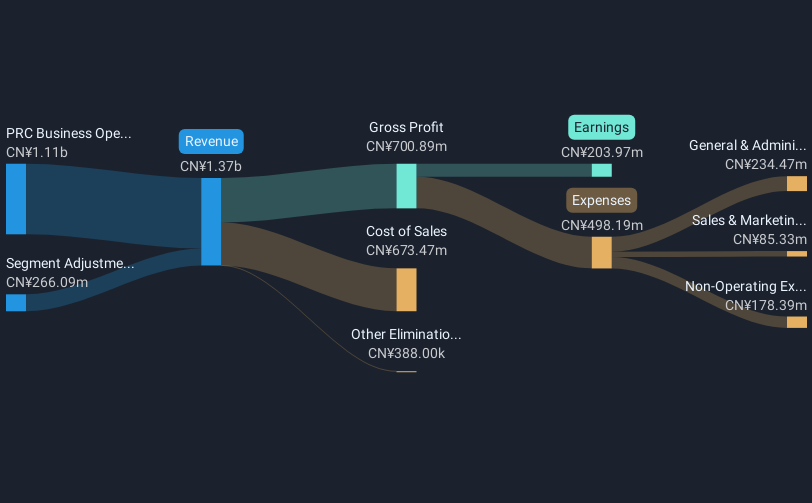

Operations: The company's revenue primarily stems from its business operations in the PRC, totaling CN¥1.11 billion.

Market Cap: HK$4.76B

Global New Material International Holdings has demonstrated stability and growth potential, with earnings increasing by 0.9% over the past year, surpassing the chemicals industry's decline. Its financial health is supported by a debt-to-equity ratio reduction and strong liquidity, as short-term assets exceed both short- and long-term liabilities. The company benefits from experienced management and board teams, while its operating cash flow effectively covers debt obligations. Although recent profit margins have decreased to 14.8%, future earnings are forecasted to grow significantly at 31.24% annually, indicating promising prospects for investors seeking opportunities in this sector.

- Navigate through the intricacies of Global New Material International Holdings with our comprehensive balance sheet health report here.

- Gain insights into Global New Material International Holdings' outlook and expected performance with our report on the company's earnings estimates.

Xiwang FoodstuffsLtd (SZSE:000639)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xiwang Foodstuffs Co., Ltd. operates in China, focusing on the research, development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements with a market cap of CN¥3.43 billion.

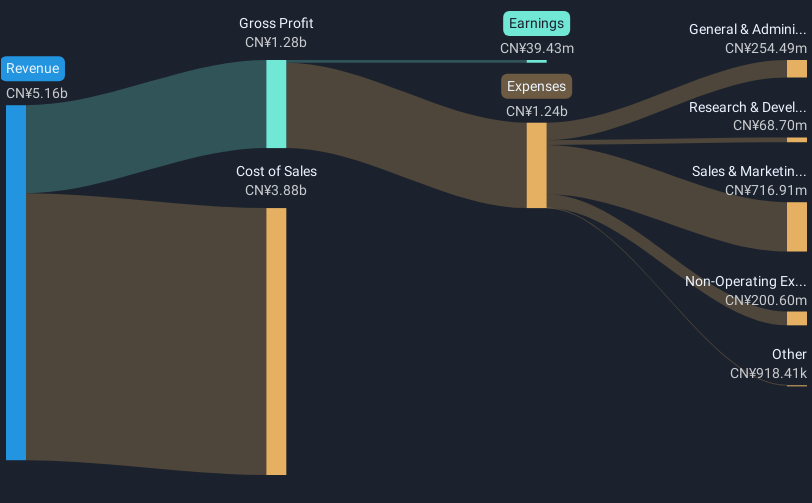

Operations: No specific revenue segments are reported for Xiwang Foodstuffs Co., Ltd.

Market Cap: CN¥3.43B

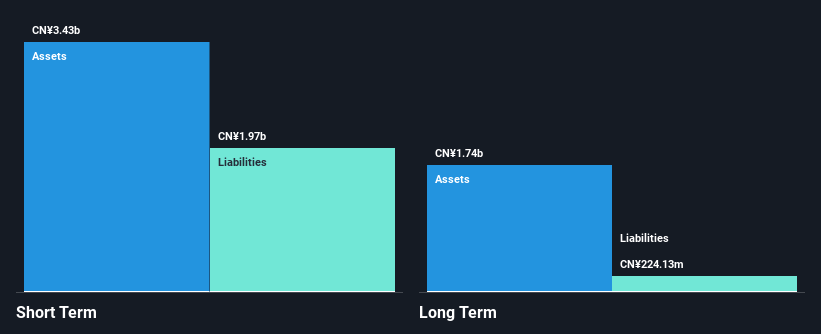

Xiwang Foodstuffs Co., Ltd. has recently turned profitable, which marks a significant milestone for the company. Its financial health appears robust with short-term assets of CN¥3 billion surpassing both short- and long-term liabilities, indicating strong liquidity. The company's net debt to equity ratio is satisfactory at 1.3%, although its interest coverage by EBIT remains weak at 2.1x, suggesting potential concerns in managing debt obligations effectively. Despite a large one-off loss impacting recent results, operating cash flow adequately covers its debt, and no significant shareholder dilution occurred over the past year, reflecting stability amidst volatility concerns in the penny stock market.

- Click here to discover the nuances of Xiwang FoodstuffsLtd with our detailed analytical financial health report.

- Examine Xiwang FoodstuffsLtd's past performance report to understand how it has performed in prior years.

Pubang Landscape Architecture (SZSE:002663)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pubang Landscape Architecture Co., Ltd operates in garden engineering construction and garden landscape design in China with a market cap of CN¥3.19 billion.

Operations: Revenue Segments: No specific revenue segments are reported for Pubang Landscape Architecture Co., Ltd.

Market Cap: CN¥3.19B

Pubang Landscape Architecture Co., Ltd. has recently achieved profitability, marking a pivotal development for the company. Its financial position is strong, with short-term assets of CN¥3.4 billion exceeding both short- and long-term liabilities, indicating solid liquidity. The debt to equity ratio has significantly improved over the past five years from 28.8% to 8.3%, and its debt is well covered by operating cash flow at 50.9%. Despite high share price volatility over the past three months, its experienced management team and board provide stability without significant shareholder dilution in the past year.

- Click to explore a detailed breakdown of our findings in Pubang Landscape Architecture's financial health report.

- Understand Pubang Landscape Architecture's track record by examining our performance history report.

Make It Happen

- Discover the full array of 5,718 Global Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000639

Xiwang FoodstuffsLtd

Engages in the research and development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives