Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Toly Bread Co.,Ltd. (SHSE:603866) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Toly BreadLtd

What Is Toly BreadLtd's Debt?

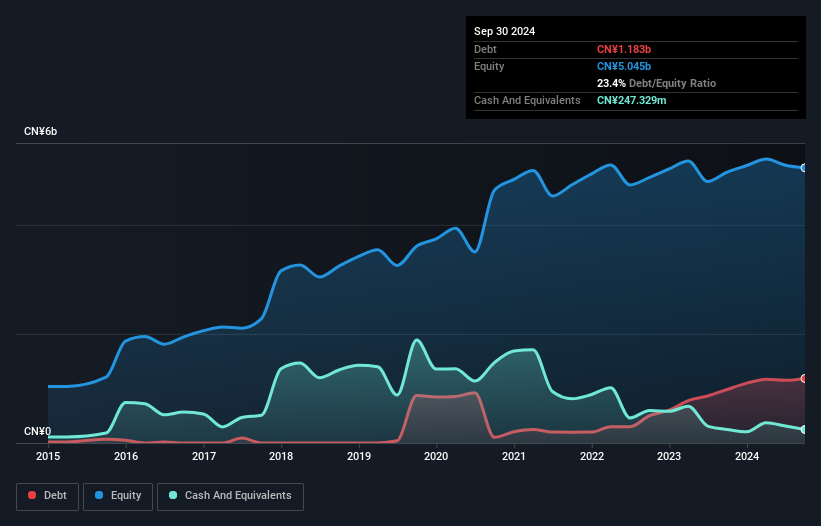

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Toly BreadLtd had CN¥1.18b of debt, an increase on CN¥981.6m, over one year. However, because it has a cash reserve of CN¥247.3m, its net debt is less, at about CN¥935.8m.

How Strong Is Toly BreadLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Toly BreadLtd had liabilities of CN¥1.67b due within 12 months and liabilities of CN¥453.4m due beyond that. Offsetting these obligations, it had cash of CN¥247.3m as well as receivables valued at CN¥506.1m due within 12 months. So its liabilities total CN¥1.37b more than the combination of its cash and short-term receivables.

Given Toly BreadLtd has a market capitalization of CN¥10.6b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Toly BreadLtd's net debt is only 0.97 times its EBITDA. And its EBIT easily covers its interest expense, being 39.3 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the other side of the story is that Toly BreadLtd saw its EBIT decline by 5.8% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Toly BreadLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Toly BreadLtd reported free cash flow worth 19% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

On our analysis Toly BreadLtd's interest cover should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. Looking at all this data makes us feel a little cautious about Toly BreadLtd's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Toly BreadLtd that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Toly BreadLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603866

Toly BreadLtd

Engages in the produces, processes, and sales of baked products in China.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives