Investors Appear Satisfied With Leshan Giantstar Farming&Husbandry Corporation Limited's (SHSE:603477) Prospects

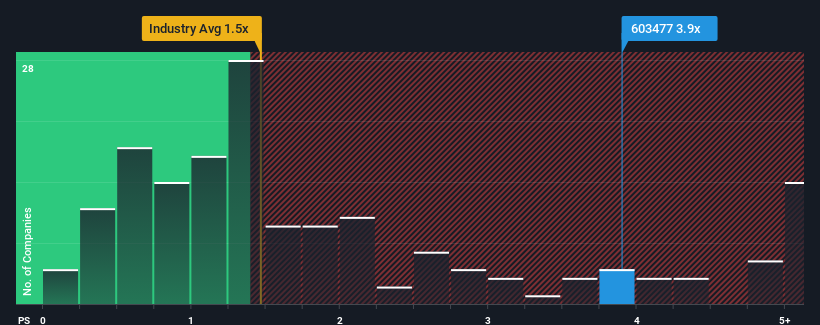

When close to half the companies in the Food industry in China have price-to-sales ratios (or "P/S") below 1.5x, you may consider Leshan Giantstar Farming&Husbandry Corporation Limited (SHSE:603477) as a stock to avoid entirely with its 3.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Leshan Giantstar Farming&Husbandry

How Leshan Giantstar Farming&Husbandry Has Been Performing

Leshan Giantstar Farming&Husbandry could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Leshan Giantstar Farming&Husbandry's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Leshan Giantstar Farming&Husbandry's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 97% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 91% during the coming year according to the five analysts following the company. That's shaping up to be materially higher than the 18% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Leshan Giantstar Farming&Husbandry's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Leshan Giantstar Farming&Husbandry's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 1 warning sign for Leshan Giantstar Farming&Husbandry that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603477

Leshan Giantstar Farming&Husbandry

Engages in livestock and poultry breeding in China.

High growth potential and good value.

Market Insights

Community Narratives