Amidst the backdrop of reignited U.S.-China trade tensions and concerns over a prolonged government shutdown, global markets have experienced volatility, with key indices like the S&P 500 and Nasdaq Composite showing mixed performances. As investors navigate these uncertainties, identifying stocks with strong fundamentals and growth potential becomes crucial, particularly in sectors resilient to geopolitical fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Q P Group Holdings | 17.07% | -2.56% | -2.55% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| JiaXing Gas Group | 49.18% | 19.35% | 19.32% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. is engaged in the production, processing, and sale of rice wine both in China and internationally, with a market capitalization of CN¥9.94 billion.

Operations: The company primarily generates revenue from the production and sale of rice wine. Its financial performance is highlighted by a notable gross profit margin, reflecting its cost management efficiency within the industry.

Kuaijishan Shaoxing Rice Wine, a burgeoning player in the beverage sector, has shown promising financial strides. Over the past year, earnings grew by 11%, surpassing the industry average of 0.2%. The company reported revenue of CNY 816.81 million for H1 2025, up from CNY 735.65 million a year ago, with net income rising to CNY 93.88 million from CNY 90.78 million. Its debt-to-equity ratio impressively dropped from 9.4% to just 0.1% over five years, and it maintains high-quality earnings while being free cash flow positive—indicating robust financial health amidst market volatility.

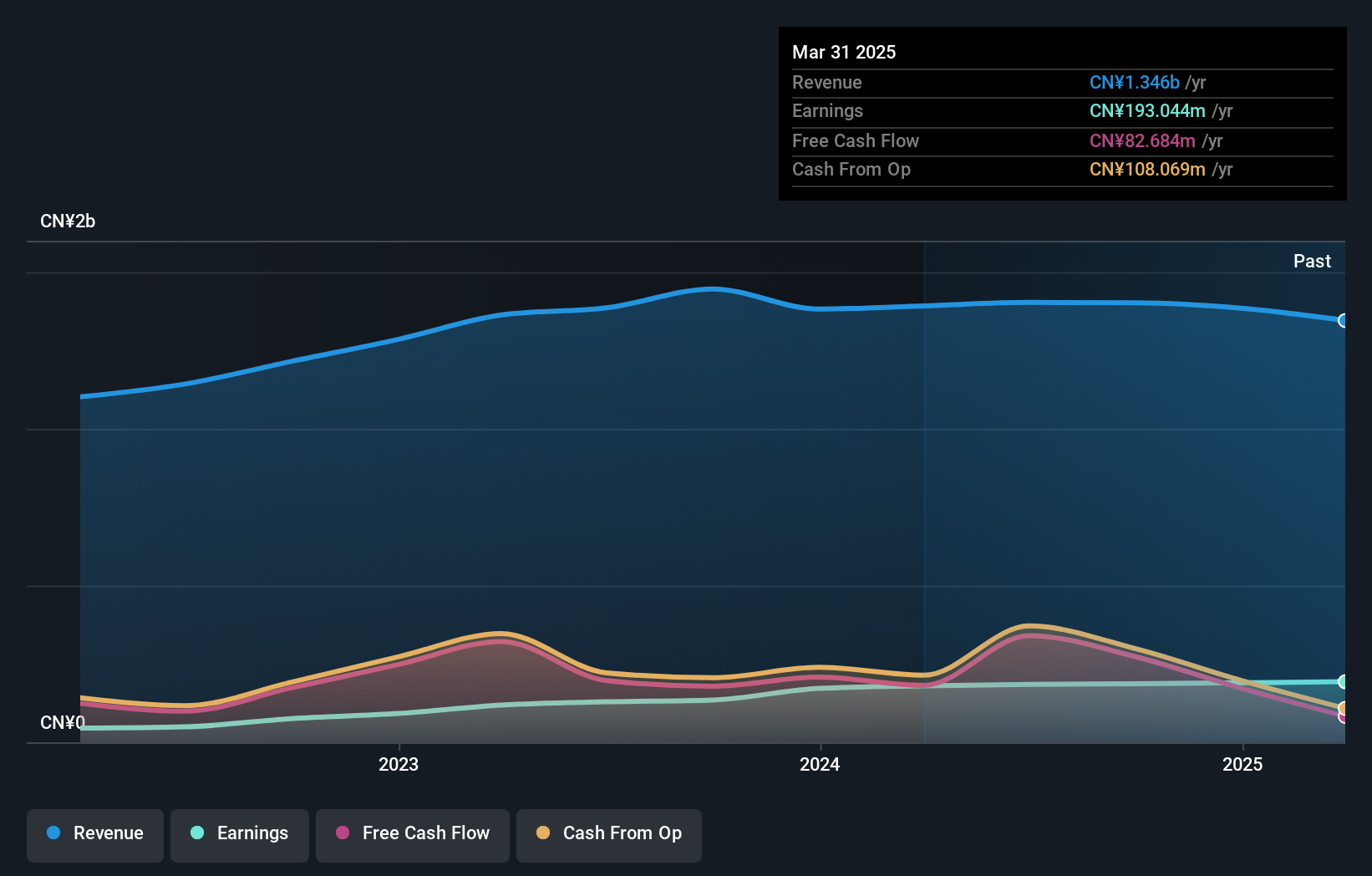

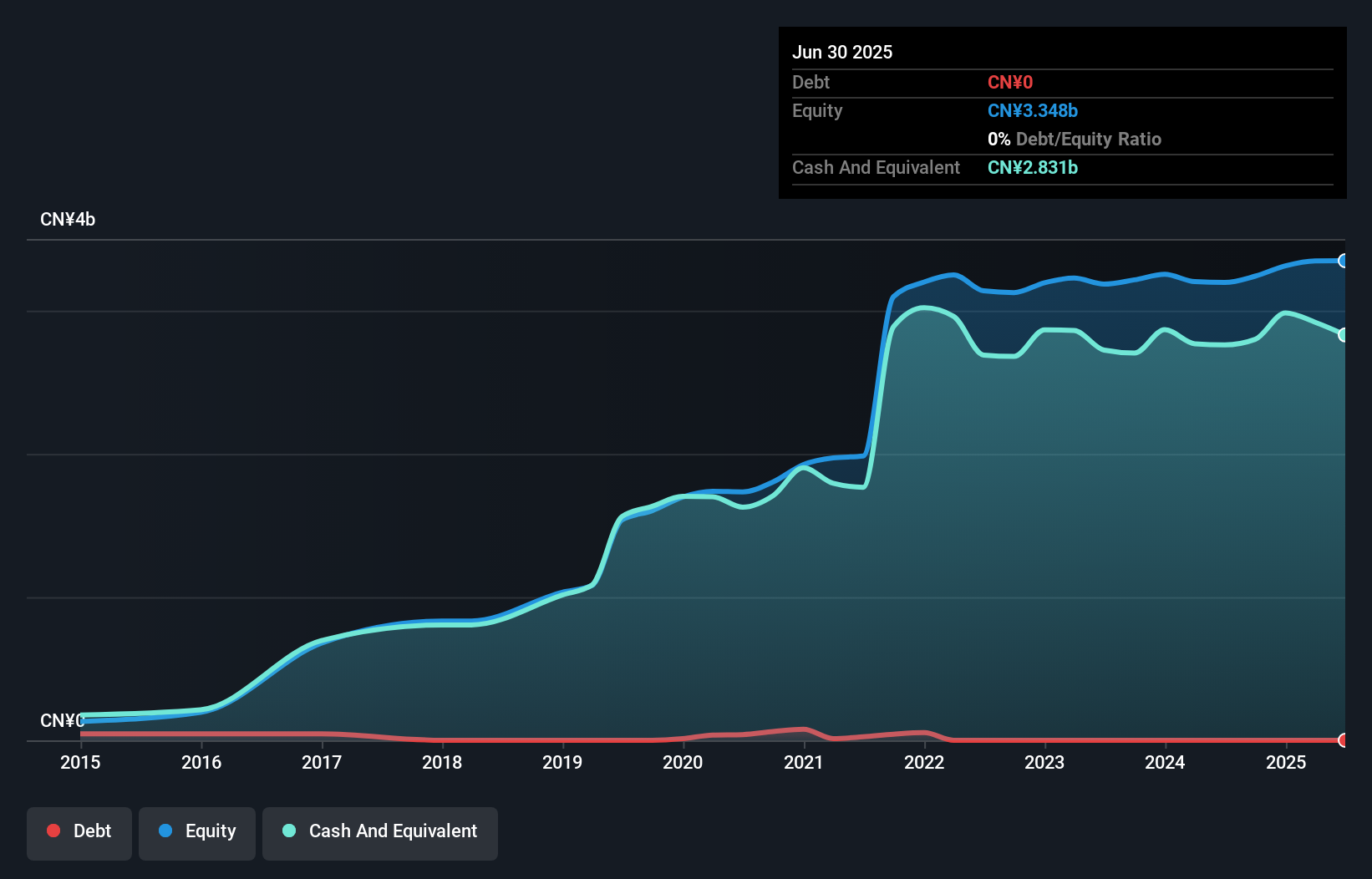

Eastcompeace TechnologyLtd (SZSE:002017)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastcompeace Technology Co. Ltd specializes in smart card and system solutions, serving both domestic and international markets, with a market capitalization of approximately CN¥13.34 billion.

Operations: Eastcompeace Technology Co. Ltd generates revenue primarily from its Smart Card Business, contributing CN¥985.13 million, and its Digital Security and Platform Business, which adds CN¥299.23 million.

Eastcompeace Technology, a nimble player in the tech space, showcases robust financial health with no debt as of now, contrasting its debt to equity ratio of 3.6% five years ago. The company has consistently delivered high-quality earnings and maintained positive free cash flow. Despite a volatile share price recently, it reported net income of CNY 80.47 million for the half-year ending June 2025, slightly up from CNY 79.3 million the previous year. Earnings per share improved marginally to CNY 0.1386 from CNY 0.1366, indicating stable performance amidst industry challenges and internal governance changes approved last month.

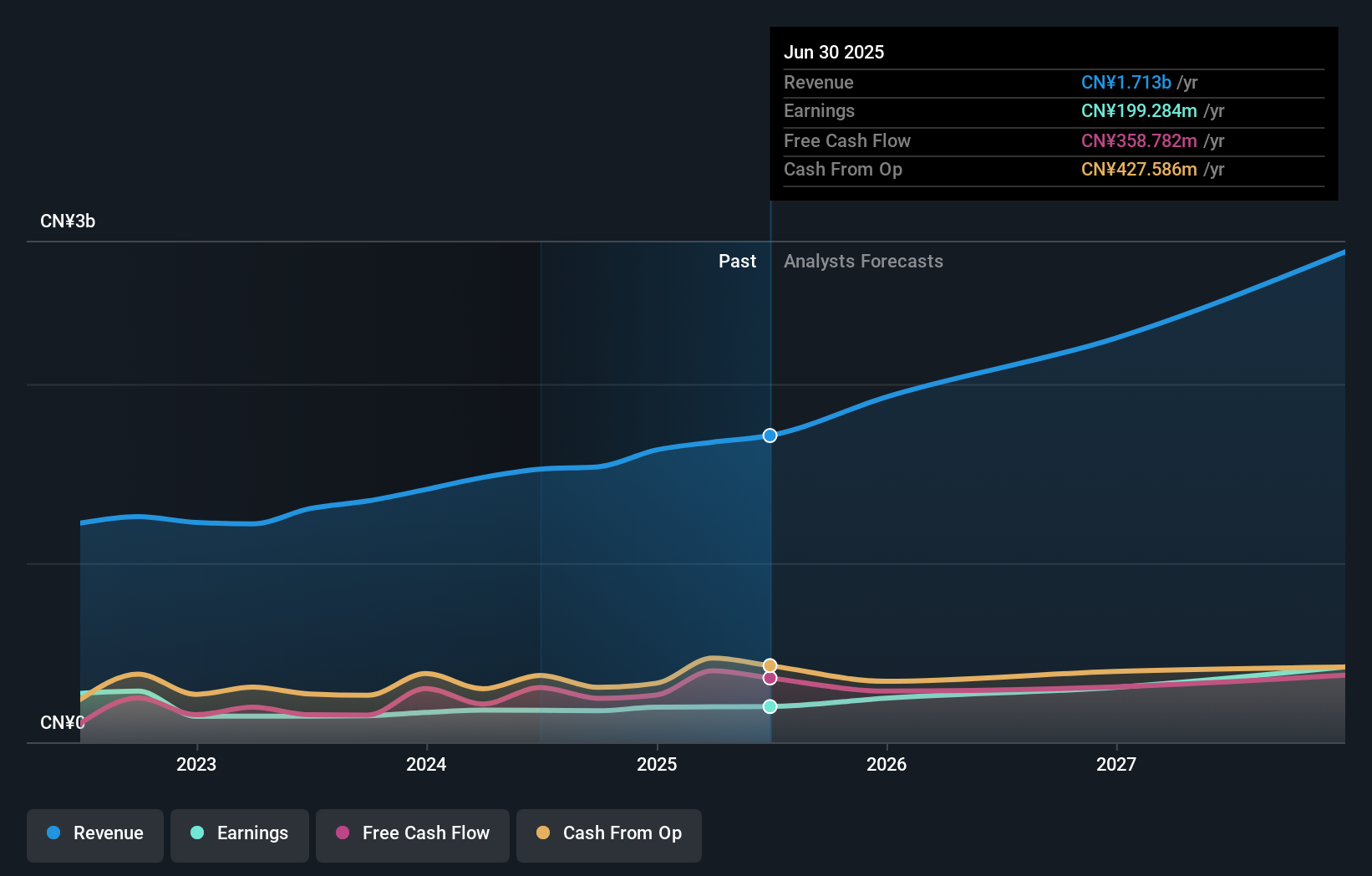

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou DPtech Technologies Co., Ltd. and its subsidiary focus on the research, development, production, and sale of network security and application delivery products across China, Hong Kong, and international markets with a market cap of CN¥12.96 billion.

Operations: DPtech generates revenue primarily from the sale of network security and application delivery products. The company has experienced a notable trend in its gross profit margin, which has varied over recent periods.

Hangzhou DPtech Technologies, a nimble player in the tech sector, showcases impressive financial health with no debt and a solid earnings growth of 15.8% over the past year, outpacing the industry average of 1.1%. The company is valued attractively with a price-to-earnings ratio of 84.2x, below the industry benchmark of 88.3x. Recent amendments to its articles at an extraordinary general meeting suggest strategic shifts that could impact future operations positively. Despite modest net income growth from CNY 52 million last year to CNY 52.15 million this half-year, its forecasted annual earnings growth stands strong at 28.48%.

Where To Now?

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 2911 more companies for you to explore.Click here to unveil our expertly curated list of 2914 Global Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaijishan Shaoxing Rice Wine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601579

Kuaijishan Shaoxing Rice Wine

Produces, processes, and sells rice wine in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives